PNJ: Bullish with a Target Price of $4.74/share

VNDIRECT maintains a bullish recommendation on the stock PNJ of Phu Nhuan Jewelry Public Company with a target price of $4.74/share. The growth drivers are from the expansion of stores and new customer base.

Accordingly, the number of PNJ‘s stores is expected to increase by 8.7% and 6.9% year-over-year in 2024-2025. The target growth in sales per store maintains at 2% in line with the growth trend of the middle and high-end class.

In the period 2024-2025, VNDIRECT forecasts PNJ‘s retail revenue to increase by 11.4% and 9.3% year-over-year; 24K gold revenue is estimated to increase by 12.1% and 1.7% year-over-year in the context of increasing demand for gold trading.

VNDIRECT also believes that PNJ‘s new customer base also targets the mid-range jewelry segment, thereby supporting the increase in gross profit margin in 2024. Specifically, PNJ‘s gross profit margin is expected to increase by 0.2 points and 0.4 points percentage points year-over-year in 2024-2025.

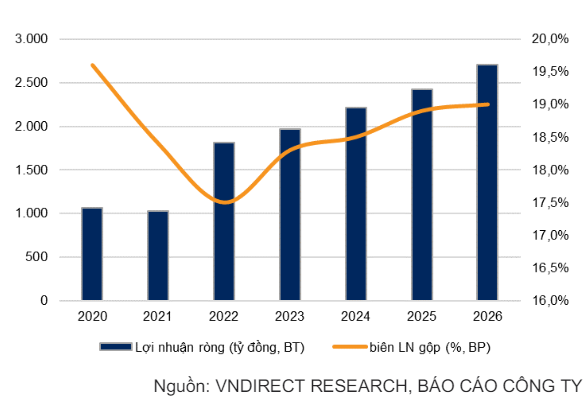

Despite implementing many marketing programs, PNJ will still manage costs well with the ratio of selling expenses to revenue remaining stable at 10%-11%. In 2024, VNDIRECT forecasts PNJ‘s net income to increase by 10.8% year-over-year and continue to increase by 9.4% to VND 2,390 billion (~$97.5 million) in 2025.

|

PNJ’s Business Results Forecast 2026 2024-2026

|

On the other hand, PNJ is trading at a P/E of 16.9 times – still lower than the average of peers at 19 times despite the company having a higher ROE and net income growth rate. This valuation is quite attractive compared to the profit growth outlook and the company’s leading position in the Vietnamese jewelry market.

Read more here

BWE: Raise Weighting with a Target Price of $2.1

Mirae Asset Securities (Vietnam) recommends increasing the weighting of BWE shares of Binh Duong Water Environment Joint Stock Company with a target price of $2.1/share with the expectation that M&A will be a growth driver.

Previously, in 2023, BWE completed 14 transactions with a total investment value of approximately $55.8 million. This M&A activity targets companies with large market share in key areas with high urbanization rates. After M&A, BWE has increased its capacity to 930,000 m3/day and night, up 12.4% year-over-year in 2023.

According to Mirae Asset, the acquisition of BWE Long An is expected to contribute an average of $7.4 million in revenue and $1.4 million to BWE‘s net income in 2024-2025, after which it is expected to maintain a growth rate of 10% per year upon doubling the capacity of the Nhi Thanh water plant to 120,000 m3/day. In addition, the joint ventures are expected to double their income from associates and joint ventures, to $1.6 million/year.

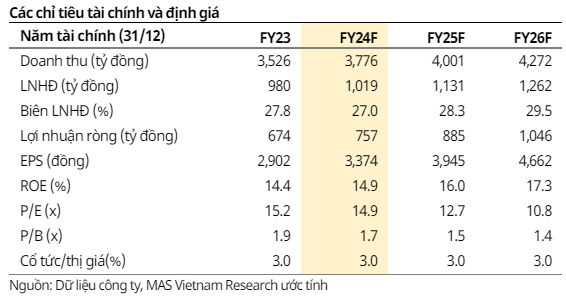

In 2024, BWE‘s revenue is expected to increase by 7.1% year-over-year to $156 million and the net income is estimated to recover to $31.3 million, up by 12.3%. Overall, BWE‘s revenue and net income growth in 2024-2028 is expected to remain stable at 6.6% and 15.6% per year.

|

BWE’s Business Results Forecast 2024-2026

|

Note that BWE‘s actual business results in 2024 may not meet the forecast due to the exchange rate loss. In 2023, the Company recorded a net exchange rate loss of $1.1 million.

Read more here

Buy IDI Shares with a Target Price of $0.6

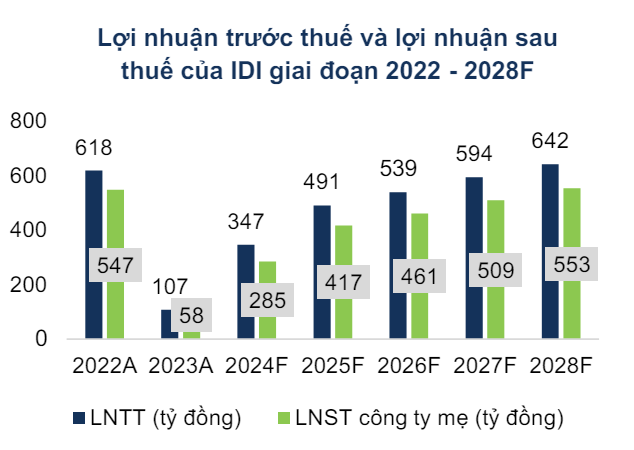

FPT Securities (FPTS) recommends buying IDI shares of Multinational Development Investment JSC – IDI with a target price of $0.6/share based on IDI‘s 2024 business results are expected to recover positively.

Source: FPTS

|

Accordingly, IDI‘s net revenue and profit after tax of the parent company are expected to reach $333.2 million and $11.7 million, respectively, up 12% and 394% year-over-year. The growth drivers come from the strong recovery in demand for tra fish in the two main markets of China and Mexico from the second half of 2024, combined with the context of tight supply of tra fish in the entire industry which will support the recovery of export prices in these two markets.

Compared to China, FPTS expects demand in Mexico to recover 1 quarter earlier as Mexican importers are entering a new inventory cycle as inventories have declined to low levels since the end of 2023. At the same time, the export price of tra fish to Mexico has shown signs of bottoming out since December 2023, reinforcing the view of a clear recovery in demand for tra fish in Mexico from the second quarter of 2024.

However, the long-term export outlook for the key market remains China (accounting for 18% of total revenue) due to the expected growth in demand for seafood. According to the FAO, per capita seafood demand in China is expected to increase by 1.27%/year during 2021-2032, reaching 46kg/year by 2032 due to improving incomes.

FPTS positively assesses this trend as the seafood consumption of Chinese people is significantly lower than in high-income areas of the country such as Macau and Hong Kong. Therefore, this will be a favorable condition for companies with the second largest export market share in this market, such as IDI, to expand exports in the long term.

Read more here

—