|

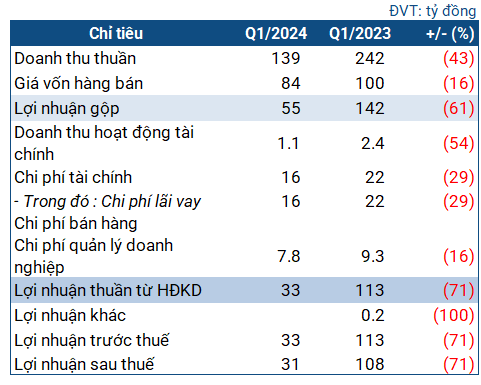

CHP’s Business Indicators in Q1 2024

Source: VietstockFinance

|

In Q1, CHP recorded 139 billion VND in revenue, a 43% decrease year-over-year. Despite a reduction in the cost of goods sold, after deduction, the company’s gross profit was 55 billion VND, 61% lower than the same period last year.

Expenses in the period saw a significant decrease, but this had little impact on the final result as revenue had declined sharply. At the end of Q1, CHP’s net profit was 31 billion VND, less than one-third of the same period last year.

Compared to the plan outlined in the 2024 General Meeting of Shareholders’ documents (to be held on the morning of April 25, 2024), CHP has only achieved 20% of its revenue target and 16% of its after-tax profit target.

Similar to other businesses in the same industry, CHP attributed these results to the impact of climate change and the El Nino phenomenon, which have led to unfavorable hydrological conditions. The low water flow into the A Luoi reservoir has reduced the electricity output and caused a significant decline in revenue. This phenomenon is expected to continue until mid-year, so CHP’s business outlook is unlikely to improve in the next quarter.

Nevertheless, CHP’s balance sheet as of the end of Q1 remains healthy. Total assets decreased by 6% compared to the beginning of the year, to nearly 2.8 thousand billion VND. Of this, over 454 billion VND are current assets, a decrease of 20%. The company holds nearly 280 billion VND in cash and cash equivalents, almost twice the amount at the beginning of the year. Accounts receivable decreased sharply by 61%, to 164 billion VND.

On the other side of the balance sheet, short-term debt is 277 billion VND, 36% lower than at the beginning of the year, of which nearly 209 billion VND is bank loans (unchanged). The corresponding current ratio is 1.6 times. Long-term debt is recorded at 543 billion VND, a decrease of 9%.