PNJ Revenue Hits Record High in Latest Quarter

| PNJ Achieves Record Quarterly Revenue |

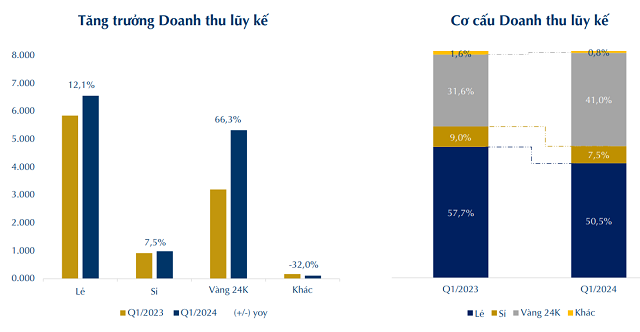

PNJ announced a surge in 24k gold revenue, attributed to increased customer demand and the acquisition of new clients for its “Tai Loc” and 24k products. The retail jewelry segment also experienced growth, driven by the launch of new collections tailored to customer preferences, effective marketing strategies, and sales promotions that attracted both new and returning customers.

Source: PNJ‘s Q1 2024 Operating Report

|

According to PNJ‘s Q1 2024 operating report, the share of 24k gold revenue rose from 31.6% to 41%, while retail jewelry revenue declined to 50.5% from 57.7% in the same period last year.

At the annual General Meeting of Shareholders, PNJ‘s Deputy Chairman and General Director, Mr. Le Tri Thong, explained the shift in revenue structure compared to previous years. Consumers are increasingly opting for gold bars (24k gold) due to speculative tendencies, as opposed to purchasing jewelry solely for aesthetic purposes amidst rising gold prices.

However, PNJ‘s profit margin for 24k gold sales remains below 1% due to rising gold prices. In contrast, retail jewelry offers a higher profit margin since gold only accounts for 50% of the cost of goods sold for jewelry products.

| PNJ‘s Net Income Over the Past Quarters |

Consequently, the change in product mix affected profitability, resulting in a first-quarter net income of approximately 738 billion VND, roughly matching the previous period, despite the record-breaking revenue.

For the current year, PNJ has set a revenue target of 37,147 billion VND, representing a 12% increase compared to 2023. Net profit is projected to rise by 6% to 2,089 billion VND. These figures would set new records for the company. However, Chairwoman Cao Thi Ngoc Dung emphasized that this plan is conservative.

Based on the performance in the first quarter, PNJ has achieved 34% of its revenue target and over 35% of its profit goal.

PNJ‘s total assets reached 12,969 billion VND as of the end of the first quarter, reflecting a 10% decrease since the beginning of the year. Inventory accounts for the largest share of the company’s assets, at 73%, primarily comprising finished goods, merchandise, and raw materials, valued at approximately 9,517 billion VND, down 13% year-over-year.

As of March 31, 2024, PNJ‘s short-term debt had decreased significantly by 85% from the beginning of the period to 364 billion VND.