Customer Deposits in Securities Companies Reach Record High in Q1 2024

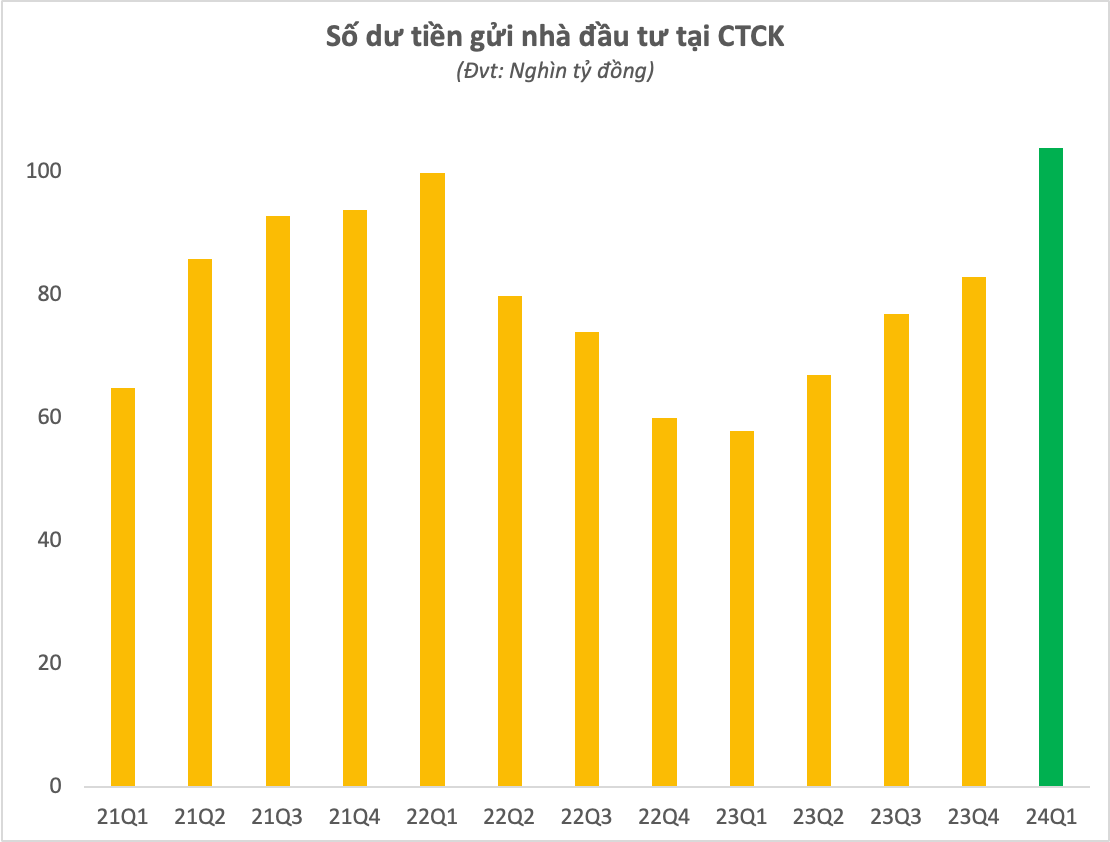

According to statistics from the financial report of the first quarter of 2024, customer deposits in securities companies (SCs) amounted to approximately 104,000 billion VND at the end of Q1 2024. This is primarily composed of deposits from investors trading securities managed by SCs.

This marks the fourth consecutive quarter that investor deposits in SCs have increased compared to the previous quarter, reaching the highest level ever recorded, surpassing the 100,000 billion VND mark set in Q1 2022. Compared to the end of 2024, the figure has increased by approximately 21,000 billion VND within just the first three months of the year.

