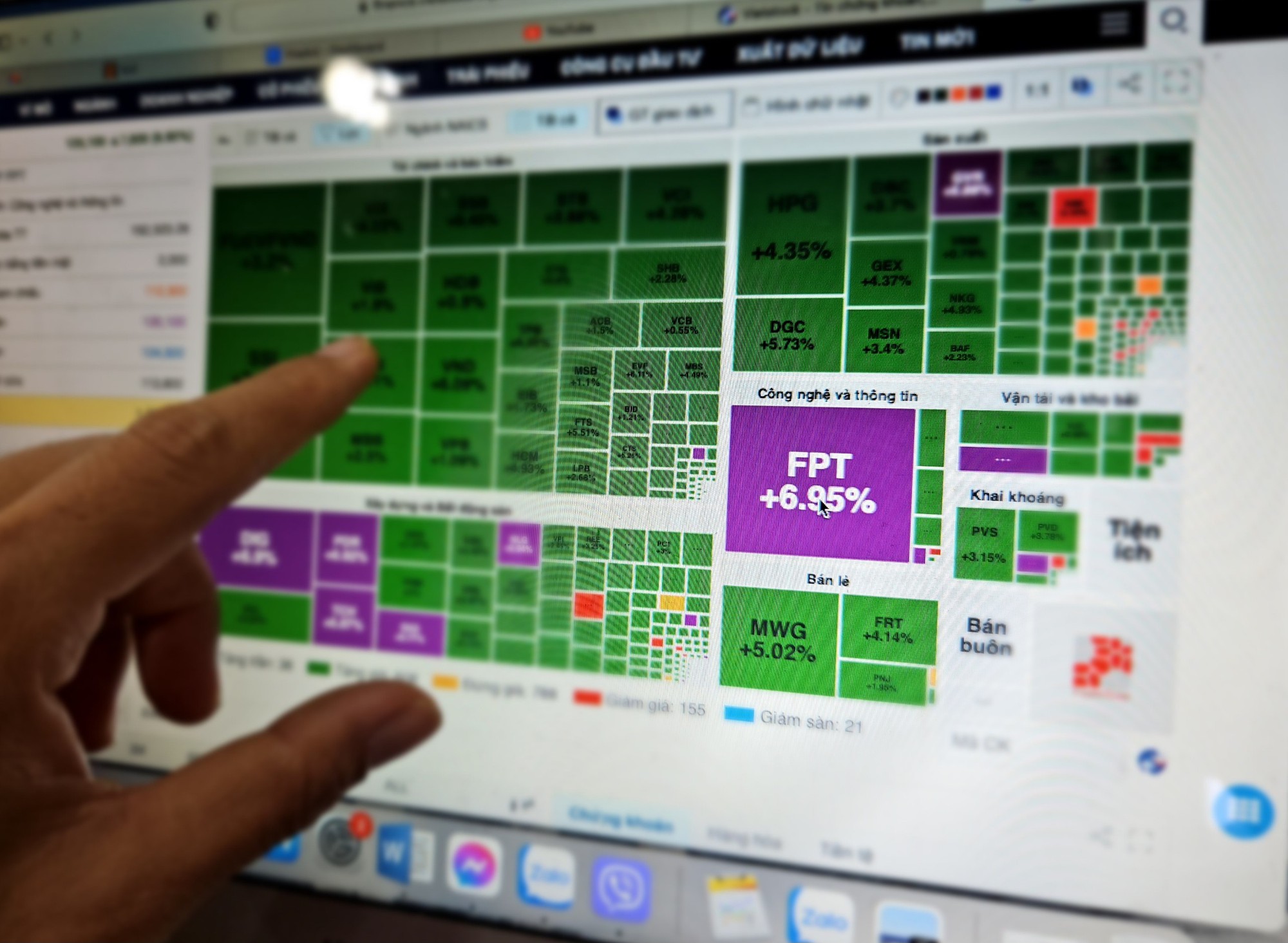

In a turn of events that surprised many investors, the stock market opened in the green today, led by a number of key stocks in the VN30 index such as GVR, FPT, MWG. The rally spread to real estate, banking, securities, and public investment groups.

Many individual investors are still cautious and hesitant to buy, but they have also limited their selling. Thus, the buying power of several investor groups easily pushed the market higher. The VN-Index easily crossed the 1,200 mark and closed at 1,205.61, up 28.21 points (+2.4%), making it one of the best-performing markets in the world today.

The Hanoi Stock Exchange’s indices also rose significantly. The HNX-Index gained 5.24 points to 227.87, while the Upcom-Index gained 0.86 points to 88.37.

The market saw nearly 600 stocks gain, with a number of stocks hitting the daily漲停板 limit, closing in the purple color. NLG, KSB, PDR, NBB, and DIG, most of which are real estate companies, were among the top performers.

Several stocks in the VN30 basket, such as FPT and GVR, also rose to the limit, significantly boosting the index.

Several stocks surged to daily漲停板 limits today, particularly in technology and real estate…

Foreign investors were also active, buying approximately 2,500 billion VND worth of shares while selling more than 2,700 billion VND. Overall, foreign investors sold a net 244 billion VND.

Notably, many investors expressed surprise at the stock market’s sharp turnaround. After several sessions of losses that pushed the VN-Index below 1,200 points, many brokerage firms warned that the market was still in a short-term correction.

“Yesterday, when the brokerage group’s stocks fell sharply again, I regretted not selling after the previous strong rally. Little did I know that brokerage stocks would rebound so strongly today. The market has been on a roller coaster ride for investors in just three days,” said Minh Hoang, a resident of Ho Chi Minh City.

Some investors expressed regret for cutting losses in previous sessions or holding cash but not daring to buy when the market was down.

Mr. Vo Kim Phung, Deputy Head of Analysis at BETA Securities, believes that the State Bank of Vietnam’s intervention has helped stabilize the exchange rate. Meanwhile, news of the KRX system going live and the government’s directive to improve credit limits have all contributed positively to the market.

In terms of market valuation, the recent decline pushed the VN-Index below 1,200 points, making many fundamentally sound stocks attractive for medium- to long-term investors. This has activated some medium- to long-term money flows into the market.

VPS Securities believes that the strong recovery of the VN-Index to the 1,200 point level will be met with strong resistance in the range of 1,210 – 1,240 points in the coming sessions. This phase is suitable for short-term swing trading or accumulation of stocks for the May 2024 period.