In its recent report on Infrastructure Development and Investment Corporation (IDI), FPTS Securities (FPTS) gave the company’s business operations a positive assessment. According to FPTS, IDI’s business performance is expected to show a strong recovery in 2024, with net revenue and parent company after-tax profit reaching VND 8,064 billion (up 12% YoY) and VND 285 billion (up 394% YoY), respectively.

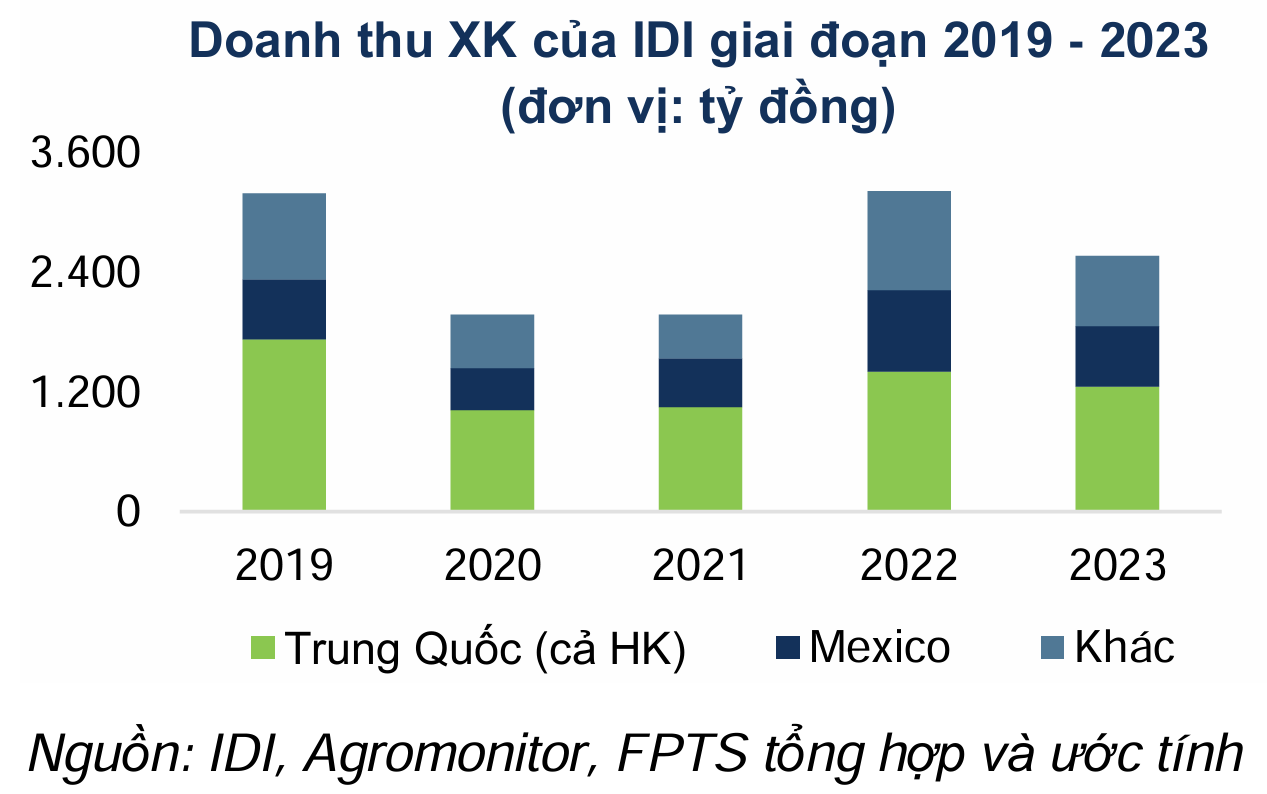

The growth momentum will be driven by the robust recovery in demand for tra fish in two key markets, China and Mexico, from the second half of 2024. This, combined with the tightening supply of tra fish industry-wide, will support the recovery of export prices to these markets in 2024.

According to the FAO, per capita seafood demand in China is projected to increase by 1.27% per year from 2021 to 2032, reaching 46kg per year by 2032 due to improving incomes. FPTS expects this to provide favorable conditions for IDI, the second-largest exporter to this market, to expand its exports in the long term.

However, FPTS also notes the effectiveness of large non-core investments and loan transactions between the parent company, ASM, and IDI (totalling 17% of IDI’s total assets in 2023).

IDI provided a long-term loan to its parent company, ASM, amounting to VND 457 billion at the end of 2023. The interest rate that IDI applies to ASM is a combination of a fixed rate of 10% per year and a floating rate. At present, FPTS does not see any significant risk to this loan and will monitor it further as the interest rate that IDI borrowed in 2023 is estimated to be lower, at 8.5% per year, and the parent company ASM’s interest coverage ratio, as measured by the ratio of profit from operating activities to interest expense in 2023, is maintained at a minimum of 1.08x.

Regarding non-core investment projects, IDI invested in Europlast Long An Solar Power Company in 2023. The investment value was VND 246 billion, and IDI also recorded a dividend of VND 11.4 billion from the company in the same year. In December 2023, according to inspection conclusion No. 3166/TB – TTCP issued by the Government Inspectorate, Europlast Long An Solar Power Company was found to have violated land laws by starting the solar power project without the Long An Provincial People’s Committee leasing the land since 2019.

At present, FPTS cannot immediately assess the impact of this violation on Europlast Long An’s business operations due to limited access to information.

In 2022, IDI acquired Vinh An Dak Nong Investment JSC, whose main business is rubber tree plantation. In this transaction, IDI allocated VND 392 billion to acquire 98% of the shares from the subsidiary. Notably, VND 317 billion was recorded under “Trade Advantage” at the end of 2022. The recognition of a large trade advantage while revenue and after-tax profit remain unrecorded as of 2023 raises FPTS’ concerns about the effectiveness of this investment.

In 2020, IDI invested in the Binh Long urban area project in An Giang province. As of the end of 2023, the total investment capital for this project was VND 401 billion. However, the value of the project remained unchanged compared to the end of 2022, and the revenue from real estate business was insignificant in 2023, which raises our concerns about the progress of IDI’s implementation of this project.