Net Profit Movement of AAA Since 2010

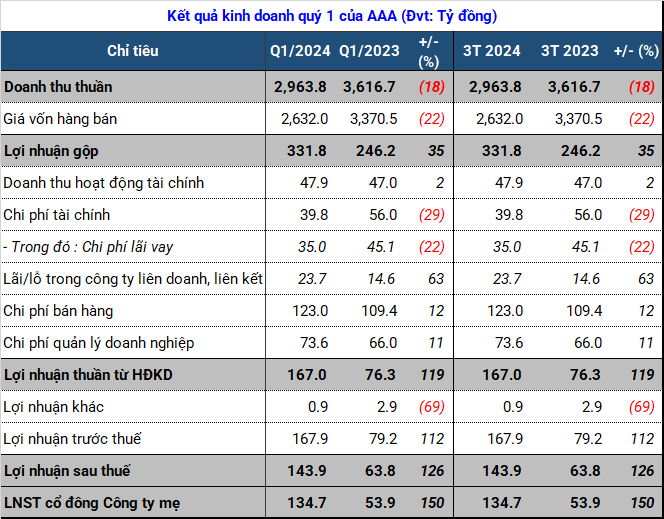

Despite an 18% decrease in revenue to VND 2.9 trillion, An Phat Holdings Plastic Joint Stock Company (HOSE: AAA) reported positive results in the first quarter of 2024.

AAA reported more efficient production, business, and trading activities than the same period last year due to stable plastic resin prices. Data shows that the cost of goods sold to revenue ratio has reached its lowest level in many years, at 88.8%, compared to 93.2% in the first quarter of 2023.

Other factors also favored the company. For example, financial expenses were reduced by 29% to VND 40 billion, primarily due to a significant reduction of VND 10 billion in interest expense. Additionally, the company recorded a remarkable profit of VND 24 billion from its associated companies and joint ventures, compared to just over VND 14 billion in the same period last year.

Increased expenses, including selling expenses and general and administrative expenses, were adverse factors but not significant. AAA reported a net profit of nearly VND 135 billion, a 149% increase.

For 2024, the plastics company set a revenue target of VND 12 trillion and a profit after tax of VND 377 billion, of which 25% and 38% have been achieved, respectively.

According to AAA, the production of plastic packaging products and plastic resin additives will continue to drive core profit growth this year by increasing the proportion of high-margin industrial and biodegradable packaging. Plastic exports are also projected to grow by 4.4% in 2024.

Source: VietstockFinance

|

After three months, AAA‘s total assets were approximately VND 11.6 trillion, almost unchanged. However, there was a notable doubling of short-term receivables to VND 2.5 trillion. This was accompanied by an VND 800 billion decrease in investments held to maturity, leaving approximately VND 200 billion.

Specifically, short-term loans receivable increased by nearly VND 700 billion compared to the beginning of the year, reaching VND 759 billion, but no detailed explanation was provided. Similarly, long-term loans receivable also increased by over VND 300 billion from the previous VND 77 billion.

As a result, AAA‘s total loans receivable increased by approximately VND 1 trillion within three months. Short-term prepayments to suppliers also doubled from the beginning of the period to VND 698 billion.