Recently, street food for Vietnamese youth, especially in major cities like Hanoi and Ho Chi Minh City, has become quite diverse and rapidly changing. It is observed that grilled stone sausage, also known as Ha Khau sausage, is becoming a new culinary trend after lemon tea or baked milk tea from Vân Nam.

It is noteworthy that most of these new trends originate from China. For example, the lemon tea trend that once caused a sensation on social media platforms originated from China, with the main ingredient being lemons from Guangdong. Similarly, the new star, grilled stone sausage, is also believed to have originated from Ha Khau, China.

In fact, many young snack lovers in Vietnam are whispering about a unique drink that is making waves in this neighboring country, which is chili coffee. Many local coffee shops are starting to research and be ready to jump on the trend if it suits the taste of customers.

Photo: Lemon tea, which once caused a sensation on social media platforms, originated from China.

In the restaurant segment, traditional Chinese cuisine has long been a part of the Vietnamese F&B industry with well-established names like Dimsum, Hong Kong hotpot, and Hailidao.

Another example is the Mixue bubble tea brand, which has quickly made its mark in the market, attracting customers and changing perceptions about products, prices, and added value for Vietnamese bubble tea.

From an insider’s perspective, the Chinese culinary wave can be attributed to the mindset of “domestic Chinese goods of good quality”. These brands and products have been well-established in the domestic Chinese market, arousing curiosity for experience and use. It cannot be denied that Chinese food products have reasonable prices, easy accessibility, and appeal to the taste buds of Vietnamese consumers. At the same time, consumers are gradually forgetting their concerns about the origin of food products from China, thanks to the peace of mind when using domestic Chinese products.

From a business perspective, many people believe that this wave is helping to diversify the F&B market and enhance the overall customer experience at the same price range.

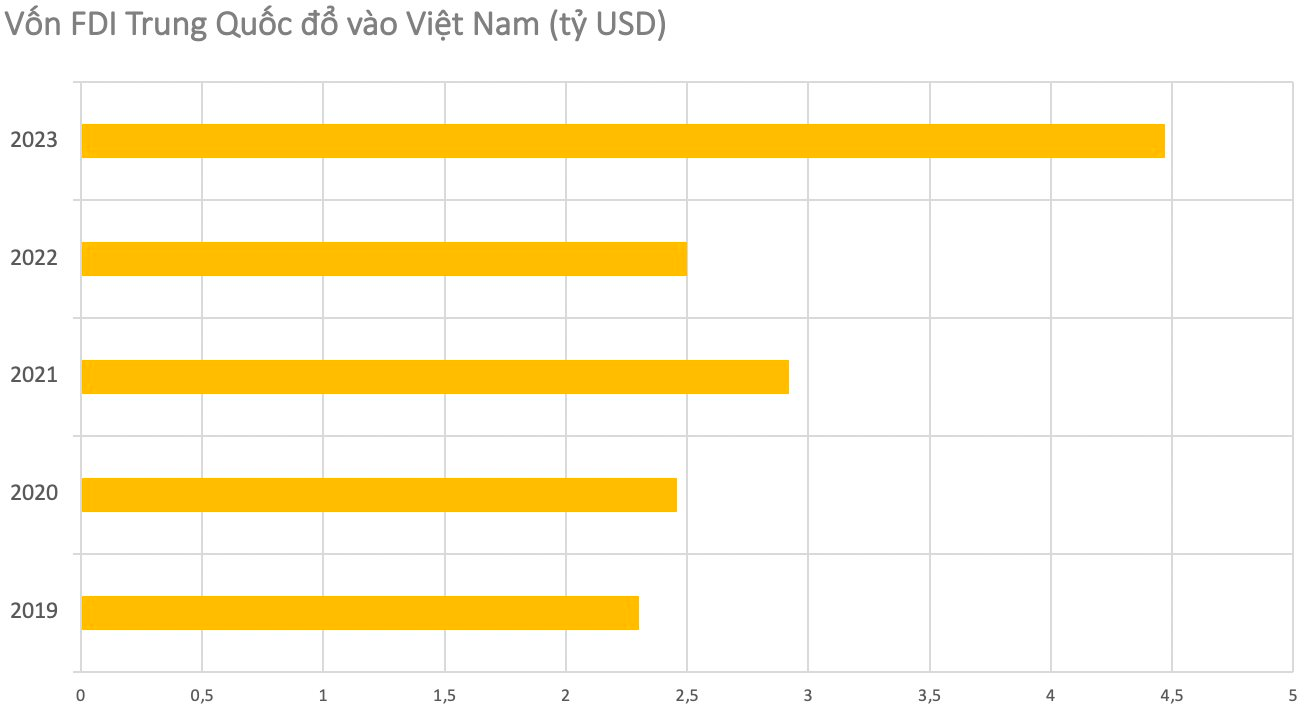

The hottest trend in the F&B industry comes at a time when Chinese investment in the Vietnamese market has increased significantly in 2023.

Photo: Statistics from the Foreign Investment Agency.

According to statistics from the Foreign Investment Agency, as of January 20, 2024, the total newly registered capital, adjusted capital, and capital contribution to buy shares, contributed capital (GVMCP) of foreign investors (FDI) reached over 2.36 billion USD, an increase of 40.2% compared to the same period in 2023. Among them, China is the leading investor in terms of the number of new investment projects, accounting for nearly 19%.

China currently ranks 6th out of 144 countries and territories investing in Vietnam with a total registered capital in effect until the end of 2023 of nearly 27.479 billion USD. In 2023 alone, the total registered capital of Chinese businesses in Vietnam reached 4.47 billion USD, ranking 4th among all foreign investors in Vietnam in terms of registered capital.

The presence of Chinese businesses in Vietnam is increasingly prominent and covers various industries and sectors. According to statistics from the Ministry of Planning and Investment, in addition to familiar fields such as restaurants, hotels, and consumer goods, Chinese investors have also expanded into other industrial and manufacturing sectors, such as electronics, garment and textile, leather and footwear, and electricity.

For example, in 2023, Jinko Solar Holding, a Chinese solar cell manufacturer, invested 1.5 billion USD in a complex photovoltaic technology project in Quang Ninh. Or, Runergy Group invested 293 million USD to build a semiconductor materials factory in Nghe An. BYD, China’s largest electric car company, also invested 269 million USD in an automotive component project in Phu Tho.

According to SCMP, the rising production costs domestically and the “China +1” shift in supply chains, as well as geopolitical tensions, are the factors driving Chinese businesses to invest more in Vietnam.