Vinasun 2024 Annual General Meeting: Cautious Revenue Outlook Amidst Market Challenges

VNS’s 2024 Annual General Meeting. Photo: Chau An

|

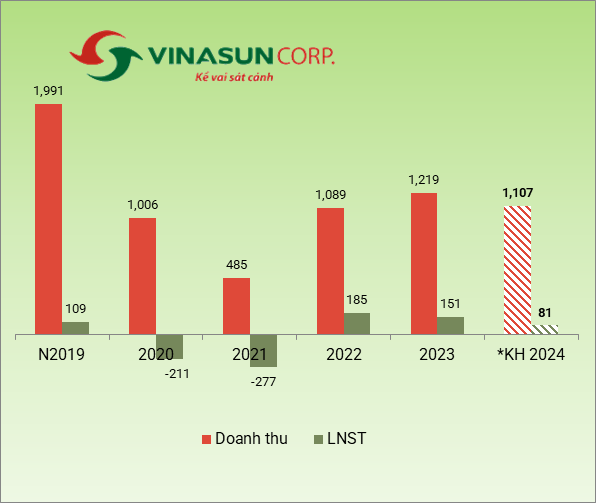

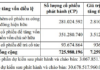

The 2024 Annual General Meeting of Vinasun Corporation (VNS) has approved a revenue target of over VND 1.1 trillion, a decrease of more than 9% compared to the previous year. The majority of revenue is expected to come from Vinasun’s taxi operations, totaling over VND 1 trillion, while the remaining portion will be generated by Vinasun Green, the company’s transport subsidiary in Da Nang, with an estimated VND 96 billion.

The target after-tax profit is set at VND 81 billion, representing a decline of nearly 47% year-over-year.

Source: VNS

|

The company anticipates that 2024 will be a year of economic recovery, but also recognizes the presence of challenges, including ongoing risks and global economic factors that may impact consumer spending. Vinasun itself faces competition from other market players. As such, the company has set a cautious target for 2024, with a focus on recovery and growth, including a transition to hybrid vehicles to replace gasoline-powered cars and cater to evolving consumer preferences.

|

Performance and Business Plan 2024 of VNS, Unit: Billion VND

Source: VietstockFinance

|

Regarding its operations, Vinasun plans to diversify its business approach to align with market developments, primarily focusing on the key markets of Ho Chi Minh City, Binh Duong, Dong Nai, and Da Nang. The company will also prioritize attracting skilled labor and exploring partnerships with potential companies in transportation, technology, and consumer payments.

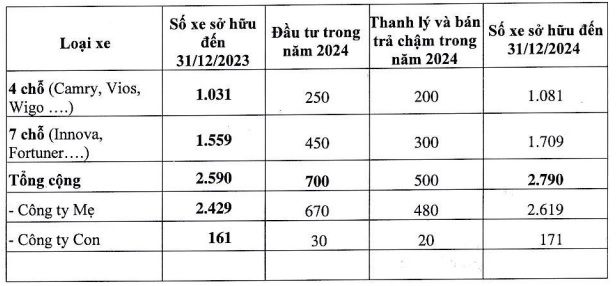

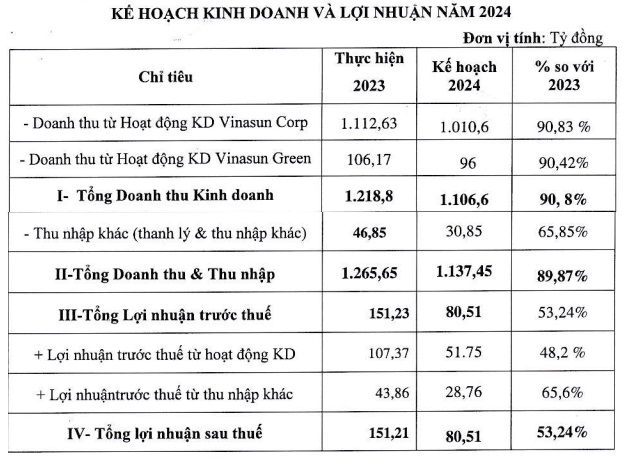

For its investment plan, Vinasun intends to acquire 700 Toyota Hybrid vehicles in 2024. The company emphasizes that this acquisition is part of its long-term growth strategy. Approximately 500 vehicles will be sold or leased to drivers under a franchising arrangement, but the company will adjust the number and type of vehicles as needed to ensure optimal performance.

