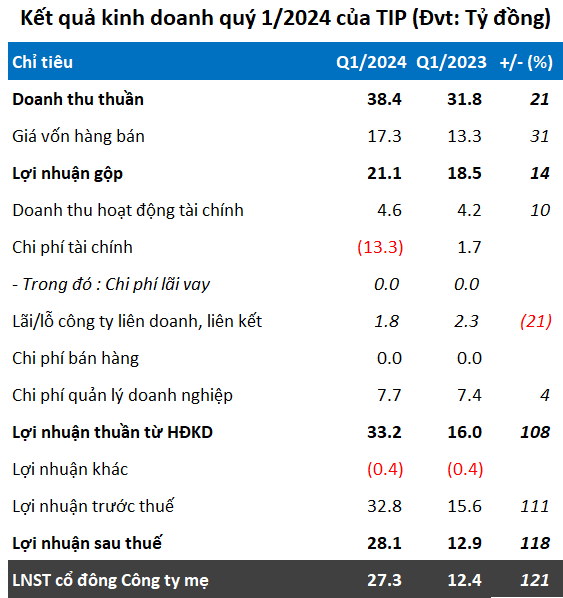

According to the Q1/2024 financial statements, TIP recorded a net revenue of VND38 billion, up 21% YoY. Meanwhile, net profit reached VND27 billion, 2.2 times higher than the same period last year.

For 2024, TIP targets total revenue of VND264 billion and after-tax profit of VND165 billion, down 5% and 8% compared to 2023, respectively. The company fulfilled 16% of its total revenue plan and 17% of its after-tax profit target in Q1.

Explaining the reasons for the revenue growth, the company mentioned recovering orders and more stable operations of its tenants in Tam Phuoc Industrial Park. Notably, the major factor was the reversal of a provision for Olympic Coffee JSC due to an increase in its charter capital, resulting in a lower ownership rate for TIP and its subsidiary Tin Khai at Olympic Coffee.

Source: TIP

|

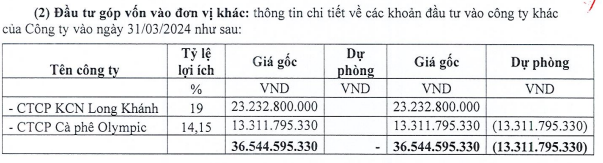

According to the explanatory notes, TIP invested more than VND114 billion in Olympic Coffee JSC, with a 14.15% ownership ratio. As of the end of Q1, the company reversed a provision for impairment loss of VND13 billion at Olympic Coffee.

Source: VietstockFinance

|

As of the end of March, TIP‘s total assets reached VND2,020 billion, up 2% compared to the beginning of the year. Notably, bank deposits with terms of 1-3 months amounted to VND79 billion, while those with a 6-month term exceeded VND75 billion.

Inventory stood at VND145 billion, down 5% compared to the beginning of the period. Work-in-progress for manufacturing and business activities accounted for the majority of inventory, with VND59 billion concentrated in the Thanh Phu urban area project, VND43 billion in the Tam Phuoc 18ha residential area project, VND7 billion in the Kiosk project, and VND13 billion in the market and market street real estate project.

On the other side of the balance sheet, TIP had VND254 billion in liabilities, an increase of 7% compared to the beginning of the year. Notably, unearned revenue amounted to VND154 billion, a decrease of 13%, mainly consisting of land rent and infrastructure usage fees awaiting allocation. It is worth mentioning that the company does not have any financial debts.