In 2023, Vietbank Raked in 647 Billion VND in Post-Tax Consolidated Profit

Specifically, in 2023, Vietbank recorded a consolidated post-tax profit of nearly 647 billion VND. After deducting provisions for funds and adding retained earnings from previous years, the bank had over 1,593 billion VND in undistributed profits. The bank plans to use nearly 1,445 billion VND for stock dividends, with the remaining 148 billion VND retained as profit. The stock dividend is expected to be distributed in Q3 or Q4 of 2024.

The additional capital from the issuance of shares to pay 2024 dividends is expected to be used for asset investment, supplementing capital for development, expanding the network of operations, and ensuring compliance with safety ratios in operations.

Also this year, Vietbank plans to continue implementing the capital increase plan through a rights offering to existing shareholders (already approved by the State Bank of Vietnam) with a total additional amount of 1,003 billion VND. To date, the bank has completed offering over 100.3 million shares and is carrying out procedures to request the State Bank of Vietnam’s approval to amend the license. The expected completion time is in Q2 or Q3.

Vietbank’s current charter capital is 4,777 billion VND. If the capital license amendment procedure is completed and the share issuance for dividend payment is successful, the bank’s charter capital will increase to nearly 7,225 billion VND.

With the additional charter capital, Vietbank has set two business plans for 2024: the baseline target and the target.

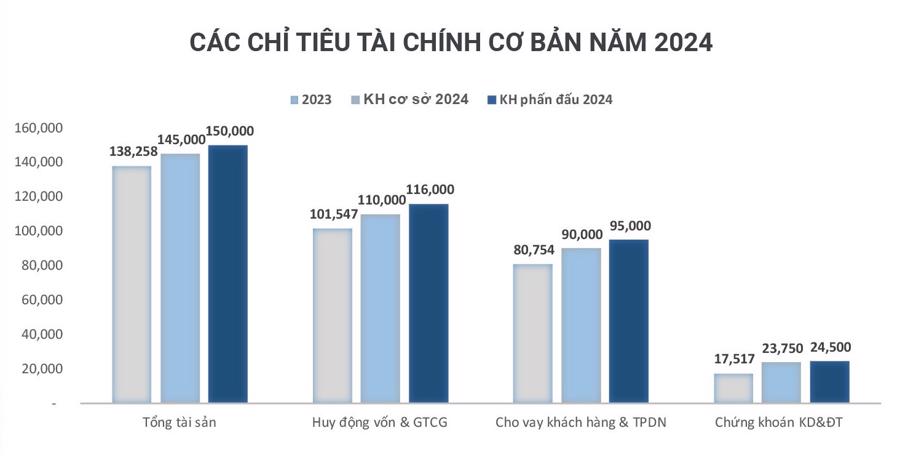

Specifically, under the baseline plan, the bank aims to achieve a pre-tax profit of 950 billion VND, an increase of 17% compared to the 2023 result. The bank aims to increase total assets by 5% from the beginning of the year to 145,000 billion VND by the end of 2024; mobilize 8% more from customers (including valuable papers) to 110,000 billion VND; increase total outstanding loans by 11% to 90,000 billion VND; and control the bad debt ratio below 2.5%.

Under the enhanced plan, Vietbank aims to increase pre-tax profit by 29% to 1,050 billion VND; mobilize from customers and credit balance growth of 14% and 18%, respectively, to 118,000 billion VND and 95,000 billion VND.

Previously, Vietbank’s 2023 AGM approved the listing of VBB shares on the Ho Chi Minh City Stock Exchange (HOSE) when market conditions are favorable.

Based on business operations in 2021, 2022, and the restructuring plan for operations in conjunction with bad debt treatment for the period 2021-2025, Vietbank has met the conditions for business results, financial ratios, and management and governance. However, in 2023, the domestic market context has changed, creating challenges. In such a context, listing shares would not reflect true value and ensure the rights of shareholders. Therefore, Vietbank has not yet listed in 2023. Thus, the bank will continue to submit the 2024 AGM plan for listing on HOSE when market conditions are favorable.

Vietbank stated that it will transition its model from credit dependence to multi-service business. The bank will accelerate bad debt treatment, improve credit quality, and minimize new NPLs to control the ratio of on-balance sheet bad debts, bad debts sold to VAMC, and bad debts at below 3% by 2025.

At the same time, the bank also aims to increase the proportion of income from non-credit services in Vietbank’s total income to 12-16% by the end of 2025; increase the proportion of bank lending capital to low-carbon manufacturing and consumption sectors.

The bank aims to achieve a pre-tax profit of 1,600 billion VND by 2025; increase total assets to 170,000 billion VND; mobilize market capital of 135,000 billion VND and credit balance of 110,000 billion VND. The charter capital is expected to increase to 10,000 billion VND. The ROE ratio is targeted to exceed 11%.