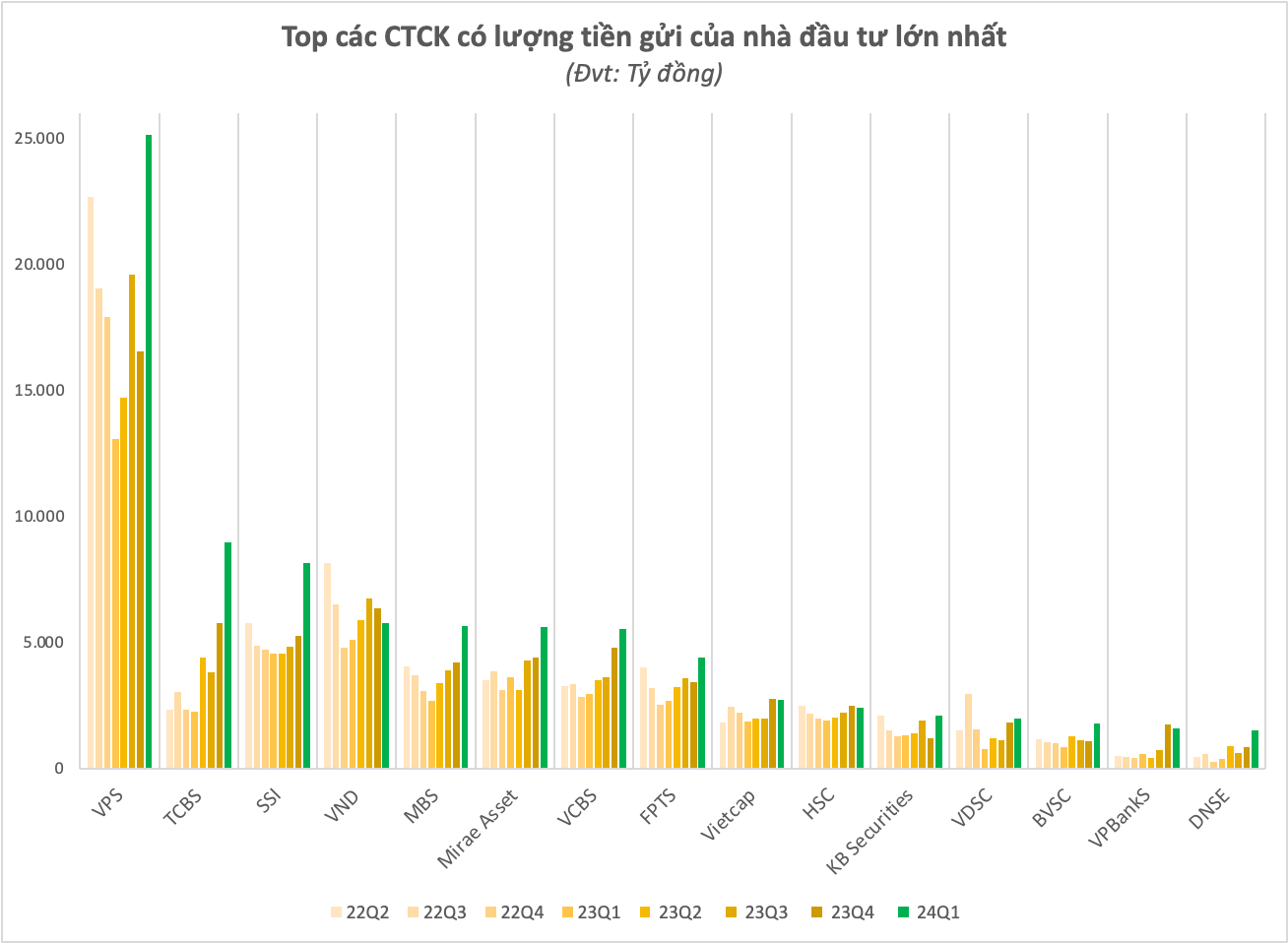

VPS continues to be the SC with the largest customer deposits, with nearly 25,200 billion VND as of March 31, 2024. This represents a significant increase of 8,600 billion VND compared to the end of 2023, marking the highest growth in the industry. VPS currently holds the largest market share in brokerage services, with 1/5 of the market share on the HoSE floor and approximately 1/4 of the market share on the HNX and UpCOM floors. It even holds 2/3 of the derivative market share, far surpassing its competitors. Therefore, it is not surprising that it has the highest amount of investor deposits in its accounts.

