The local stock market has just experienced 2 impressive trading sessions, both in terms of points and liquidity. At the end of the session on February 27, the VN-Index rose by 13.29 points (1.09%) to 1,237.46 points. Liquidity also increased, with a trading value on HoSE of over 21,462 billion dong. Most sectors unanimously rose, with large-cap stocks and key stocks attracting capital. HPG alone traded over 2,621 billion dong, the highest on the market, accounting for over 11% of HoSE’s liquidity.

Influential sectors such as banking, real estate, and securities also saw strong stock performance. The upward trend of the VN-Index did not encounter strong resistance or excessive volatility, despite today being the time for stocks bought on the 6th last week (a strong correction session) to return to investors’ accounts with certain profits.

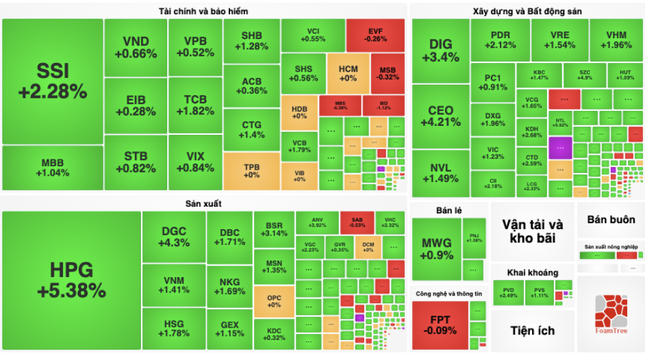

The market was covered in green in the session on February 27.

Commenting on the recent trading session, Mr. Nguyen The Minh – Director of Analysis at Yuanta Vietnam Securities – pointed out that the market’s upward momentum continued as capital flowed back to large-cap stocks. Points, liquidity, and breadth were all positive, reflecting investors’ optimism.

With the VN-Index approaching the old peak, Mr. Minh believes that a correction may occur, but the pressure is not significant. Meanwhile, the market’s upward trend is being supported by large-cap sectors such as banking, securities, and steel. The possibility of the VN-Index surpassing 1,245 points is real when money is concentrated in large-cap stocks.

According to Mr. Minh, another highlight of the market is liquidity, which is being maintained above 19,000 billion dong. With low interest rates and investors’ optimism due to profitable investments, money is flowing more strongly into the stock market. “Investors’ savings accounts are about to mature in the context of very low deposit interest rates, less than 5% per year, making them search for higher-risk investment channels with better returns. Stocks are an attractive choice at the moment, while bond liquidity is still low, with prolonged risks from previous years,” Minh analyzed.

The positive stock market has led to margin loans being reduced by nearly 50% compared to last year, with many companies offering loans at 6-8% per year. Whether to use leverage has become a concern for many investors. From the perspective of Nguyen The Minh, the use of margin still needs to be balanced to achieve good profits and risk prevention. Margin interest rates have been decreasing since late 2023, mainly due to low savings interest rates.

“Investors usually accelerate the use of margin when the market is booming, liquidity is high, and it somewhat resembles the current stock market situation. In 2024, the upward trend of the market is predicted to be more sustainable, but investors need to be mindful and only use margin loans focused on large-cap stocks and sectors with potential, such as banks, securities, and steel,” Minh said.

Regarding capital flows, the analysis team at SSI Securities believes that record-low interest rates will be the main driver of growth, especially for individual investors. Deposits at banks continue to increase as other investment channels are limited. This capital flow could return to the stock market in stages throughout 2024.

After a 13-point increase of the VN-Index, experts from BIDV Securities (BSC) believe that in the coming sessions, the VN-Index may continue to inertially rise, returning to the 1,250 range, accompanied by fluctuations.

In the medium and long term, Saigon – Hanoi Securities believes that the VN-Index is gradually moving to form a wider mid-term accumulation channel from 1,150 to 1,250 points. Currently, the VN-Index is almost reaching the upper resistance zone of the accumulation channel, so the short and medium-term risks are increasing.

Short-term investors should not chase after stocks in rising sessions and may consider gradually taking profits with stocks that have reached their targets in the current phase, as the risk of a short-term market decline is high.