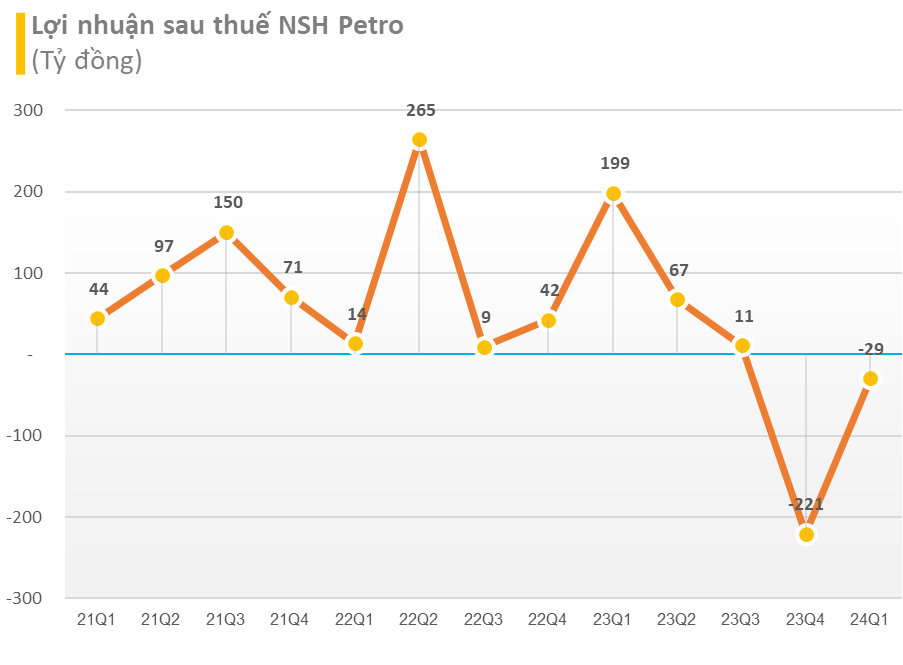

NSH Petro, a petroleum trading and investment joint-stock company in Southern Vietnam (NSH Petro – Code: PSH), has just released its consolidated financial report for the first quarter of 2024, showing a sharp decline in net revenue by 88% year-on-year, reaching 476 billion VND. Deducting the cost of goods sold, NSH Petro’s gross profit was 22 billion VND, a decrease of 94% compared to the same period last year, with the gross profit margin narrowing from 9.5% to 4.6%.

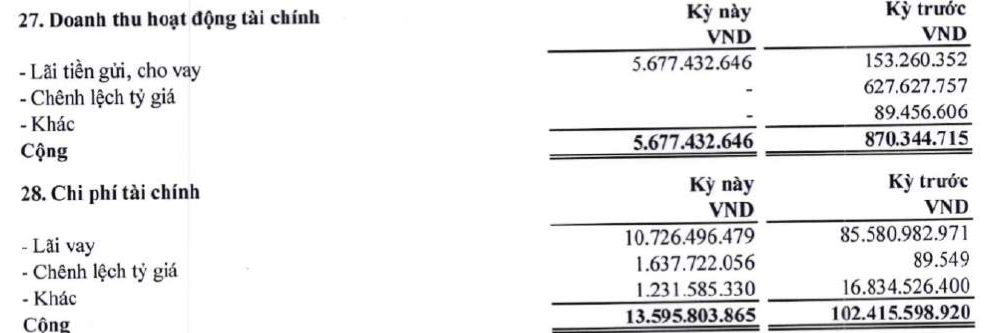

During this period, NSH Petro recorded a significant decrease in financial expenses, from 102 billion VND in Q1 2023 to nearly 14 billion VND, mainly due to a substantial reduction in interest expenses. Sales and administrative expenses also declined compared to the same period last year.

After deducting expenses, the petroleum company suffered a net loss of over 29 billion VND, in contrast to the 199 billion VND net profit recorded in the same quarter last year.

As of March 31, 2024, NSH Petro’s total assets amounted to 11,079 billion VND. Notably, a significant portion of NSH Petro’s assets are financed through debt. Total liabilities at the end of the first quarter reached over 9,500 billion VND, six times higher than the equity. Of this, financial debt alone reached over 6,700 billion VND, an increase of nearly 700 billion VND compared to the beginning of the year, accounting for approximately 60% of the total capital.

NSH Petro is recognized as one of the largest petroleum distributors in the Southwest region of Vietnam. The company was established on February 14, 2012, and is headquartered in Hau Giang province. The Chairman of the Board of Directors and the legal representative is Mr. Mai Van Huy.

According to the company’s website, NSH Petro currently operates 67 gas stations and 550 petrol stations in the Mekong Delta region. Additionally, the company owns a petrochemical refinery with a capacity of 700,000 liters of finished products per day and a system of 9 wharves with a total capacity of over 500,000 m3.

It is worth noting that in December 2023, the Hau Giang Provincial Tax Department issued a decision to enforce tax collection from NSH Petro, with an outstanding tax debt of over 1,159 billion VND. The reason for the enforcement, as stated by the Hau Giang Provincial Tax Department, was that NSH Petro had tax arrears exceeding 90 days.

Concurrently, the Can Tho City Tax Department also issued a decision to enforce tax collection by suspending the use of invoices for the NSH Petro branch in Can Tho (Lot 2.7 Tra Noc Industrial Zone, O Mon District, Can Tho City). The reason for the enforcement was that the NSH Petro branch in Can Tho had tax arrears exceeding 90 days, amounting to over 92.5 billion VND.

According to the company’s explanation, on December 20, 2023, the Hau Giang Provincial People’s Committee sent an official letter to the Ministry of Finance and the General Department of Taxation requesting advice on resolving difficulties for NSH Petro, creating favorable conditions for the company to commit to the local government to gradually pay its tax arrears to the state budget.

The Ministry of Finance also sent an official letter to the Hau Giang Provincial People’s Committee regarding NSH Petro’s request for a gradual payment of tax arrears. The Ministry of Finance stated that under Clause 5, Article 124 of Law No. 38/2019/QH14 of the National Assembly on Tax Administration and Clause 2, Article 66 of Circular No. 80/2021/TT-BTC of the Ministry of Finance guiding procedures for the gradual payment of tax arrears, NSH Petro is currently subject to enforcement measures for tax debts by the tax authority.

Therefore, to be eligible for a gradual payment of tax arrears, NSH Petro must submit a complete application in accordance with the regulations in Circular No. 80/2021. This includes obtaining a letter of guarantee from a credit institution and submitting it to the Hau Giang Provincial Tax Department for consideration and processing of the gradual payment of tax arrears within the prescribed authority.

“If the company fails to complete the application for gradual payment of tax arrears, the Hau Giang Provincial Tax Department will take enforcement measures against the company in accordance with the law,” said the Ministry of Finance.

In the stock market, PSH shares are currently trading at 5,010 VND per share, less than half of their value at the beginning of 2024. Notably, PSH shares recently rose by the maximum daily limit for two consecutive trading days after five consecutive trading days of hitting the floor price.