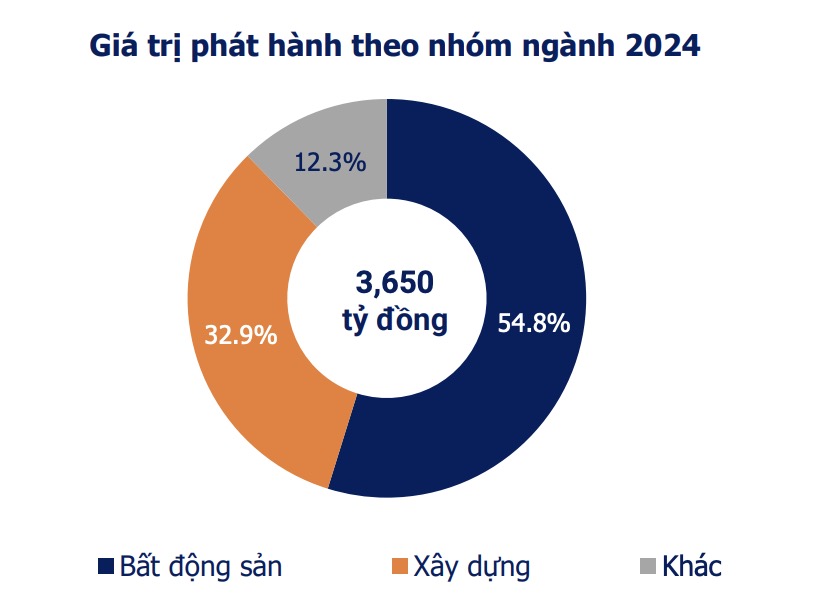

Compared to previous months, the value of issuances has significantly decreased from an average of around 43 trillion VND, equivalent to a 91% decrease. The issuances had an average interest rate of 10.7% per year and an average term of 5.25 years.

Source: VBMA

|

Source: VBMA

|

January also saw a bond issuance by the Infrastructure Investment Corporation of Ho Chi Minh City (HOSE: CII) worth over 2.8 trillion VND. The bond batch with the code CII42301 was issued in December 2023 (completed in January 2024), was a convertible bond, with a total of over 28.4 million bonds offered for sale, with a term of 10 years and a face value of 100,000 VND. The applicable interest rate is 10.5% per year for the first 4 periods, and floating thereafter.

CII’s bonds are convertible into common shares, unsecured and without warrants. The bonds can be converted into common shares every 12 months, at a conversion rate of 1:10, meaning each bond can be converted into 10 common shares.

A total of 22.8 million bonds (accounting for 80.14% of the offered volume) were purchased by 4,033 domestic individual investors, 70,734 bonds (0.25%) were purchased by 73 foreign individual investors, and 5.3 million bonds (18.66%) were purchased by 24 foreign institutional investors. In total, over 28.1 million bonds were issued, equivalent to 99.05% of the total bonds offered for sale.

CII netted over 2.8 trillion VND from this offering. According to the May 2023 resolution, the funds raised will be used to contribute capital or invest in bonds of two companies: Ninh Thuan BOT Multi Member Limited Liability Company (1,200 billion VND) and VELUXIP CMVN Investment and Construction Joint Stock Company (1,640 billion VND). However, due to certain developments, CII is expected to propose an adjustment to this purpose at the General Meeting of Shareholders.

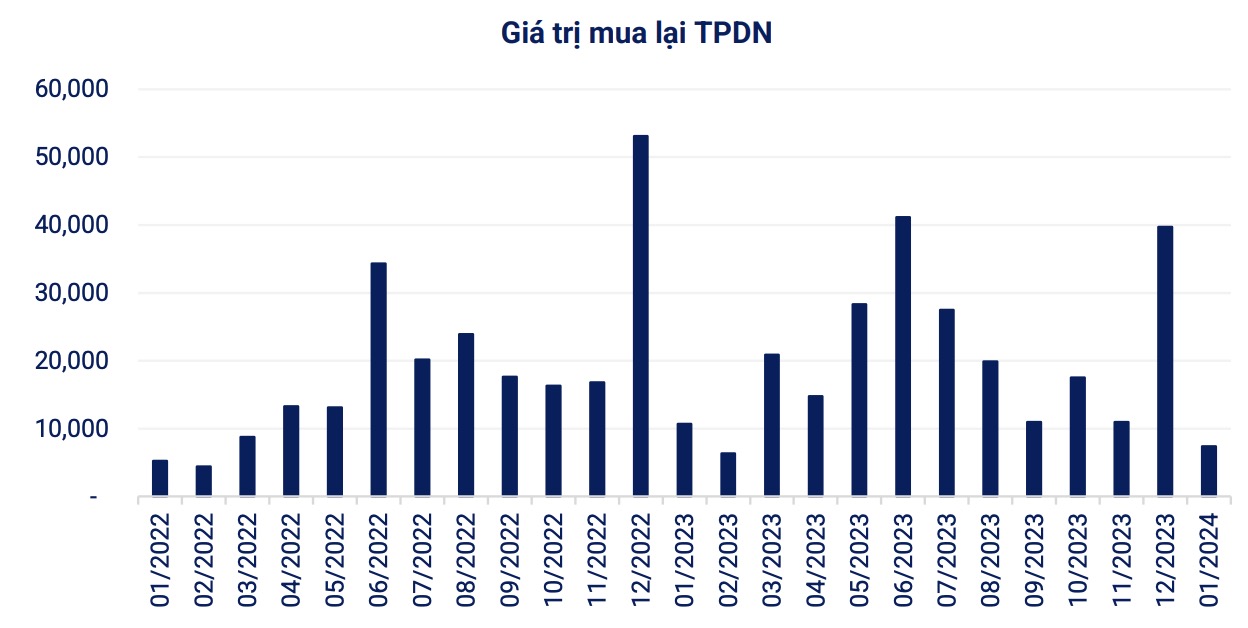

In terms of repurchases, in January 2024, nearly 7.4 trillion VND of corporate bonds were repurchased, a 31.1% decrease compared to the same period. In 2024, it is estimated that more than 279 trillion VND of bonds will mature, with the majority being in the real estate sector with nearly 116 trillion VND, accounting for 41.4%.

Source: VBMA

|

There were 7 companies reporting delayed principal and interest payment in the month, with a total value of over 8.8 trillion VND (including interest and remaining debt of the bonds), and 5 bond codes were extended repayment time for interest and principal.

There will be 2 notable issuances coming up. The first is from the Thanh Thanh Cong – Bien Hoa Joint Stock Company (HOSE: SBT), where the Board of Directors has approved a bond issuance plan in the first quarter of 2024 with a maximum total value of 500 billion VND. These are non-convertible bonds, without warrants, and secured with assets, with a face value of 100 million VND/bond (equivalent to a total issuance of 5,000 bonds).

The bond batch has a maximum term of 3 years, applying a fixed interest rate of 11% per year for the first 2 periods; for the remaining periods, the interest rate is calculated based on the reference interest rate plus a margin of 3.85% per year.

The second issuance is from Ban Viet Joint Stock Commercial Bank (UPCoM: BVB). BVB’s Board of Directors has approved a separate bond issuance plan in 2024 with a maximum total value of 5.6 trillion VND, expected to be divided into 6 issuances. These are non-convertible bonds, without warrants, secured with assets, with a face value of 100,000 VND/bond, a maximum term of 8 years, and a fixed interest rate of 8% per year.

Chau An