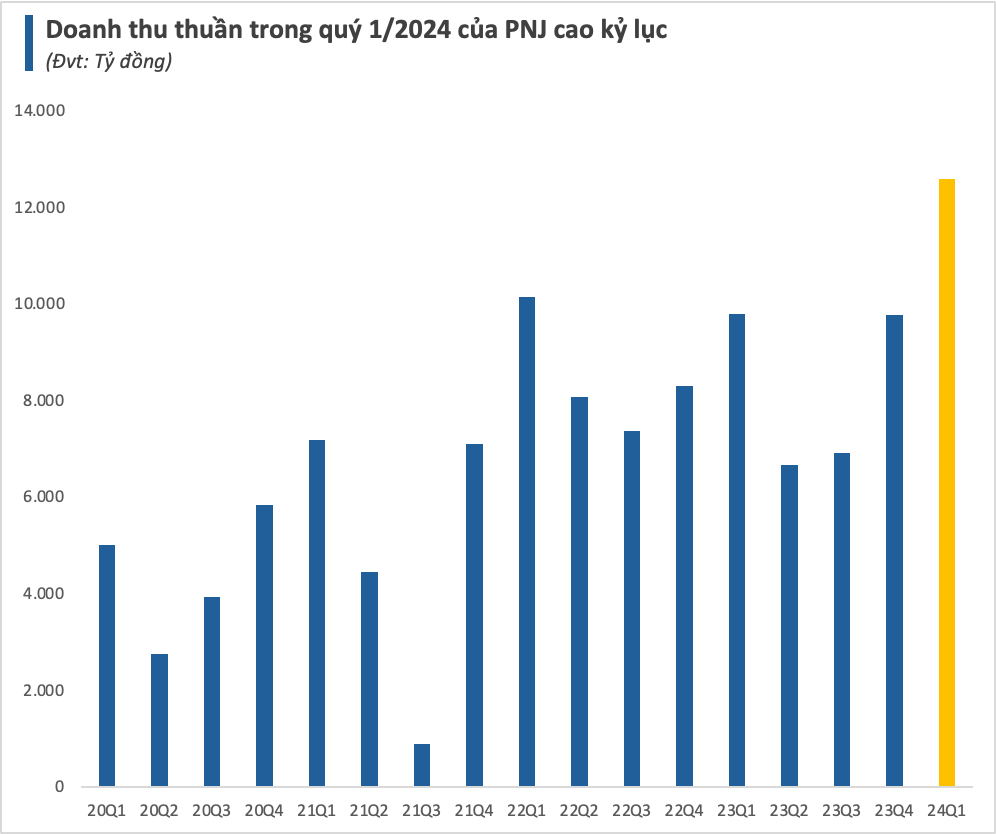

Phu Nhuan Jewelry Public Company Limited (PNJ) recorded a remarkable revenue growth of 29% in Q1/2024, reaching a record-breaking VND12,594 billion. This is the highest quarterly revenue in the company’s operating history.

