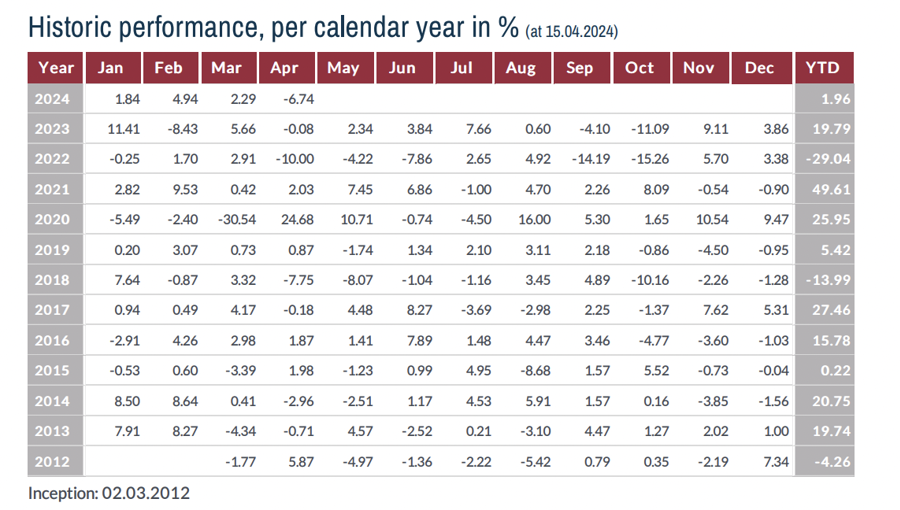

For instance, Lumen Vietnam Fund. After the recent market plunge, the fund recorded a performance of -6.74%, bringing its year-to-date return down to just under 2%. In contrast, the fund recorded a positive performance of over 9.32% during the previous 3 months.

The fund’s current portfolio has its largest exposure to FPT at 7.11%; followed by VNM at 5.08%; MWG at 4.59%; MSN at 4.52%; with other notable holdings including PLX, CTG, STB, VHM, VNM, BVH.

In terms of valuation, the P/E ratio has increased to near its long-term average. The fund believes that the period of the market being deeply undervalued has come to an end. Nevertheless, the fund maintains a positive view on the market outlook over the medium-to-long term, based on the following fundamentals:

As of end-March 2024, the P/B valuation of the Vn-Index remains cheap at 1.8x, which is one standard deviation below its 5-year average; Equities are expected to remain the preferred investment channel in Vietnam over the coming years, attracting increasing inflows from domestic investors.

Solid macroeconomic conditions continue to show improvement and the government’s efforts to navigate the economy towards growth are promising. Notable developments include: Considerable progress towards upgrading the stock market to emerging market status after the latest draft Circular was issued by the State Securities Commission (SSC). Key highlights include: Removal of the pre-funding requirement, allowing brokerage firms to accept buy orders from foreign institutional investors without the clients’ accounts being 100% cash-funded.

Clear guidelines in case of cash shortfall or failed trades, with brokerage firms required to take ownership of the shares in their trading accounts.

Improved settlement obligations between brokerage firms and custodian banks; Enhanced disclosure requirements through mandatory English language publication.

The government’s proactiveness in accelerating the issuance of the Land Law, ahead of market expectations, signals potential for a faster than expected recovery in the Real Estate sector. Spillover effects from a recovering real estate market are expected to extend to other sectors, especially consumer-related industries.

With its current cash position, the fund plans to capitalize on future market volatility by investing in companies with potential growth catalysts at more reasonable valuations. The fund will prioritize companies with strong financial positions that have been restructuring their operations over the past year to better capture growth and expansion opportunities. The diversified investment strategy, with a focus on mid- and small-cap stocks, should continue to deliver solid results for the fund in the coming years.

Previously, another foreign fund, Pyn Elite, also recorded a performance decline of 9.5% over the past three weeks. Thus, with the recent decline, the fund has erased its gains over the past two months, with its year-to-date performance falling to 5.85% from 15% previously.

“The ingredients for a continued uptrend are in place. Fast corrections hurt, but you need to stomach them if you are in the game,” the fund’s head, Petri Deryng, stressed.

Earlier, the fund manager also noted that the strengthening US dollar has had a negative impact on other Asian emerging market currencies, with the Euro weakening as well. The Vietnamese Dong has depreciated, and political noise in Vietnam triggered a sell-off in the stock market in early trading sessions.

“However, the economic growth and earnings growth outlook for listed companies this year is excellent. The stock market is trading at very attractive valuations relative to earnings growth. Vietnamese interest rates have declined, and the banking system liquidity is ample. The large moves in the stock market are unwelcome, but they do not change our expectations for a positive development of the VN-Index,” the head of Pyn Elite Fund commented.