Pioneer Securities Annual General Meeting (AGM) on the morning of April 24

|

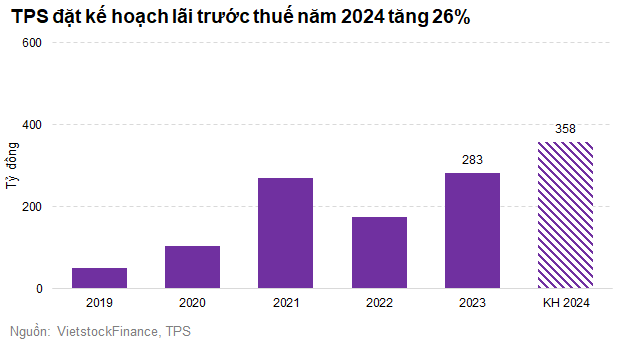

The Company’s executives commented that in 2024, the Vietnamese stock market still has many variables that need to be considered due to the Vietnamese economy expected to continue to suffer a “double negative impact” from adverse factors of the world economic context and the current internal limitations. However, with the assessment that the stock market has many growth drivers in 2024, TPS sets a target of pre-tax profit expected to increase by 26% compared to the previous year, reaching nearly 358 billion VND. Revenue reached 2,552 billion VND, down 13%.

The above plan is also based on the diversification of revenue sources, optimizing costs, developing core business areas such as investment banking services, stock brokerage, margin lending and proprietary trading. At the same time, invest in developing technology infrastructure; focus on internal controls, risk management, ensuring product safety, and business operations of TPS…

In Q1/2024, TPS achieved pre-tax profit of VND 96 billion, up 28% year-on-year and implementing 28% of the plan set for the whole year.

Want to double authorised capital

The AGM also approved the plan to increase the charter capital through 3 options.

Firstly, issue 36 million shares as dividends at the rate of 100:12 (12%), meaning that shareholders owning 100 shares will receive 12 new shares; the plan will be implemented in Q2/2024.

Secondly, issue a maximum of 14.5 million shares under the Employee Stock Ownership Plan (ESOP), with an issue price of VND 10,000/share; expected to be implemented in Q2-3/2024; the number of ESOP shares issued is subject to a one-year transfer restriction from the end date of the issuance.

Thirdly, TPS plans to issue 210.3 million shares through a rights issue to existing shareholders (the expected exercise ratio is 2:1.2), the issue price is not lower than the par value of VND 10,000/share; expected to be implemented in Q3-4 /2024 until the end of Q2/2025.

If successful, the total additional capital through the 3 methods mentioned above is estimated to reach 2,608 billion VND, thereby bringing the Company’s charter capital to a maximum of 5,608 billion VND. At the end of Q1/2024, TPS‘s charter capital reached 3,000 billion VND.

Regarding the distribution of profits in 2023, shareholders proposed a 10% dividend in shares and 2% in cash; also requesting the ESOP transfer restriction period be limited to 2 years.

“In fact, we have also thought a lot about this“, said Mr. Do Anh Tu – Chairman of the Company’s Board of Directors when explaining about ESOP. He said that TPS sees that the opportunities in the market are quite good, and wants to use maximum resources this year to develop business, so as to reap the rewards in 2025 – 2026, with great success. Regarding the ESOP story, the Company wants to motivate cadres, employees and the frontline leaders, so the proposal is in accordance with market practice, which is a one-year transfer restriction period.

Chairman of TPS Board of Directors – Mr. Do Anh Tu – presenting at the meeting

|

Previously, Mr. Tu also presented TPS‘s viewpoint on the development of margin lending as well as addressing the concerns of dilution due to additional issuance from shareholders. He said that in 2024 – 2025, the stock market would develop strongly, P/E valuations would be cheap, and the development of margin lending would increase; and if TPS wants to grow, it must also increase margin lending and increase its charter capital. Increasing charter capital for business operations will help increase profits, offsetting the issue of dilution. Therefore, in the short term, the issuance may be dilutive, but in the long term, it will be reflected in the business results.

The AGM also approved the issuance of derivative securities; offering covered warrants; and the implementation of the provision of services for clearing and settlement of securities transactions.

Issuing bonds with a total maximum limit of 1,000 billion VND

Another important issue approved at the meeting is the issuance/offering of the Company’s bonds with a maximum total bond issuance limit of 1,000 billion VND to supplement medium- and long-term capital sources in order to meet the needs to expand business operations such as proprietary trading, underwriting of securities, carrying out investment activities and other legal activities.

Regarding bonds, a shareholder raised the question that this is the Company’s strength and whether there have been any preparations for the expected recovery in 2024.

On this issue, Ms. Bui Thi Thanh Tra – General Director, said that TPS is one of the companies that strongly distributes corporate bonds. TPS is the unit that selects issuers with prestige and capacity to ensure safety and asset value for bond packages. Currently, the issuing organisations that TPS advises on the issuance still ensure the interests of investors and have not violated any rules.

In the past year, in particular, many issuing organisations have collapsed since 2022; and the management is not strict, and enterprises have massively issued bonds without following standards. Accordingly, the Ministry of Finance also issued criteria, and in 2024, they have been very strictly applied to professional securities investors; TPS has also placed orders through the Stock Exchange, which is a condition for greater transparency for investors.

Ms. Bui Thi Thanh Tra – General Director of TPS speaking at the meeting

|

In 2024, Ms. Tra believes that the bond market is also gradually recovering, but it will not be as hot as in 2020 and 2021. Businesses have also become more cautious. TPS selects prestigious units, ensures quality, as well as sources of payment and debt repayment.

“Currently, TPS is approaching credit rating agencies to guide businesses that TPS is advising on issuance as well as future businesses to comply with that and ensure the credit rating ratio. Looking ahead, we also want the issued bonds to be rated and the issuing organisations to also be rated.

The platform and customer base we have built over the past 2-3 years as well as the past year have had difficulties, but TPS still ensures its reputation and will continue to exploit this segment”, said Ms. Tra.

Ms. Tra also clarified the investment in DGT bonds (about 200 billion VND) in the Company’s proprietary bond portfolio, saying that the current valuation of the collateral (including 2 mines and shares of DGT) is larger than the value TPS is holding.

Election of additional Members of the Board of Directors and Board of Supervisors for the 2021 – 2026 term

Finally, the shareholders elected 4 additional Members of the Board of Directors for the 2021 – 2026 term (including 1 independent member of the Board of Directors), including Mr. Ta Quang Luong, Ms. Pham Thi