LGC’s 2023 Financial Year Annual General Meeting of Shareholders was held on the afternoon of April 23.

|

Record Plan

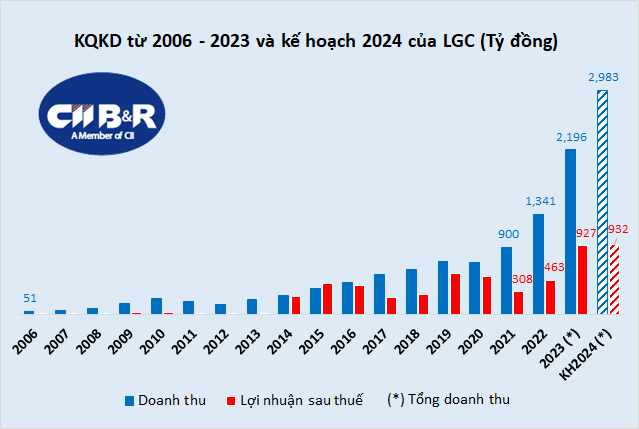

LGC’s 2023 Financial Year Annual General Meeting of Shareholders approved the 2024 business production plan with total revenue of over VND 2,983 billion, an increase of 36% compared to 2023; after-tax profit of nearly VND 932 billion, a slight increase of 0.5%. Both of these targets are the highest in the past 18 years, since the business was listed on HOSE in 2006.

Source: VietstockFinance

|

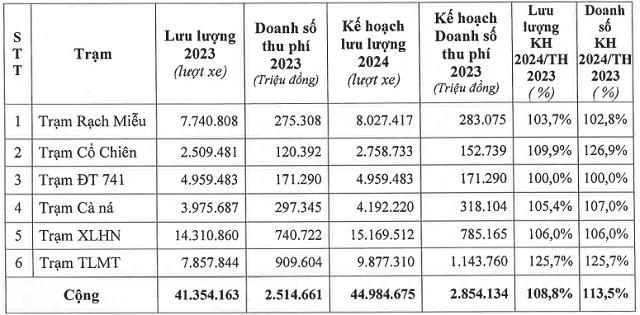

The company expects the traffic volume through 6 toll stations (including Rach Mieu, Co Chien, DT 741, Ca Na, Hanoi Highway and Trung Luong – My Thuan stations) in 2024 to reach nearly 45 million, an increase of 9% compared to 2023. Most of it is concentrated at Hanoi Expressway (over 15.1 million vehicles) and Trung Luong – My Thuan station (nearly 9.9 million vehicles).

The revenue plan at 6 toll stations in 2024 will contribute the largest revenue source as Trung Luong – My Thuan station with nearly VND 1,144 billion, an increase of 26% compared to the previous year and accounting for 38% of total revenue. Next is Hanoi Highway station, which is expected to bring in over VND 785 billion, an increase of 6% and accounting for 26%.

|

LGC’s 2024 Projected Revenue Targets

Source: LGC

|

Contributing capital to establish a subsidiary to operate and manage the expressway routes

Mr. Nguyen Van Chinh – General Director and Member of the Board of Directors of LGC said that current BOT projects are facing increasing difficulties, therefore, the Company has agreed to expand the business lines related to transport infrastructure such as bidding for and operating expressway routes.

Specifically, in 2023, in order to serve the management and operation of expressway projects in the future, the company contributed capital and held a controlling stake of 66.67% of the charter capital of MCSC Service Company Limited (formerly under the management of Infrastructure Investment Corporation). Ho Chi Minh City (HOSE: CII) and transformed into CII Bridge and Road Management and Operation Service JSC (CII O&M).

Although it was only transformed in 2023, the business results of CII O&M are relatively positive, with estimated revenue of VND 100 billion. Through 2024, CII O&M will exploit the Trung Luong – My Thuan expressway, as a premise for bidding for and operating the North-South expressway projects of the State, said Mr. Chinh.

In addition, in 2023, LGC restructured its investment capital in the two projects Hanoi Expressway and Trung Luong – My Thuan in the direction of lower cost of capital, the value of capital restructured is VND 9,340 billion.

In addition, LGC mainly invests in transport infrastructure in the form of BOT and operates mainly in Ho Chi Minh City, and is operating and managing the largest toll station in this area, which is Hanoi Highway. station.

With that resource, in the coming time, LGC will mainly focus on researching projects in Ho Chi Minh City calling for investment under Resolution 98 and participating in bidding for projects with high feasibility.

“In the coming time, LGC will follow up and study the list of 5 key investment projects in the form of PPP in Ho Chi Minh City, and is expected to bid for these projects in the second quarter of 2025, and the Company is focusing on closely following the criteria to participate in bidding for projects.

At the same time, LGC is also looking for and evaluating BOT projects that are being invested or exploited and investors have a need to transfer to decide on investment. Currently, there are two relatively large and feasible projects in this portfolio being assessed and studied for investment,” said Mr. Chinh.

Dividend 2024 at a rate of 32%

LGC shareholders also approved the 2024 cash dividend at a rate of 32%. In which, the Company will use 12% of the after-tax profit of 2024 and 20% of the undistributed after-tax profit from previous years to date to implement the dividend.

For 2023, shareholders also agreed on a cash dividend at a rate of 11%. Previously, in April 2024, LGC spent nearly VND 386 billion for all 3 dividend installments with a total implementation rate of 20%, including 6% in 2020, 8% in 2022 and an interim dividend installment 1/2023 at the rate of 6%. Thus, LGC has at least 1 more interim dividend payment with a rate of 5% for 2023 in the coming period.

As of the end of 2023, LGC’s major shareholder structure includes Ho Chi Minh City Infrastructure Investment Corporation (HOSE: CII, the parent company) holding 54.82% of capital and Metro Pacific Tollways Corporation holding 44.94% of capital. here.