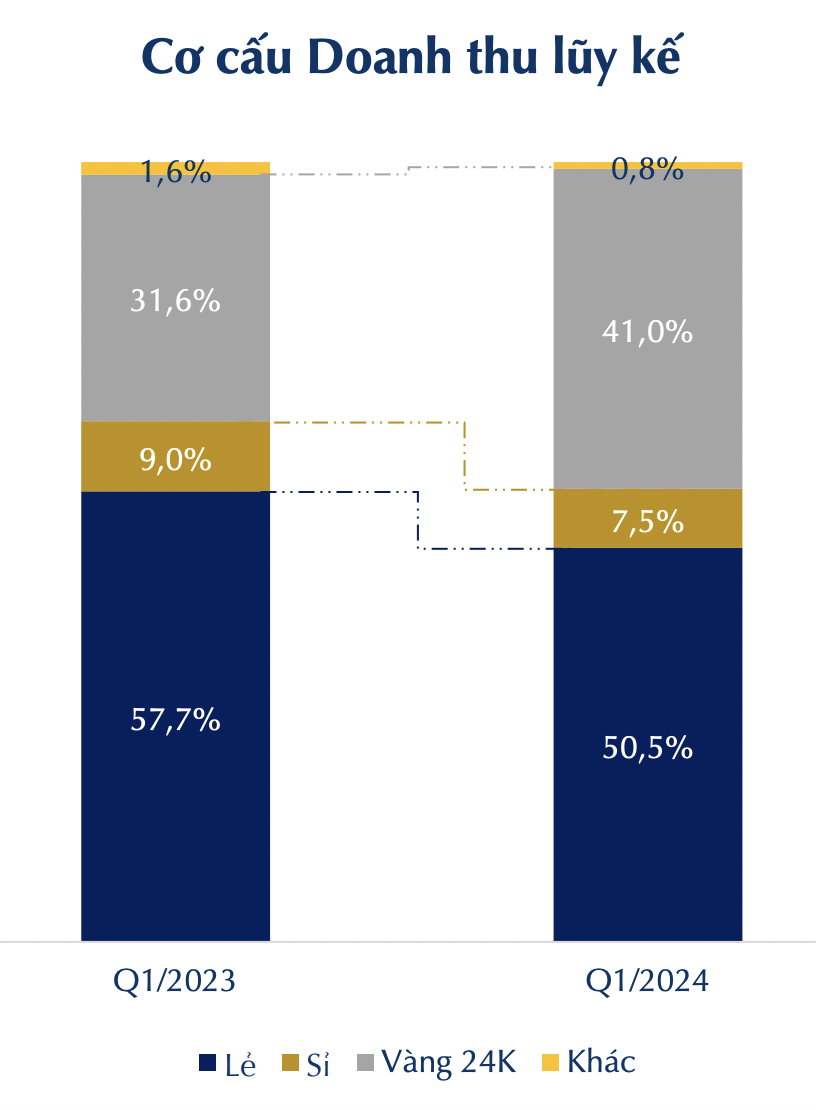

Analyzing the revenue structure in the first three months of 2024, while retail and wholesale jewelry achieved a stable growth rate between 8 and 12% compared to the same period last year, the 24K gold (9999 gold) segment witnessed a remarkable 66.3% surge. Notably, the 9999 gold sales channel generated nearly VND520 billion for PNJ in Q1, accounting for a 41% share, significantly higher than 32% in the same period last year.

According to PNJ, brisk trading in 24K gold and the company’s success in attracting numerous new customers purchasing Fortune and 24K products led to a significant increase in revenue. This is understandable as the recent period saw gold prices reaching new highs, particularly for gold bars and gold rings. In comparison to the beginning of the year, the price of gold bars has increased by around 14%, while gold ring prices have jumped by almost 20%.

However, it is crucial to note that the increase in gold prices has had some impact on PNJ’s input costs, coupled with the fact that the profit margin on 24K gold is lower than that of jewelry. In an address at the 2024 Annual General Meeting of Shareholders, Phu Nhuan Jewelry Chairwoman Cao Thi Ngoc Dung stated that the cost of goods sold would fluctuate in line with raw material prices, as they account for approximately 50%, and the company would adjust prices when fluctuations exceed 5%. Ms. Dung noted that the recent surge in gold prices has been a balancing act for the company, which needs to safeguard its assets and raw material supply. The company was even forced to slow down production at times when gold prices fluctuated sharply on an hourly basis.