TCBS and SSI are ranked after VPS, with investor deposits of approximately 9,000 billion and 8,200 billion VND, respectively. Both companies have increased their investor deposits, with TCBS gaining over 3,200 billion and SSI growing by 2,900 billion VND. This is the highest level of investor deposits ever recorded by TCBS at the end of a quarter, while SSI’s figure is the highest since Q3 2021.

In contrast, VNDIRECT Securities Corporation has seen a decrease in investor deposits compared to the beginning of the year, falling by almost 600 billion to below 5,800 billion VND by the end of Q1.

However, most of the top companies have shown an increase in this category compared to the end of 2023. MBS increased its investor deposits by over 1,400 billion to nearly 5,700 billion; Mirae Asset increased by nearly 1,200 billion in 3 months to 5,600 billion; similarly, VCBS maintained nearly 5,600 billion in investor deposits, an increase of around 800 billion compared to the beginning of the year.

On the downside, in addition to VNDIRECT, other SCs that recorded lower investor deposits after 3 months include Vietcap, HSC, and VPBankS. The largest decrease was seen at BSC Securities Company, with investor deposits declining by nearly 1,400 billion to 1,500 billion VND as of March 31, 2024.

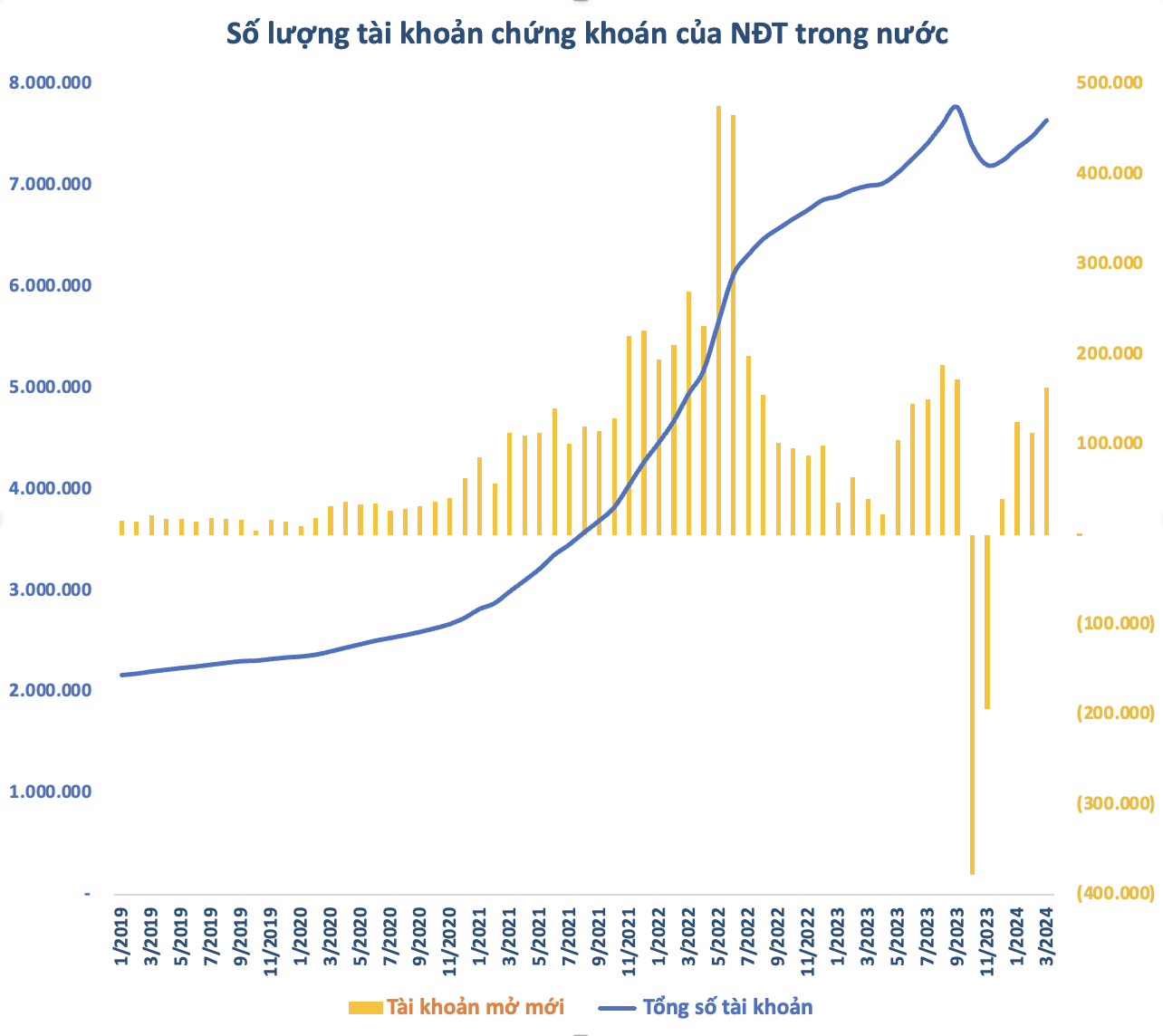

The increase in account balances is occurring alongside a resurgence in the number of securities accounts. Following a period of decline due to regulatory scrutiny and data cleansing, the number of domestic investor securities accounts has rebounded over the past four consecutive months, from December of last year to March of this year. In March alone, the number of domestic investor accounts increased by 163,621, marking the largest increase in the past six months. As of the end of March 2024, Vietnam had over 7.6 million individual securities accounts, equivalent to approximately 7.6% of the population.

Not only have investor deposits in SCs increased, but the demand for leverage among securities investors has also been stimulated. Outstanding loans in SCs were estimated at 206,000 billion VND at the end of Q1 2024, an increase of approximately 26,000 billion compared to the end of last year. Among these, outstanding margin loans were estimated at around 195,000 billion VND, also increasing by 23,000 billion in the first three months of the year. This is a record high in Vietnam’s securities history.

