Update

Chairman of the BOD Sacombank Duong Cong Minh

|

Mr. Duong Cong Minh – Chairman of the BOD shared at the conference: “I am the largest shareholder of Sacombank, rumors that affect me also affect the rights of Sacombank and shareholders.

I am not related to Ms. Truong My Lan and the cases of Ms. Truong My Lan, her case has been indicted and prosecuted. This is a rumor that Mr. Thang Dang wrote on Facebook.

The reason for this issue is because when Sacombank lent money to Bamboo Airways, I had to act as an advisor to Bamboo Airways’ credit to avoid losing capital. At that time, Mr. Thang asked for VND 200 billion for himself, but then Mr. Quyet’s family fired Mr. Thang before the new investor came in. I suggested that Mr. Thang work with the new partner.

If I were involved with Ms. Truong My Lan as well as Van Thinh Phat, I would never be sitting here. I assure you that in any case, I am always focused on the bank, for the bank.”

The 2024 Annual General Meeting of Shareholders of Sacombank was held on the morning of April 26, 2024.

|

BEFORE THE CONFERENCE

Scene before the conference

|

Shareholders register to attend the conference

|

The Final Destination of the Restructuring Journey

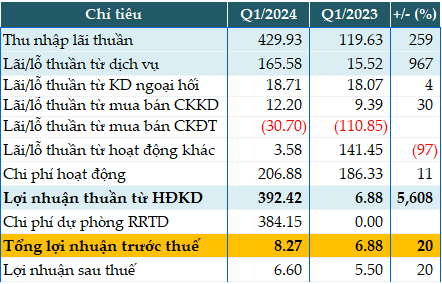

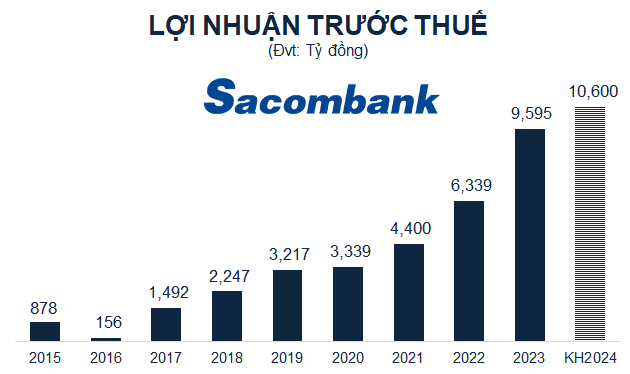

In 2023, Sacombank achieved VND 9,595 billion in pre-tax profit, an increase of over 51% compared to the previous year and fulfilled the set plan. The ratio of non-performing loans on the balance sheet was 2.1%, up 1.18% year-on-year, in the context of increased credit risks and declined debt repayment capacity of customers. However, the credit quality was generally still under control as the overall non-performing loan ratio decreased by 0.16%.

Regarding the bad debt settlement, in 2023, Sacombank recovered and settled VND 7,941 billion of bad debts and frozen assets, of which VND 4,487 billion were debts under the Project, reducing their proportion in total assets to 3%. Adequate provisions for risk were set up in accordance with regulations, with a total balance of provisions reaching VND 25,099 billion, an increase of over 10%, of which provisions for loans increased by 34%.

The pre-tax profit plan for 2024 is VND 10,600 billion, an increase of 10%

In 2024, it is forecasted that potential risks from macroeconomic factors will still exist. However, when the internal strength has been accumulated, as Sacombank is approaching the final destination of the restructuring journey, it will continue to accelerate to fully conclude the successful restructuring roadmap and enter a new development stage with many higher goals. Sacombank sets the key targets for the new year:

(1) Increase the scale and effectiveness of all units throughout the system, ensuring the system operates safely and effectively.

(2) Breakthrough in business, build and complete digital transaction points.

(3) Continue the digital transformation, increase utilities of products and services to bring experiences and security to customers.

(4) Reduce the overall non-performing loan ratio to below 3%, complete and terminate the Post-Merger Restructuring Project.

(5) Implement procedures for distributing dividends to shareholders from retained earnings to increase financial capacity, making Sacombank one of the leading retail banks.

Sacombank expressed confidence in completely resolving outstanding issues to complete the restructuring ahead of schedule, thus setting growth targets higher than in 2023. Total assets by the end of 2024 are set to reach VND 724,100 billion, an increase of 10% compared to the beginning of the year. Total mobilized capital will reach VND 636,600 billion, an increase of 10%.

Total outstanding credit will reach VND 535,800 billion, an increase of 11%, and will be adjusted according to the mobilization and lending growth targets in accordance with the credit limit allocated by the State Bank. The non-performing loan ratio will be controlled at below 2%.

The pre-tax profit target for 2024 is VND 10,600 billion, an increase of 10% compared to the result in 2023.

Source: VietstockFinance

|

Retained earnings accumulated to VND 18,387 billion

Regarding the profit distribution plan, Sacombank has VND 7,469 billion in profit for distribution. After setting up the funds, the bank has VND 5,716 billion in consolidated after-tax profit. Together with the nearly VND 12,671 billion of retained earnings from the previous year, Sacombank has VND 18,387 billion in accumulated consolidated retained earnings.

In 2023, although the actual pre-tax profit target reached VND 9,595 billion, 101% of the set plan, the BOD unanimously agreed on practicing saving, so the actual remuneration for the BOD and SAC in 2023 only accounted for 0.71% of the consolidated pre-tax profit of the 2023 fiscal year, lower by 0.29% than the approved allocation.

In 2024, the BOD plans to submit the remuneration of the BOD and SAC to 1% of consolidated pre-tax profit.

At this AGM, Sacombank also plans to elect an additional member to the SAC, increasing the total number of SAC members for the term 2022-2026 to 5.

CEO of Sacombank – Ms. Nguyen Duc Thach Diem

|

Discussion:

Credit growth direction? What is the proportion of real estate lending?

Total outstanding loans are nearly VND 500,000 billion, of which about VND 100,000 billion are outstanding real estate loans, of which personal consumer real estate accounts for 60%.

The 2024 credit growth direction will focus on green fields, agriculture, green industry, renewable energy, import and export, and priority areas for small and medium enterprises. STB does not lend or invest in corporate bonds.

Why haven’t dividends been distributed yet?

Mr. Duong Cong Minh