Liquidity Declines on Vietnamese Stock Market Despite Intraday Volatility

Despite a brief surge in volatility during the afternoon session, trading liquidity on Vietnam’s two exchanges remained relatively stagnant compared to the morning. Selling pressure remained subdued, while blue-chip stocks fluctuated within a narrow range, supporting the key index. The VN-Index closed with a modest decline of 0.64 points, while the VN30-Index managed to stay afloat, adding 1.55 points.

A notable aspect of the day’s trading was the exceptionally low liquidity. Total成交量 on both exchanges reached only 13,202 billion VND, representing a 28% decrease from the previous day and the lowest level in three months. Afternoon trading witnessed a slight uptick of 15% compared to the morning session, reaching approximately 7,076 billion VND due to a brief bout of volatility.

The market’s strongest recovery and peak occurred within the first 40 minutes of the afternoon trading session, with the VN-Index rising above its reference point by 2.8 points. This was shortly followed by a rapid downturn, with the index dropping to a new low of 5.4 points. The fluctuation was primarily driven by the performance of major stocks. All major pillars such as VCB, VIC, VHM, BID, and even market leaders FPT and MWG, experienced volatility. However, the overall market breadth remained relatively unchanged. At its peak, the VN-Index recorded 133 advancing stocks and 319 declining stocks, while at its trough, 123 stocks were up and 346 were down. The positive momentum that had pushed the VN-Index above its reference point in the morning did not translate into a significant improvement in market breadth.

The volatility caused by the impact of major stocks could raise concerns among investors, particularly given the recent strong market rally and the potential for profit-taking among those who had purchased stocks at the market bottom. While afternoon liquidity increased by 15% compared to the morning, the absolute volume remained low, the weakest since early February.

The low trading volume observed during the afternoon session, as well as throughout the day, can be interpreted as a positive sign, indicating that investors are holding onto their shares even when they have profited from the recent market upswing.

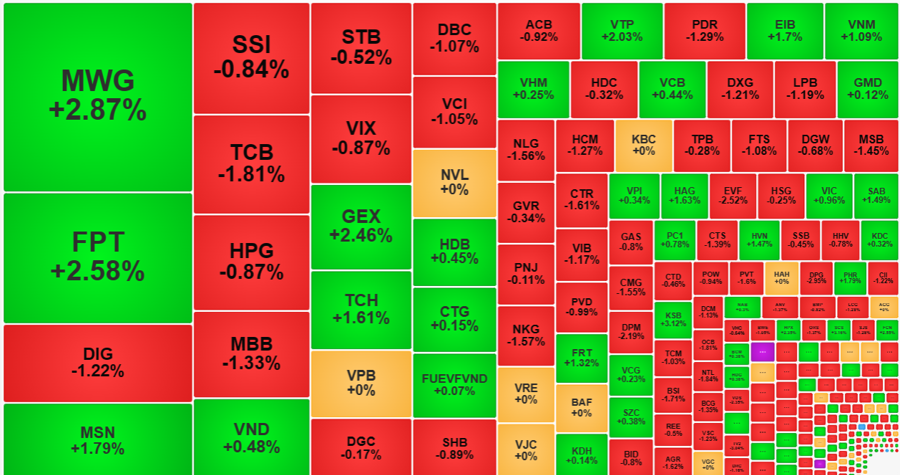

Blue-chip stocks generally underperformed today but maintained stability. The VN30-Index closed with a gain of 0.13%, making it the only capital-weighted index on the HoSE to advance. Mid-cap stocks declined by 0.4%, while small-cap stocks lost 0.37%. The breadth of the blue-chip basket was also lackluster, with 11 stocks advancing and 16 declining. However, most of the decreases were relatively mild, with significant declines limited to TCB at -1.81%, MBB at -1.33%, and VIB at -1.17%. These were offset by gains in FPT (+2.58%), MWG (+2.87%), MSN (+1.79%), and VNM (+1.09%). Notably, the impact of FPT and MWG on the VN-Index was limited, resulting in the index closing below its reference point.

Mid and small-cap stocks suffered the most today, with the HoSE closing with 109 stocks down more than 1%, compared to only three in the VN30. DIG, DBC, VCI, PDR, DXG, LPB, NLG, and NKG were among the most heavily traded stocks, with turnover exceeding 100 billion VND for each. Excluding VN30 stocks, the number of stocks declining by more than 1% on the HoSE accounted for approximately 22.2% of the total market volume.

Despite the overall weakness, bottom-fishing efforts had a positive impact on prices. The narrow market breadth confirmed that stocks lacked the strength to recover fully to the reference point, but the ability to rebound from the bottom remained relatively positive. Specifically, over 53% of traded stocks on the HoSE closed at a price higher than their lowest point of the day by at least 1%. Typically, selling pressure is considered dominant when the closing price is at the lowest level. The fact that closing prices improved suggests that there was demand support at lower price levels, regardless of whether this demand was sufficient to lift prices above the reference point.

Foreign investors increased their buying activity during the afternoon session. Specifically, foreign institutions injected nearly 1,220 billion VND into the HoSE, a 24% increase compared to the morning, while their selling decreased by over 7% to 1,284.9 billion VND, resulting in net selling of only 65.4 billion VND. In the morning, foreign institutions had net sold 401 billion VND.

On the other hand, negotiated cross-trading recorded net selling of 277.9 billion VND in FUEVFVND fund certificates. When combining negotiated and regular trading, the net selling in stocks amounted to approximately 189 billion VND. DIG, GAS, GEX, HDB, CTR, LPB, HDC, MSN, and EVF were among the stocks sold net, with volumes ranging from 20 billion to 40 billion VND. On the buying side, MWG added +209.6 billion VND, VND +45.3 billion VND, TPB +42.6 billion VND, HPG +40.8 billion VND, KDH +28.6 billion VND, VNM +21.9 billion VND, and ASM +20 billion VND.