Siam Brothers Vietnam (SBV): Q1 2024 Financial Performance with Ambitious Business Plan

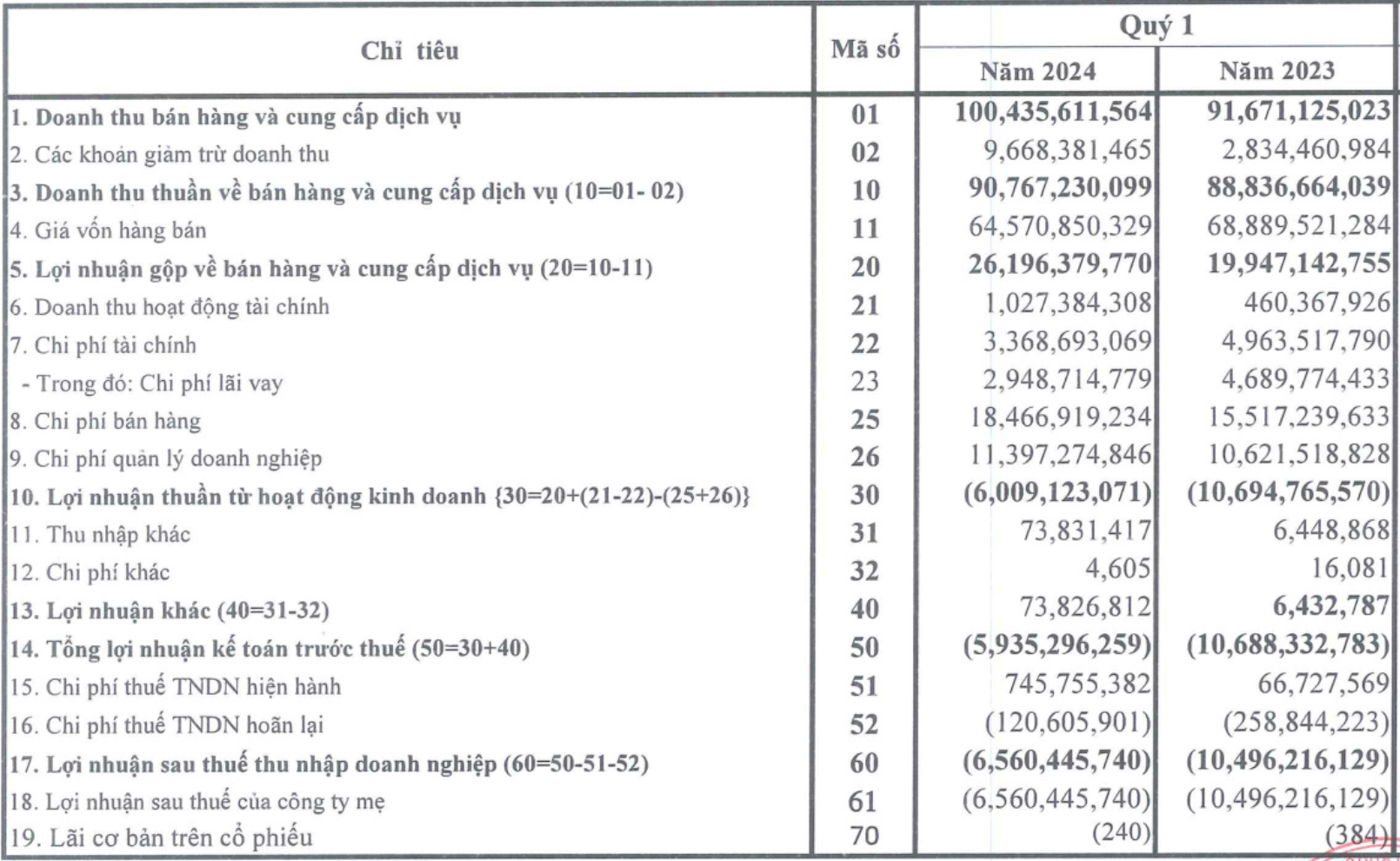

Siam Brothers Vietnam Joint Stock Company (stock code: SBV) has recently released its financial report for the first quarter of 2024, showing a slight 2% increase in net revenue to 91 billion VND compared to the same period last year. A reduction in the cost of goods sold resulted in a 31% increase in the company’s gross profit, reaching 26 billion VND.

Despite improvements in financial revenue and a significant decrease in financial expenses to 3.3 billion VND, the company’s selling and administrative expenses increased substantially to 18.4 billion VND and 11.3 billion VND, respectively. As a result, SBV reported a net loss of 6.5 billion VND, an improvement over the loss of 10 billion VND incurred in the same quarter of the previous year.