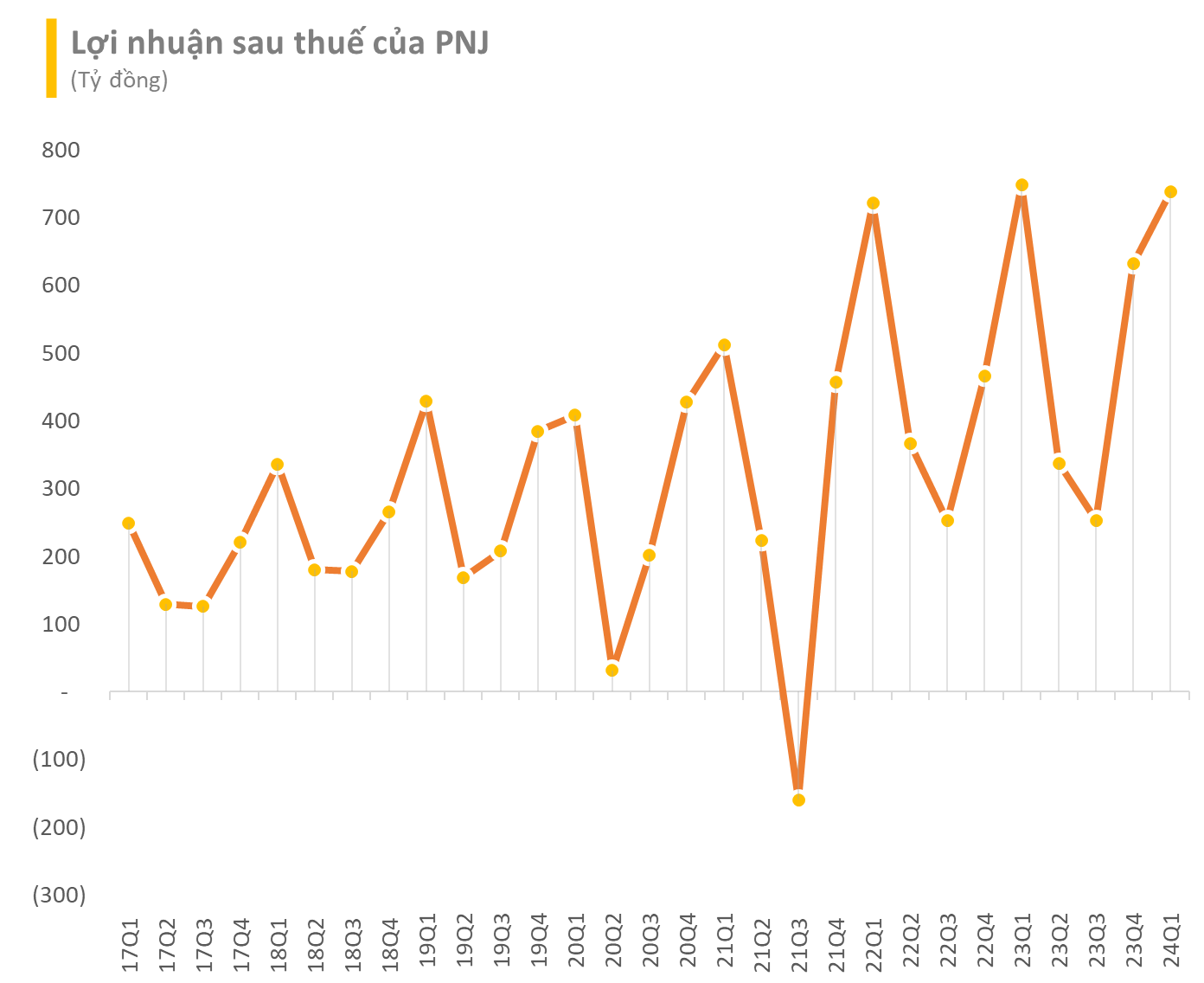

In Q1/2024, the growth rate of cost of goods sold outpaced that of revenue, rising by 32%. This led to a decrease in gross profit margin from 19% to 17%, resulting in gross profit of VND2,149 billion. When combined with other expenses, PNJ recorded an after-tax profit of VND738 billion, a modest 1% decline compared to the record set in Q1/2023. Nonetheless, this marked the second consecutive quarter of profit growth compared to the previous quarter. On average, PNJ made approximately VND8 billion in profit per day in the first three months of 2024.

Furthermore, based on the cash flow statement, the company’s operating cash flow amounted to over VND1,887 billion in the first three months of the year, improving by 35% year-on-year.

