Vinaconex’s 2024 Annual Shareholders’ Meeting was held in Hanoi on the morning of April 24. Photo: BTC

|

According to the voting record, as of 8:39 AM on April 24, Vinaconex’s 2024 Annual Shareholders’ Meeting was attended by 55 shareholders, representing over 296.6 million shares, equivalent to 55.5% of the total number of shares entitled to vote. The meeting met the quorum requirements.

Vinaconex’s Three Main Business Pillars

Speaking at the meeting, Mr. Dao Ngoc Thanh, Chairman of Vinaconex’s Board of Directors, shared about Vinaconex’s three main business pillars. For the construction sector, in 2023, the total value of contracts won by the entire Vinaconex system reached VND 13,200 billion, setting a record for contract value in a year, ensuring work for 2024 and subsequent years.

Some major contract packages include: Two packages in the Long Thanh International Airport project, some packages in the North-South Expressway project phase 2021-2025 (Vung Ang – Bung section), the Tuyen Quang – Ha Giang Expressway project, and package number 9 – the Ring Road 4 project around the capital region.

With a five-year vision of striving to be in the top 5 construction contractors in Vietnam, the Vinaconex brand has become the second-ranked company in the top 10 construction contractors in Vietnam in 2023 (according to Vietnam Report).

Mr. Dao Ngoc Thanh, Chairman of Vinaconex’s Board of Directors, speaking at the meeting. Photo: BTC

|

In the real estate sector, 2023 could be considered the bottom, Vinaconex expects 2024 to recover slightly, but is still very slow. If last year, Vinaconex continued to implement large projects that would certainly lead to negative results, affecting shareholders. The Green Diamond condominium project at 93 Lang Ha has been put into operation, meeting the conditions for sale; new urban areas in Quang Ninh, Phu Tho, Khanh Hoa… especially the Cat Ba Amatina tourism urban project (Vinaconex ITC) are all under preparation, ensuring effective investment. The Company’s Board of Directors must consider each project individually because real estate is the second pillar, next to construction, so it must be given attention and must have new progress.

The third pillar is financial investment, the Company continues to carry out the process of merging and divesting joint ventures and associated companies. In particular, financial investments in some strategic subsidiaries, such as the Dakba Hydropower project (Bach Thien Loc Joint Stock Company) or investments in water supply and education companies, all bring high profits.

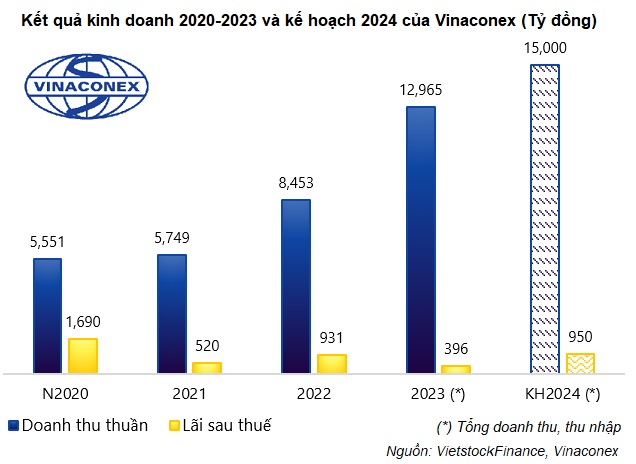

2024 post-tax profit target increases by 140%

In 2024, Vinaconex sets a target for total revenue and consolidated income of VND 15,000 billion and post-tax profit of VND 950 billion, respectively increasing by 15% and 140% compared to 2023. If the plan is completed, this will be the highest profit in the past four years since 2021. The Company also plans to pay a dividend of 10%.

Plan to issue more than 183.5 million shares, increasing capital to over 7,000 billion

Regarding the profit distribution plan for 2023, VCG proposes to issue more than 64 million shares to pay dividends to shareholders at a rate of 12% (owning 100 shares, receiving an additional 12 shares). These shares will not be subject to transfer restrictions. The expected implementation time is in 2024 after approval by the State Securities Commission (SSC).

After the dividend distribution, Vinaconex’s retained post-tax profit is over VND 136.5 billion.

In addition, the Company’s Board of Directors submitted to the shareholders for approval a plan to offer additional shares to existing shareholders to increase charter capital. Specifically, VCG plans to offer for sale a maximum of more than 119.7 million shares, equivalent to 20% of the total number of outstanding shares at the time of the offering (including the number of shares expected to be issued to pay dividends in 2023). The exercise ratio is 5:1 (owning 05 shares, purchasing 01 new share). The additional shares offered for sale will not be subject to transfer restrictions.

With an expected offering price of VND 10,500 per share, the amount expected to be raised from the offering of over VND 1,197 billion will be used by Vinaconex to supplement working capital for production and business activities, specifically to pay maturing debts, including debts to banks, credit institutions, contractors and suppliers due in 2024 and 2025.

Authorization for the Board of Directors to select the appropriate offering time after obtaining approval from the SSC, expected to be implemented in 2024-2025.

If both plans are completed 100%, Vinaconex will issue a total of over 183.5 million new shares and the Company’s charter capital is expected to increase from nearly VND 5,345 billion to nearly VND 7,183 billion.

Discussion:

Are the profit margins of public investment projects good?

Chairman Dao Ngoc Thanh: The profit margin of public investment is set at a fixed price that the business cannot control. When doing transportation projects, the main material is embankment material, which must be purchased from sources of approved origin, making it very difficult for contractors. The profit margin is low, but Vinaconex will try to achieve at least 2% or more.

Regarding the story of construction materials at the Long Thanh airport project, could the increase in material prices affect Vinaconex?

Mr. Duong Van Mau – Executive Vice President of Vinaconex, directly managing the Long Thanh project: Vinaconex is implementing two packages in the Long Thanh airport project. Vinaconex’s contract value compared to the project construction contract is about 11%, excluding the equipment part, it is about 22%.

Package 5.10 is in line with Vinaconex’s core competence, which is reinforced concrete, glass roof, ceiling… The value of reinforced concrete is about 500 billion, Vinaconex has taken the initiative to purchase raw materials in advance, and is expected to complete all the concrete part by August 2024. As for the roof and steel structure, the raw materials are all imported.

The part of the airport, road and parking lot is worth over a thousand billion VND, Vinaconex has taken the initiative to purchase base rock in advance, while the supply of cement and steel is abundant. Notably, for key projects, the State is very fair with businesses, always creating favorable conditions, and contracts are adjusted according to unit prices.

Vinaconex chose the solution of actively placing orders and picking up goods in advance to bring them to the storage yard. We basically have good control, so the material part does not affect us too much.

First quarter profit about 400 billion VND

Is it possible to continue implementing other packages in the Long Thanh airport project?

Chairman Dao Ngoc Thanh: Long Thanh airport is a major project of the Vietnamese economy, because it is a large-scale project, so I think it will take not only one year but also decades to build. Vinaconex will do all the best, the most prestigious, to become a major contractor building the Long Thanh airport project.

How likely is it to complete the 2024 plan?

Chairman Dao Ngoc Thanh: When setting the business plan for