|

2024 Investment Plan of VNS

Source: VNS

|

The General Meeting also approved a transaction agreement with Vinasun Green. The agreement includes the sale of retiring vehicles from Vinasun to Vinasun Green for use in taxi operations in Da Nang, with a maximum quantity of 100 vehicles per year. This arrangement allows Vinasun to dispose of retiring vehicles while ensuring a continuous process of replacing older vehicles with newer ones, as outlined at the 2023 Annual General Meeting.

Additionally, Vinasun presented to shareholders Mr. Dang Phuoc Thanh‘s resignation as Chairman and member of the Board of Directors. Mr. Thanh is the founder of Vinasun. His resignation was approved by the Board of Directors on December 8, 2023. Mr. Ta Long Hy will step down as General Director to assume the role of Chairman of Vinasun’s Board of Directors for a three-year term (the remaining duration of the 2022-2027 term).

At the meeting, the current Chairman of the Board of Directors praised Mr. Dang Phuoc Thanh‘s contributions, regarding him as the spirit of Vinasun. “We were very sorry to receive Mr. Thanh’s resignation. Vinasun still needs him. Therefore, we have asked him, despite his busy schedule, to remain as an advisor to Vinasun, and he has agreed“.

The meeting also approved the appointment of Mr. Dang Thanh Duy (Mr. Thanh’s son, born in 1984, residing in District 1, Ho Chi Minh City) as a member of the Board of Directors. Mr. Duy is currently the General Director of VNS.

Mr. Dang Thanh Duy (third from left) at Vinasun’s 2024 Annual General Meeting

|

Discussion:

Hybrid vehicles, approximately 700 units will be invested this year. What are the company’s thoughts on this product, given that electric vehicles were not highly regarded last year? The company now considers switching to hybrid vehicles, so what are the underlying factors?

Mr. Tran Anh Minh – Deputy General Director: Vietnam’s current trend in alignment with global developments is environmental protection. Right here in Vietnam, the government has明确策划 an imperative to reduce emissions in business and manufacturing activities.

Last year, we questioned investing in electric vehicles. This issue has two sides. VinFast has been aggressively launching electric vehicles, but there is only one source of operation. So, is it a viable option?

Vinasun has been researching hybrid vehicle operations for over 15 years. In 2023, Toyota’s hybrid vehicles increased by 50% globally compared to 2022. This indicates that not only Vinasun but also the world recognizes the suitability of hybrid vehicles at this stage.

Vinasun’s investment aligns with the company’s business characteristics. The investment in these two vehicle types is not significantly different. At the same time, calculations show that hybrid vehicles can reduce fuel consumption by up to 50% compared to gasoline-powered vehicles. Operating an electric vehicle costs around VND 800/km, while a hybrid vehicle costs around VND 1,100-1,200/km, without incurring opportunity costs during charging.

Every day, Vinasun has to gather vehicles for inspection before they can be used. However, currently, there is no charging station capable of accommodating 40-50 of Vinasun’s vehicles for inspection before they can be used if they were electric vehicles.

Can the company share the estimated cost of investing in 700 hybrid vehicles? Where will this capital come from?

Mr. Tran Anh Minh – Deputy General Director: The total investment is not insignificant, around VND 630-650 billion. The plan is for 700 vehicles, but if things go smoothly, we could acquire up to 1,000 vehicles. Currently, two banks, HSBC and Vietcombank (VCB), are willing to provide financing, and we have received investment approval.

With approximately 50% financing, the required capital is over VND 300 billion. According to our calculations, even after paying a 15% dividend in 2024, Vinasun will still have around VND 150 billion for reinvestment.

With the additional vehicles, will the company dispose of the older gasoline-powered vehicles, such as transferring them to Vinasun Green in Da Nang?

Currently, Vinasun’s vehicles have an average age of only about 2.5 years