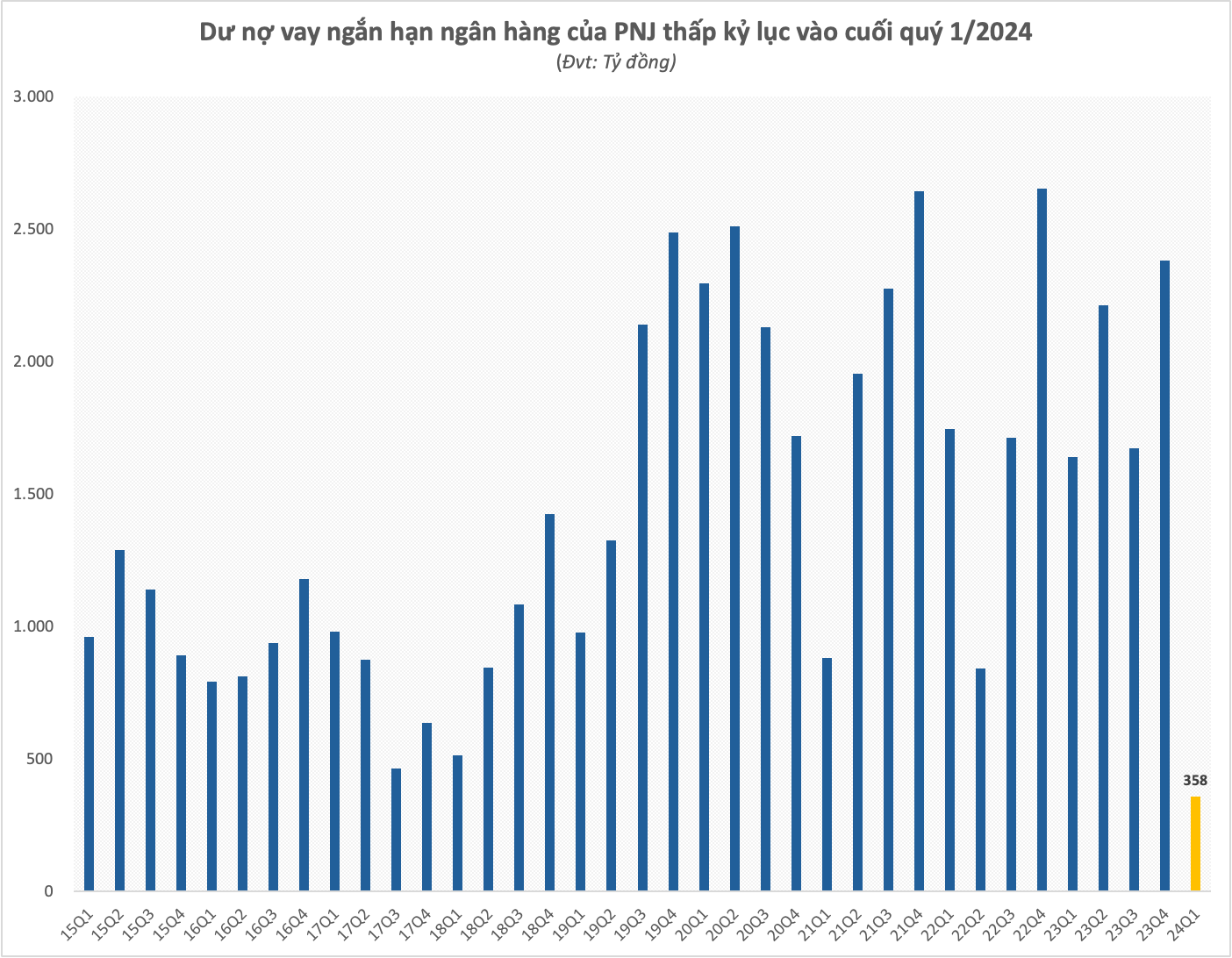

Borrowings at the Lowest Level in Years

As of March 31, 2024, PNJ’s total assets reached VND12,969 billion, reflecting a 10% reduction from the beginning of the year. Notably, inventory accounted for the largest portion of the asset structure, reaching VND9,511 billion or 73%. Cash and cash equivalents increased by 85%, amounting to VND1,661 billion.

Remarkably, accounts payable stood at VND2,494 billion, representing a significant 46% decrease compared to the beginning of the year. Short-term borrowings and finance leases saw the most significant decline, dropping by approximately VND2,000 billion or 85% year-on-year to VND363 billion. Outstanding short-term bank loans amounted to VND358 billion, a decrease of VND2,022 billion compared to the beginning of 2024. This marks the lowest level of borrowing for this jewelry company in its operating history.