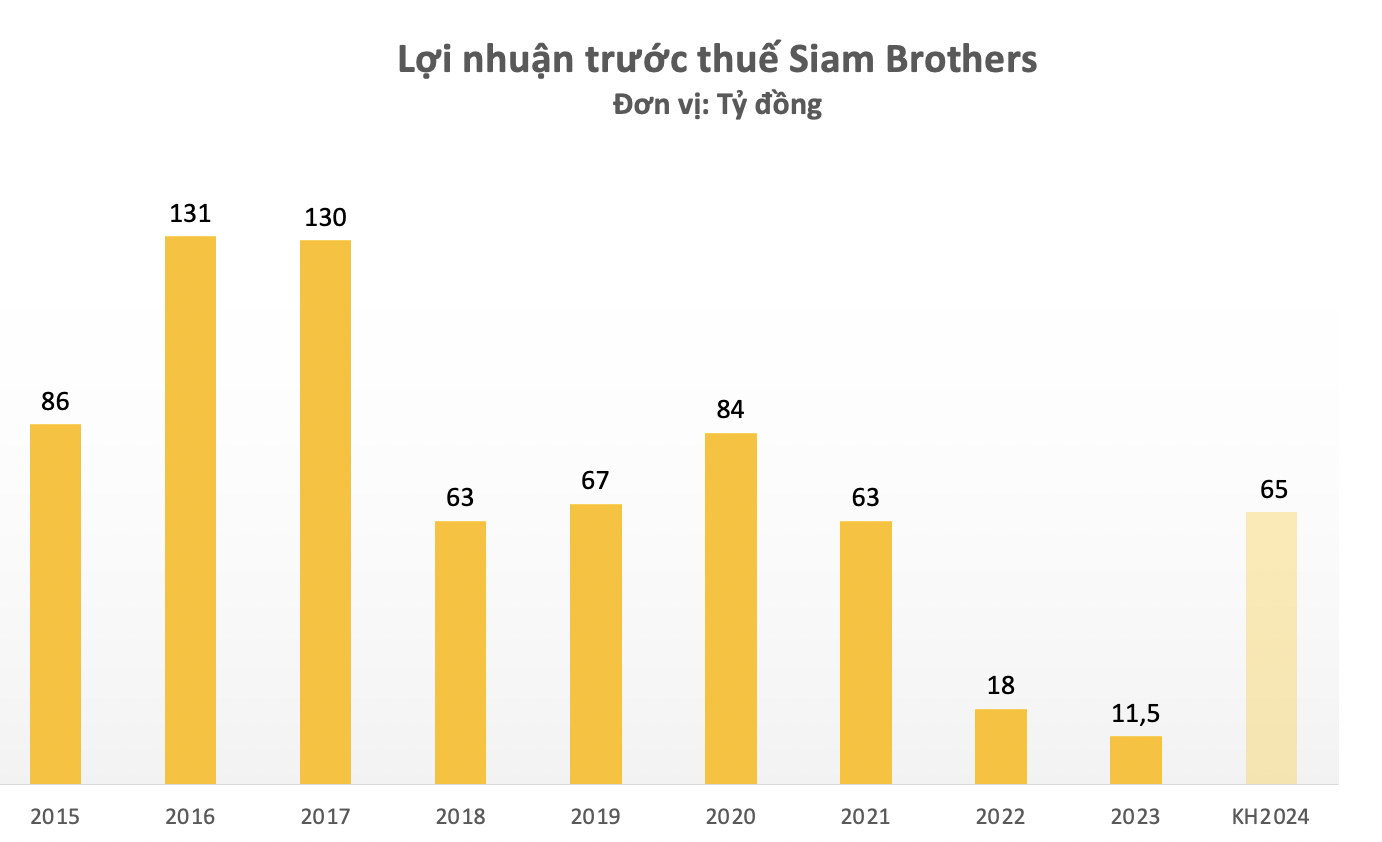

In contrast to the lackluster business performance in Q1, the company has set ambitious targets for 2024. Siam Brothers projects to achieve a revenue of 650 billion VND in 2024, a 46% increase compared to 2023. Pre-tax profit is expected to reach 65 billion VND, marking a 5.6-fold increase.

According to the company’s management, the positive business outlook for 2024 is based on the expectation of export recovery as planned last year, with the company having fully equipped machinery for signed export orders, taking advantage of the 2023 exchange rate, reducing financial costs, and leveraging the potential of certain types of agricultural twine and commercial products.

As of the end of March, the company’s total assets amounted to 838 billion VND, with current assets accounting for 65%. Total liabilities stood at 345 billion VND, with borrowings increasing by 25% compared to the beginning of the year to 247 billion VND. Retained earnings reached over 105 billion VND, a decrease of nearly 7 billion VND from the beginning of the year.

Siam Brothers Vietnam Joint Stock Company was established in 1995 with 100% of its initial investment capital coming from the Siam Brothers Group of Thailand. Siam Brothers Group is a leading manufacturer of fishing gear in Thailand, with nearly 50 years of experience in producing ropes, fishing nets, and products for the fishing, seafood, maritime transport, construction, industrial, and agricultural sectors.

Currently, SBV operates four factories with a combined production capacity of over 14,000 tons of products per year. These factories are equipped with modern production lines utilizing advanced technology from Italy, Germany, Japan, and India.

Apart from being the only company listed on the stock exchange that sells ropes, Siam Brothers Vietnam is also known for its consistent dividend payments to shareholders. In 2017, the company paid a cash dividend of 15% and issued over 6.8 million shares as a 3:1 stock dividend. From 2018 to 2022, the company consistently paid cash dividends ranging from 12% to 15% per year.

In 2023, the company recorded revenue of 445 billion VND and pre-tax profit of nearly 12 billion VND. Based on these results, SBV plans to distribute a dividend of 250 VND per share, representing 2.5% of its face value.

As the only listed company in the rope manufacturing industry, SBV has also gained recognition as a “unique” stock on the exchange. After reaching its peak in late December 2021, SBV’s share price has gradually declined to its “nominal” value and has remained within this range for over two years. At the close of trading on April 23, SBV’s stock price stood at 10,500 VND per share, with low liquidity and only a few thousand units traded.