Vietnam Stock Market Update from PYN Elite Fund

Petri Deryng, the head of Finland-based PYN Elite Fund, recently provided an update on the Vietnamese stock market. He noted that the market had experienced a significant downturn, with the VN-Index losing 8.5% of its value in just three weeks. This was compounded by a 2.6% depreciation of the VND against the USD, resulting in an overall decline of 11.1%.

PYN Elite Fund’s portfolio value has also declined by approximately 9.5% during the past three weeks.

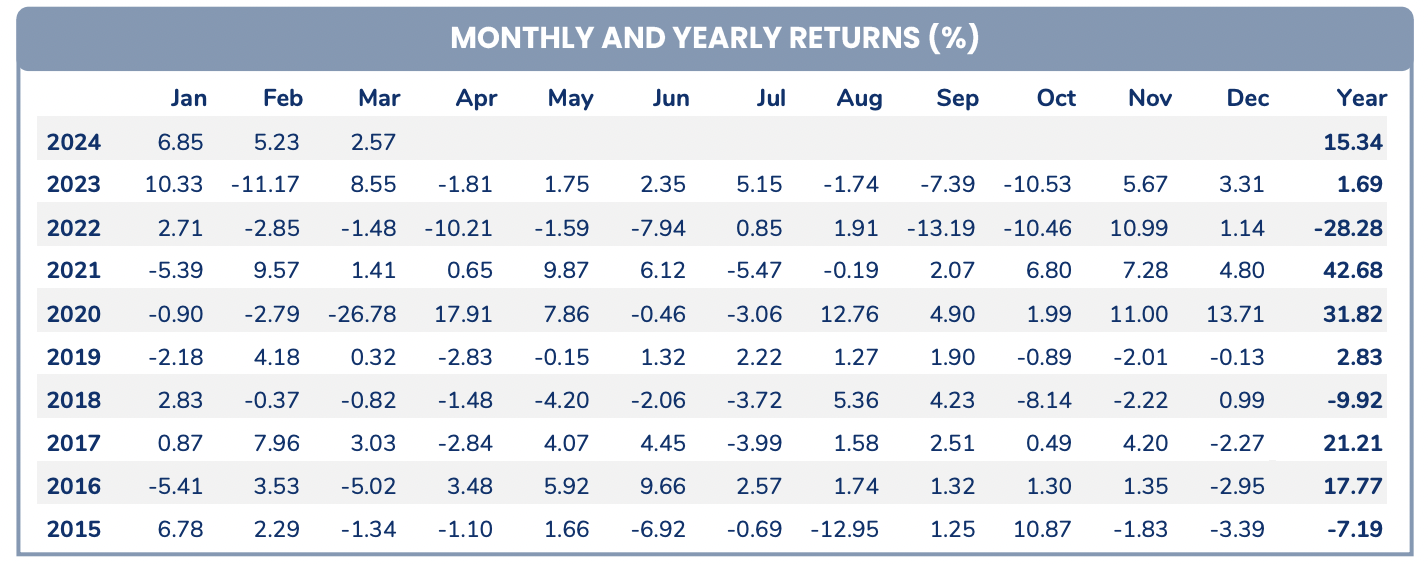

Previously, PYN Elite Fund had reported a 2.57% investment performance in March, bringing its cumulative investment performance for the first three months of 2024 to 15.34%. However, the Index’s recent drop has wiped out the gains made during the previous two months (February and March).

The fund has stated that it is currently fully invested in Vietnamese stocks and remains optimistic about the market’s prospects in 2024. Due to the sharp correction, PYN Elite is attempting to rotate some of its exposure from overvalued stocks to those that have been oversold in the recent market downturn.

Overall, Petri Deryng maintains a positive view of the Vietnamese stock market, believing it is still in an uptrend since bottoming out in November 2022. He acknowledges the current challenges but believes that the uptrend remains intact. Deryng believes that domestic investors have recently taken profits prematurely given favorable conditions such as low interest rates, ample liquidity in the banking system, and expected earnings growth this year.

“Factors supporting the ongoing uptrend in the market remain intact. The uptrend may experience some meaningful pullbacks, but investors need to tolerate correction if they intend to participate in the market,” wrote Deryng in a letter to investors.

As of the end of March, PYN Elite Fund had approximately 805.7 million EUR (~21,800 billion VND) in assets under management. Bank stocks continue to dominate the fund’s portfolio in terms of both number and weight. Notably, Sacombank’s STB stock is the fund’s largest holding, representing 14.6% of its portfolio, or 117.6 million EUR (~3,200 billion VND). Other major holdings include HDB (10.2%), MBB (9.6%), CTG (9.4%), and ACV (7.6%).

The head of PYN Elite Fund drew parallels between the economies of Vietnam and India, both of which are expected to grow vigorously over the coming decade.

“The State Bank of Vietnam’s control over credit growth in the banking system since 2012 should support sustainable growth in the Vietnamese economy and prevent overheating,” said the head of PYN Elite Fund.

Vietnam has lowered interest rates since last year, and PYN Elite Fund believes this will have a positive impact on the economy and stock market this year. In the second half of this year and into 2025, a more favorable global interest rate environment is expected, which could allow Vietnam to maintain or even lower its interest rates without putting undue pressure on its exchange rate. The narrowing of the interest rate differential with the US dollar could strengthen the Vietnamese dong in the latter part of the year, giving the State Bank of Vietnam more room to maneuver on interest rates and exchange rate policy, which should provide a positive backdrop for investor sentiment in the stock market.