PNJ’s financial cash flow statement indicates that the company borrowed nearly VND1,500 billion in new short-term debt while repaying more than VND3,500 billion of principal during the first quarter.

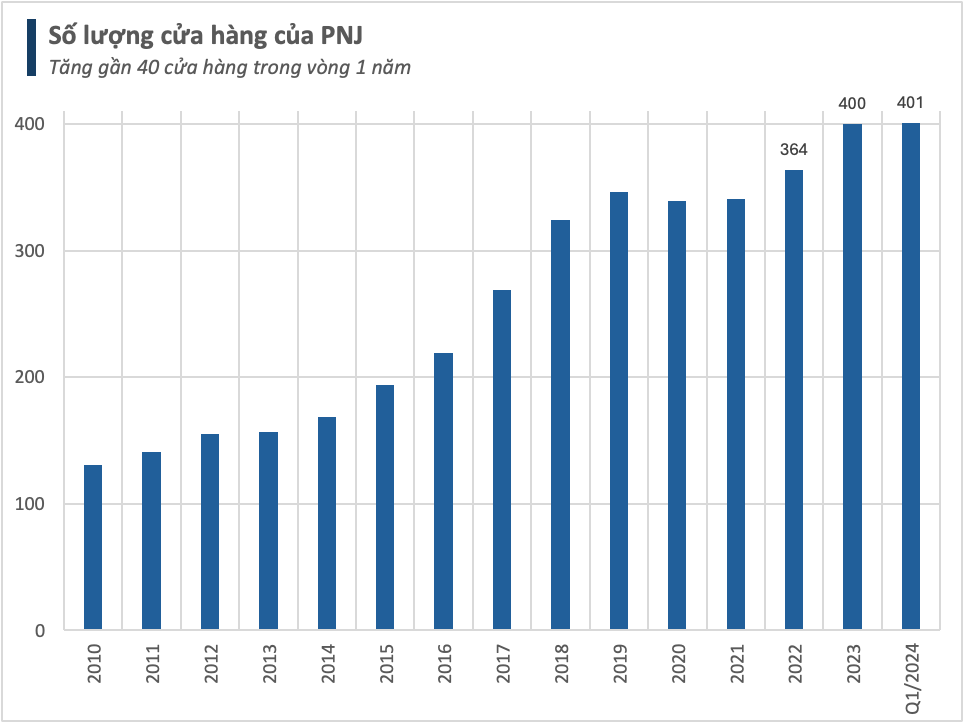

PNJ’s financial stability is complemented by its efficient cost management. In a recent report, VNDIRECT Securities assessed that despite its rapid store expansion, PNJ has effectively controlled costs, including selling and administrative expenses. VNDIRECT estimated that operating expenses per store in 2023 amounted to VND9.2 billion, which is 8% lower than the previous year.

As of March 31, 2024, PNJ had a total of 401 stores in 55 out of 63 provinces and cities. In the first few months of 2024, PNJ opened three new PNJ stores while closing two others. Currently, the store network comprises 392 PNJ stores, five Style by PNJ stores, three CAO Fine Jewelry stores, and one wholesale center.

VNDIRECT believes that despite implementing numerous marketing programs, PNJ will continue to manage its expenses effectively, with the ratio of selling costs to revenue remaining stable at around 10%-11%, while the proportion of operating expenses to revenue will witness a modest increase of 0.2 percentage points year-on-year.

Notably, PNJ’s store presence in tier-two and tier-three cities remains low, while the demand for branded jewelry products continues to grow. Therefore, VNDIRECT anticipates that new customers will continue to drive the growth of PNJ’s retail revenue in the coming years, with the primary market being in these regions. The report forecasts a 7-9% increase in the number of stores over the next two years, leading to a 10% increase in retail revenue. At the same time, revenue from 24K gold in 2024 could increase by 12% amidst growing demand for gold trading.

For the full year of 2024, VNDIRECT projects an 11% growth in PNJ’s net profit, driven by an 11% increase in net revenue, a slight increase in gross profit margin despite higher input costs, and stable selling and administrative expenses to revenue ratio. Looking ahead to 2025, PNJ’s net profit is expected to climb by another 9.4% to VND2,390 billion.