PVI Corporation (PVI Holdings) has officially announced its independent financial report for the first quarter of 2024. Consolidated revenue in the first quarter (including revenue from product sales, financial revenue and other revenue) reached 6,504 billion VND, a 50% increase over the same period last year, completing 37.4% of the annual plan.

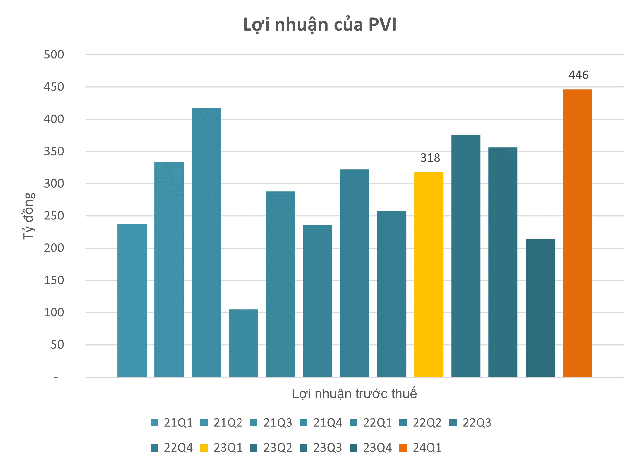

Consolidated profit before tax reached 446 billion VND, up 40% compared to the same period last year, of which the largest proportion in the profit structure was financial investment activities accounting for 48.9%. The return on equity (ROE) ratio consolidated over the year reached 18%, higher than 13.5% in Q1.2023.

Along with the growth in scale and market share in the insurance industry, PVI’s total assets have also increased significantly by nearly 14% compared to the same period, to over 30,700 billion VND. Of which, outstanding loans account for less than 3%, with negligible borrowing costs. Cash flow from operating activities reached nearly 590 billion VND, an increase of more than double compared to the same period.

Although the first quarter is quite early to fully assess the implementation of the business plan for the whole year, all PVI’s subsidiaries have exceeded the key business targets assigned by PVI.

Regarding insurance business activities, PVI Insurance Corporation (“PVI Insurance”) continues to maintain strong growth with original insurance revenue reaching 4,217 billion VND, with a growth rate of more than 30% compared to the same period and more than double that of the market.

Gross profit from insurance business activities reached 360 billion VND, up 48% over the same period last year, thanks to PVI’s continuous improvements despite the fact that the insurance market in 2024 continues to record an increase in compensation costs and price competition. domestically and internationally. Not only that, PVI Insurance in the first quarter still maintained a combined ratio of less than 90% and still held the number 1 position in the non-life insurance industry with over 20% market share.

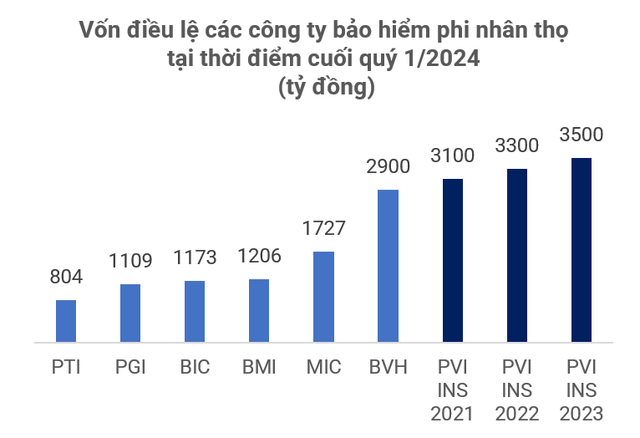

With the ever-increasing demand for business expansion, on March 29, 2024, PVI Insurance was approved by the Ministry of Finance to increase its charter capital from 3,300 billion VND to 3,500 billion VND in Official Dispatch No. 63/GPĐC23/KDBH, continuing to be the non-life insurance company with the largest charter capital in the Vietnamese market.

Regarding reinsurance activities also had strong growth from the beginning of 2024 through a strategy of expanding into the international market on the principle of ensuring safety and efficiency with Reinsurance revenue reaching 1,870 billion dong, completing 233% of the plan for the first quarter of 2024 and increasing by 64% compared to the same period last year.

Regarding financial investment activities, although the financial market at the beginning of 2024 faced many difficulties, recording a significant decrease in deposit interest rates and a scarcity of investment opportunities; however, with the investment portfolio structure that has been flexibly adjusted since the beginning of 2023, PVI has secured a relatively large amount of investment capital with good interest rates, ensuring profit expectations for investment activities for the whole 2024. Accordingly, financial investment revenue of the entire system reached 314 billion VND, completing 115% of the plan and increasing by nearly 3.5% compared to the same period with healthy investments, managed with good risk.

PVI shares continue to trade in the price range of 45,000 – 50,000 VND, especially at the end of February 2024 after exceeding the 45,000 VND/share base level, there was a good increase of about 10% to an average of 50,000 VND/share in March 2024. Liquidity continued to remain stable in the range of 30,000 – 50,000 shares/session.

On March 27, 2024, financial credit rating organization AM Best affirmed the Financial Strength Rating at A- (Excellent) and the Long-Term Issuer Credit Rating at “a-” (Excellent) for PVI Insurance with a stable outlook. In addition, Hanoi Reinsurance Corporation (“Hanoi Re”) was also upgraded by A.M Best to a bbb long-term Issuer Credit Rating with the outlook revised from stable to positive. AMBest also affirmed Hanoi Re’s Financial Strength Rating of B++ (Good) with a stable outlook.