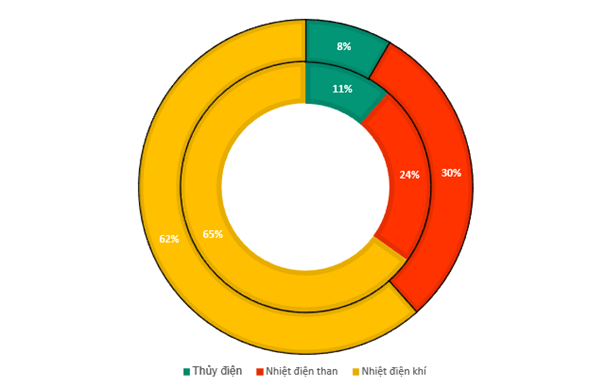

Thermal Power Accounts for Over 50% of the Energy Source Structure

Currently, POW owns numerous power plants (gas, coal, and hydropower) with a total installed capacity of 4,205 MW. Among these, thermal power accounts for more than 50% of POW’s total capacity. Ca Mau 1 & 2 Thermal Power Plants, Nhon Trach 2 Thermal Power Plant, and Vung Ang 1 Thermal Power Plant are the facilities with the largest proportions in POW’s electricity production structure.

POW’s Electricity Production Proportion in 2022 (inside) and 2023 (outside)

(Unit: Percentage)

Source: POW

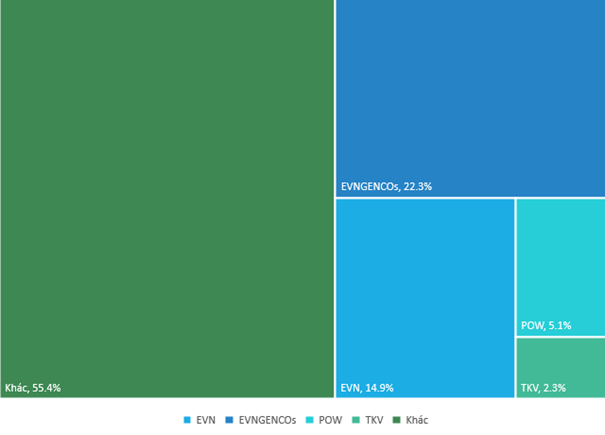

The total electricity production and import of the system in 2023 is 280.6 billion kWh, an increase of 4.56% compared to 2022. Of which, electricity production from power plants of EVN parent company accounts for about 14.9%; EVNGENCO accounts for about 22.3%, POW accounts for 5.1%, TKV accounts for 2.3%, and other sources account for about 55.4%.

Market Share of Vietnam Electricity Industry 2023 (by Electricity Production)

(Unit: Percentage)

Source: EVN, POW, and Vietnam Energy Association

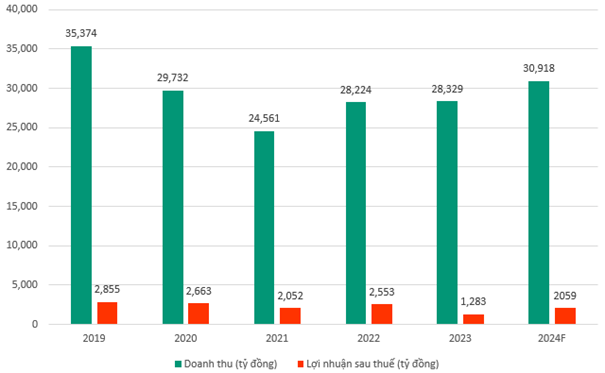

Expectations for Business Recovery in 2024

POW’s consolidated revenue and after-tax profit for the whole year of 2023 were VND 28,329 billion and VND 1,038 billion respectively, representing an increase of 0.37% and a decrease of 49.75% compared to 2022. This was primarily due to production disruptions when a series of key thermal power plants, including Vung Ang 1, Ca Mau 2, and Nhon Trach 2, underwent major overhauls. Concurrently, the group of hydropower plants, including Hua Na and Dakdrinh, had high profit margins but low electricity generation due to the impact of the El Nino phenomenon.

During 2024, POW’s business performance is projected to rebound as the major thermal power plants will no longer require overhauls like the previous year. Notably, low coal prices will significantly benefit the Vung Ang 1 power plant.

POW’s Business Results during 2019-2024F

(Unit: Billion VND)

Source: VietstockFinance

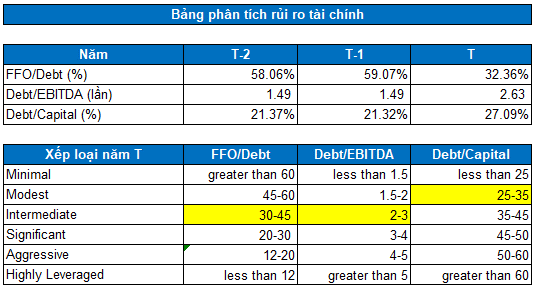

Financial Risk Increased from Modest to Intermediate

According to Standard & Poor’s criteria, POW’s financial risk assessment indicators such as FFO/Debt and Debt/EBITDA increased from Modest to Intermediate (medium risk level) in 2023. This is mainly because of the company’s production disruption when several key thermal power plants underwent major overhauls. Additionally, POW signed two large loan agreements, including VND 4,000 billion from Vietcombank and USD 200 million (untied ECA loan) from Sace/SMBC in 2023.

Source: VietstockFinance

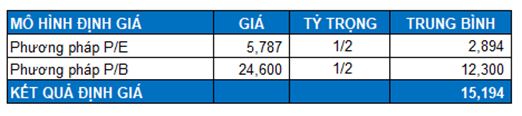

Stock Valuation

The median P/E and P/B ratios of thermal power companies in Vietnam are 12.9x and 1.69x, respectively. With an equivalent weighting between the P/E and P/B methods, the author calculates a fair value for POW of VND 15,194.

If the market price of POW’s stock falls below VND 10,700 (a discount of approximately 30% to the valuation), investors may consider buying for long-term investment purposes.

Corporate Analysis Department, Vietstock Consulting Department