The Board of Directors at Van Phu – Invest

In terms of project development , the company’s strategy is to develop and expand its land fund by participating in the bidding of projects, acquisition and mergers (M&A) of projects in localities with development potential and a specific orientation such as Bắc Giang, Bắc Ninh, Hải Phòng, Quảng Ninh…

In the past year, the company has participated in and successfully bidded for the Song Khe – Noi Hoang mixed-use housing and service complex investment and construction project, Bắc Giang province; completed the infrastructure, landscape, and a part of the rough construction of the CT2 building of the workers’ housing complex combined with commercial services in Yen Phong district, Bac Ninh; completed the terraced house component of the housing, and mixed-use commercial housing investment and construction project in Subdivision No. 2, the Southern urban area in Bac Giang city, Bac Giang province (The Terra – Bac Giang project); and completed the construction of infrastructure components and added artwork, and improved lighting systems at the Vlasta – Sam Son project, the entire project has been handed over to homebuyers.

At the end of 2023, revenue and after-tax profit reached VND 1,877 billion and VND 463.2 billion, respectively, fulfilling 85% of the revenue target and 84% of the after-tax profit target for the year.

Mr. To Nhu Toan, Chairman of the Board of Directors of Van Phu – Invest

With the forecast that the real estate market in 2024 will face many difficulties, Mr. To Nhu Toan said that Van Phu – Invest will focus on developing the real estate business and will not expand into other industries.

In addition to the main sector of residential real estate, the enterprise is also developing a service real estate segment to generate periodic income.

In terms of investment preparation , the company continues to implement projects in key locations with great potential and large reserves, including: implementing tasks related to site clearance and land allocation in the Bao Ninh 8 urban area project, Bao Ninh commune, Dong Hoi city, Quang Binh province; implementing tasks related to the feasibility study of the Song Khe – Noi Hoang mixed-use housing and service complex investment and construction project; completing the legal procedures for the Nhon Trach – Dong Nai project, Urban Area No. 22 – Bac Giang, Pham Hung – Ha Noi project, continuing to implement the BT Pham Van Dong – Go Dua project with the goal of being allocated land in 2024.

In terms of construction , in 2024, Van Phu – Invest will continue to implement projects carried over from 2023, such as: The Housing, and Mixed-Use Commercial Housing Construction Project in Subdivision No. 2, Southern Urban Area, Dinh Ke Ward, Bac Giang City, Bac Giang Province; CT2 Block of the Yen Phong Workers’ Housing and Commercial Services Project, Bac Ninh. At the same time, it will commence the construction of the Vlasta Thuy Nguyen – Hai Phong project.

In terms of business , with the target of total revenue, pre-tax and after-tax profit for the year at VND 2,775 billion, VND 405 billion and VND 350 billion, respectively, Van Phu – Invest will record revenue mainly from projects in Bac Giang with revenue of approximately VND 2,250 billion, the Oakwood Residence Ha Noi project contributing VND 180 billion, and other projects contributing VND 350 billion. During the year, the company will launch sales at several new projects such as Vlasta Thuy Nguyen – Hai Phong; workers’ housing and commercial services complex in Yen Phong, Bac Ninh.

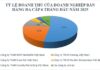

Regarding the after-tax profit distribution plan for 2023, at the Annual General Meeting of Shareholders held on April 26, 2023, the Board of Directors sought opinions on the 2023 after-tax profit distribution plan and the plan was approved by the General Meeting of Shareholders in Resolution No. 2604/2023 with an expected dividend payment ratio of 10%.

However, as 2023 marks the 20th anniversary of the company’s establishment, the Board of Directors proposed and the shareholders attending the 2024 AGM approved a change in the dividend payment ratio from 10% to 20%, with the form of payment being the issuance of additional shares to pay dividends to existing shareholders. The source for this will be the retained earnings from the accumulated after-tax profit. Thus, shareholders who own 10 shares as of the record date will receive an additional 2 new shares.

For 2024, the company’s expected dividend payout ratio is 10%.