It is evident that the positive market conditions, with the VN-Index rising steadily for 5 months to return to its 19-month peak, have reignited interest in securities. The low-interest environment has further driven investors to channel their investments into the securities market. Funds held at SCs may be due to investor inactivity or the realization of profits and subsequent retention of funds in their accounts. The Q1 financial reporting season also brought positive signals, with listed companies projecting solid earnings growth on a low base comparison, contributing to a lower market valuation. This is expected to encourage a stronger inflow of funds.

However, investors should be aware of the heightened risks in the current environment, such as international tensions, rising commodity prices, and exchange rate pressures. The recent sharp decline in the VN-Index is a reflection of these negative factors. According to Agriseco Research, the international macroeconomic environment remains complex, with the FED maintaining higher interest rates, heightened strategic competition between major countries, risks to the security of supply chains, and slowed growth prospects for major economies. These factors will likely continue to negatively impact the global economy and the securities market in particular. Exchange rates pose a risk when the USD/VND exchange rate has already exceeded 25,000 VND. The market may experience continued selling pressure from foreign investors in the coming period, as this group has sold over 1 billion USD in net sales over the past year.

Maybank IBG Research, in its recent report, also assessed that the VN-Index is showing signs of weakness as it approaches its resistance level, predicting a correction in April. However, Maybank IBG Research believes this will present an opportunity to accumulate stocks as the economic and securities outlook improves. The research firm forecasts a GDP growth of 5.8% year-over-year in 2024 (compared to 5.05% in 2023), driven by exports and domestic consumption. A stronger recovery is expected in the second half of 2024.