After a series of downward spirals, the stock market has unexpectedly turned around and surged. Buying power has helped the VN-Index break out and quickly regain the 1,200-point mark. The index closed the April 24 session with a gain of 28 points (2.4%) to 1,205. Trading liquidity on the HOSE has improved but remains low at just approximately VND16,800 billion.

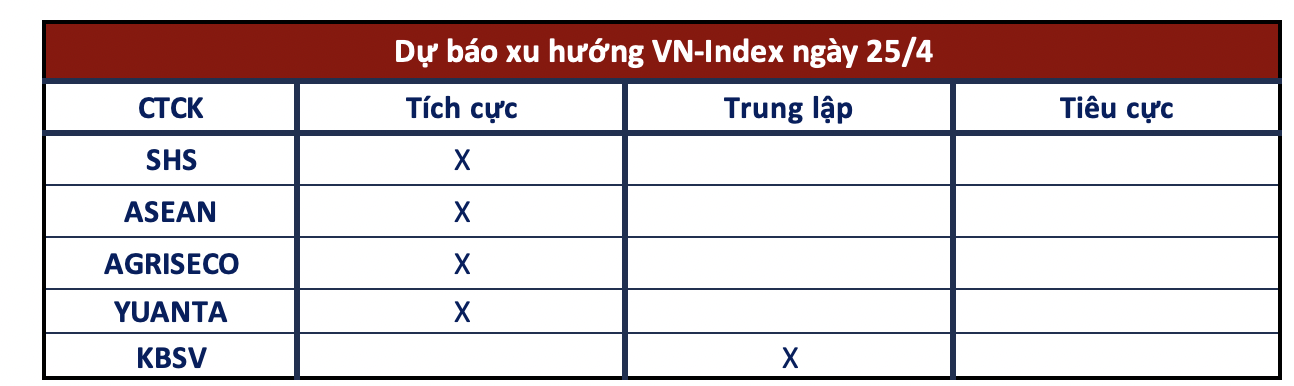

Commenting on the market in the coming sessions, securities companies all gave a positive view that the market has confirmed a short-term bottom and is likely to continue to gain points in the next session.

VN-Index confirms a short-term bottom

SHS Securities

The market rose sharply and surpassed the psychological resistance level of 1,200 points, thereby opening up the opportunity for continued recovery in the coming sessions. With this development, the VN-Index has likely completed the small W-shaped bottom pattern and will continue short-term recovery with the next resistance level around 1,225 points. Short-term investors have disbursed funds as recommended when the VN-Index signaled an increase, continuing to hold the portfolio. Investors with large proportions can take advantage of the upcoming recovery to restructure their portfolios, reducing their proportion to a safe level.

Asean Securities

The market witnessed a positive trading session, confirming a short-term bottom at 1,170 points. Buying power is starting to show signs of increasing, investors are gradually accepting to buy at higher prices. The highlight of today’s session is the “peak breaking” of some pillar stocks, contributing to spreading optimism and pushing up the recovery momentum after the previous “sell-off” session. However, this recovery is only short-term in nature. However, buying is not a priority, so investors should temporarily stop buying and wait for the stocks to be credited to their accounts.

The market continues to gain points

Agriseco Securities

On the daily chart, the VN-Index formed a strong bullish body candle, indicating that the demand side is gaining the upper hand. On the hourly time frame, the price is trending to follow the upper band of the Bollinger Bands, opening up the expectation of expanding the recovery momentum. Agriseco Research believes that the market will continue to develop in the direction of Sideway Up with alternating up and down sessions with large amplitudes around the 1,180-1,230 points range. Investors can buy more stocks in the adjustment steps to the lower boundary and vice versa, reduce the proportion in the good recovery steps to the near upper boundary. It is preferred to trade with stocks available in the portfolio and stocks belonging to the VN30 group.

Yuanta Securities

The market is likely to continue its uptrend in the next session, and the VN-Index may challenge the 1,200 – 1,225 point resistance zone in the next few sessions. At the same time, a correction may still occur in the next session when investors take profit on positions that have bottomed out in previous sessions. In addition, the short-term sentiment indicator is rising, indicating that short-term investors are less pessimistic than in the previous session.

KBSV Securities