Online

The 2024 Annual General Meeting of Shareholders (AGM) of SHB was held on the afternoon of April 25 in Hanoi. Photo: The Manh

|

According to the voting record, as of 2:10 PM on April 25, the 2024 AGM of SHB was attended by 1,361 shareholders, representing over 2.4 billion shares, equivalent to nearly 67% of the total number of shares with voting rights. The meeting was eligible to proceed.

All shareholders attending the 2024 AGM were given a cash envelope worth 200,000 VND/shareholder by SHB. Thus, the bank expects to prepare a “gift” of over 272 million VND for its shareholders.

Mr. Do Quang Hien – Chairman of SHB‘s Board of Directors, speaking at the beginning of the meeting.

|

Opening the meeting, Mr. Do Quang Hien – Chairman of SHB‘s Board of Directors expressed his happiness and pride at the presence of a large number of shareholders at SHB‘s 2024 AGM. The figure of nearly 1.4 thousand shareholders is a testament to the credibility and trust placed in the bank.

Each SHB shareholder attending the meeting received 200,000 VND. Photo: The Manh

|

Dividend payment of 5% in cash and 11% in shares for 2023

Regarding the profit distribution plan for 2023, after setting aside various funds, SHB‘s total retained profit after tax was over 5,929 billion VND. The bank plans to use nearly 5,860 billion VND to pay dividends to shareholders at a total rate of 16%, including 5% in cash and 11% in shares. The expected completion time is within 2024.

Specifically, SHB plans to spend more than 1,831 billion VND to pay cash dividends at a rate of 5%. In parallel, the bank plans to issue nearly 402.9 million shares to pay stock dividends, equivalent to a rate of 11% (owning 100 shares will receive 11 new shares). These shares are not subject to transfer restrictions.

Currently, SHB‘s charter capital is nearly 36,194 billion VND. The bank is completing the procedures to increase its capital to over 36,629 billion VND after issuing an additional 43.5 million shares under the employee stock ownership plan (ESOP).

If the 2023 dividend distribution plan is completed, SHB‘s charter capital is expected to increase to nearly 40,658 billion VND. After dividend distribution, the retained earnings will be approximately 69 billion VND.

Pre-tax profit target increase of 22%

In 2024, SHB set a pre-tax profit target of 11,286 billion VND, an increase of 22% compared to 2023. Total assets are expected to be 701,000 billion VND, charter capital of 40,658 billion VND, an increase of nearly 12%; strictly controlling the bad debt ratio below 3%. The bank also plans to pay a dividend of 18% in 2024.

|

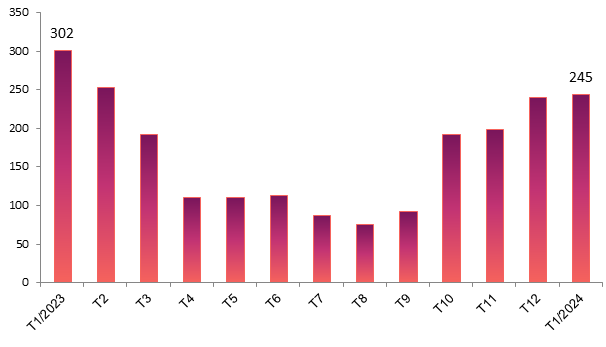

SHB‘s pre-tax profit in the period 2010-2023 |

Regarding人事, the AGM will also consider and approve the dismissal of Mr. Do Duc Hai and Mr. Haroon Anwar Sheikh from the Board of Directors.

Previously, Mr. Haroon Anwar Sheikh submitted a resignation letter due to personal reasons, while Mr. Do Duc Hai resigned to comply with the regulations of the new Law on Credit Institutions and to focus on managing SHB‘s business operations.

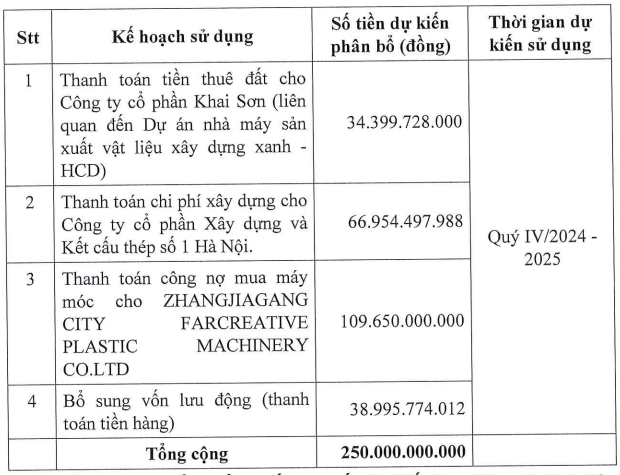

Another notable item is that the Board of Directors submitted to the shareholders a proposal to list the SHB bonds issued to the public. Specifically, on the basis of the capital source in 2024, SHB plans to issue bonds to the public with an expected amount of 5,000 billion VND, with the aim of increasing Tier 2 capital and increasing medium- and long-term capital sources. lend medium- and long-term to customers.

Discussion:

First quarter 2024 profit of approximately 4,017 billion VND

This year’s plan is ambitious with a 22% increase in pre-tax profit, while last year’s plan was not achieved. How does the management assess the feasibility of the plan? Can you reveal the Q1 2024 business results?

Mrs. Ngo Thu Ha – Member of the Board of Directors and General Director of SHB: When we set our plans, we always base them on the actual situation, based on the potential of customers and the market. In 2024, SHB will diversify its products, increase its efforts to find customers, especially digital products, target high-end customers, enterprises, supply chains, and large ecosystems. At the same time, we will reduce input costs, invest in management systems, increase income from credit, closely monitor credit quality, and handle and recover bad debts to contribute to overall profit growth…

A testament to the feasibility of the annual plan is the profit of about 4,017 billion VND in the first quarter. This is a guarantee that the numbers in the coming quarters will be maintained to ensure the feasibility of the plan.

Chairman Do Quang Hien: SHB has a clear strategy, especially the transformation work with members participating in the transformation block, in which we invite foreign leaders to join SHB to directly manage and transform SHB comprehensively.

SHB is the first bank to implement the Government’s policy of merging with a long-standing and successful bank (Habubank). It was a very difficult process while focusing on debt handling. By now, the bank has successfully merged and transformed. We have participated in successful key projects. SHB is a large-scale bank in Vietnam.

In terms of strategy, SHB focuses on understanding and delivering modern utilities that satisfy customer choices on the platform of a large customer base and value supply chains. SHB will increase services, making reforms with customers at the center. SHB will promote supply chain and import-export financing to increase revenue from services. The bank is determined to achieve breakthroughs and introduce disruptive digital technology to create a difference. 2024 will be a pivotal year for SHB to make breakthroughs.

SH