Illustrative image

|

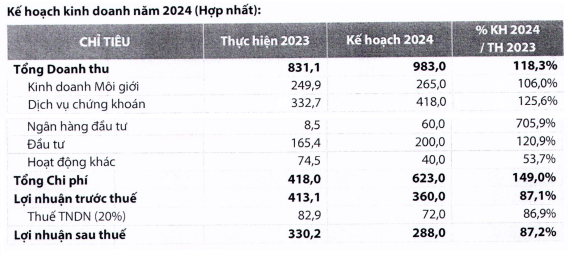

In 2024, the Company aims for a total revenue of VND 983 billion, an increase of over 18% compared to the previous year’s performance. Of which, the main source of revenue comes from securities services with VND 418 billion, an increase of nearly 26%; brokerage activities with VND 265 billion, an increase of 6%; and the investment segment is expected to bring in VND 200 billion, an increase of nearly 21%. Notably, the banking and investment segment is expected to generate revenue of VND 60 billion, an increase of nearly 706%, or 7 times the previous year’s performance.

After deducting the total expenses of VND 360 billion (an increase of 49%), the pre-tax and after-tax profits of the Company are VND 360 billion and VND 288 billion, respectively, both declining by about 13% compared to the previous year’s performance.

Source: VDS

|

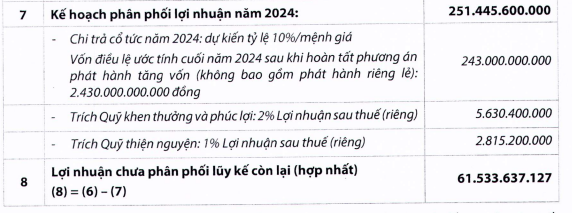

Regarding the profit distribution plan for 2023, the Company plans to use nearly VND 241.5 billion to pay dividends in the form of shares, at a rate of 11.5%; allocate a welfare and reward fund and a charity fund at the same rate of 0.75% calculated on the after-tax profit of the parent company in 2023, equivalent to VND 2.4 billion.

In addition, the Board of Directors will also propose to the General Meeting of Shareholders the profit distribution plan for 2024, including a dividend rate of 10%, equivalent to a payment of VND 243 billion (calculated on the estimated equity at the end of 2024 after completing the capital increase plan, excluding private placement, amounting to VND 2,430 billion).

Source: VDS

|

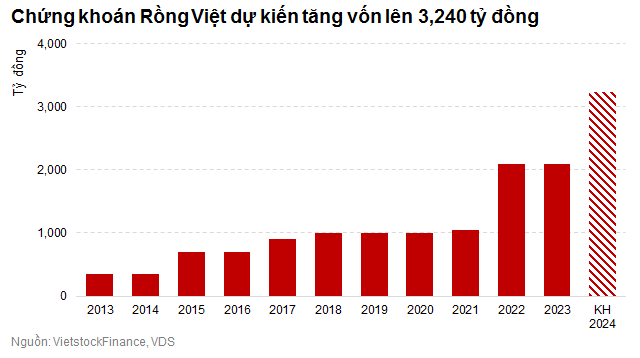

Planning to issue 114 million shares, increasing the equity to VND 3,240 billion

One of the other important agenda items to be presented to the General Meeting of Shareholders is the plan to increase the equity through the issuance of up to 114 million shares, with 2 issuance phases, and the total capital increase based on the face value is VND 1,140 billion.

In the first phase, VDS will issue 24.15 million shares to pay dividends for 2023, at a ratio of 100:11.5 (shareholders owning 100 shares will receive 11.5 new shares), the right to receive dividends in the form of new shares is not transferable. These shares will not be subject to transfer restrictions. At the same time, there is a plan to issue 8.85 million shares under the Employee Stock Ownership Program (ESOP), equivalent to 4.21% of the total number of outstanding shares.

The capital for paying dividends comes from undistributed after-tax profits as of December 31, 2023, as stated in the audited consolidated financial statements for 2023. As for the ESOP issuance plan, employees will be able to purchase shares at VND 10,000 per share, which is 55% lower than the market price of VDS shares in the morning session on March 14th (around VND 22,400 per share).

If the first phase is completed, the Company’s equity will increase from VND 2,100 billion to VND 2,430 billion.

The second phase will be implemented after the completion of the first phase, with a plan to privately offer up to 81 million shares. The total value of the offering based on face value is VND 810 billion. The offering price cannot be lower than the market price at the time of offering or the book value of the Company at the nearest date. The funds raised, VDS will use for treasury stock trading/advances, proprietary trading/underwriting, and participating in bond market activities.

After the two issuance phases, the Company’s equity can increase from VND 2,100 billion to VND 3,240 billion.

Issuing and listing secured warrants

Another agenda item to be presented to the General Meeting of Shareholders is the issuance and listing of secured warrants. The permitted transactions include: Issuance, offering, and listing of warrants; establishment of markets; trading, risk prevention; brokerage and investment advisory.

At the time of each offering, the total maximum limit of warrants shall not exceed the limit stipulated by the relevant laws and regulations and/or the regulations of the State Securities Commission.

Parallel to this, the Board of Directors will also present to the General Meeting of Shareholders the listing of non-convertible bonds, bonds without attached warrants to be publicly offered during the 2024-2025 period of Rong Viet (if issued) after completing the offering phases on the Hanoi Stock Exchange.

The General Meeting of Shareholders of VDS is scheduled to take place on April 8, 2024, at the New World Saigon Hotel, 76 Le Lai, District 1, Ho Chi Minh City.