Update

The Shareholders’ Meeting approved 13 items and proposals. The only proposal that was not approved was the one to change the headquarters location of **EIB** with a disapproval rate of 90.62% of the attending shareholders.

Eximbank’s Annual General Meeting was held on the morning of 26/04/2024

|

Chairman of Bamboo Capital Joins the Board of Directors

During this meeting, the Shareholders’ Meeting approved the dismissal of Ms. **Lê Thị Mai Loan** from her position as a Member of the Board of Directors. Ms. Loan had previously resigned due to personal reasons on 31/01/2024. She was elected to the Board of Directors at Eximbank’s extraordinary Shareholders’ Meeting on 14/02/2023.

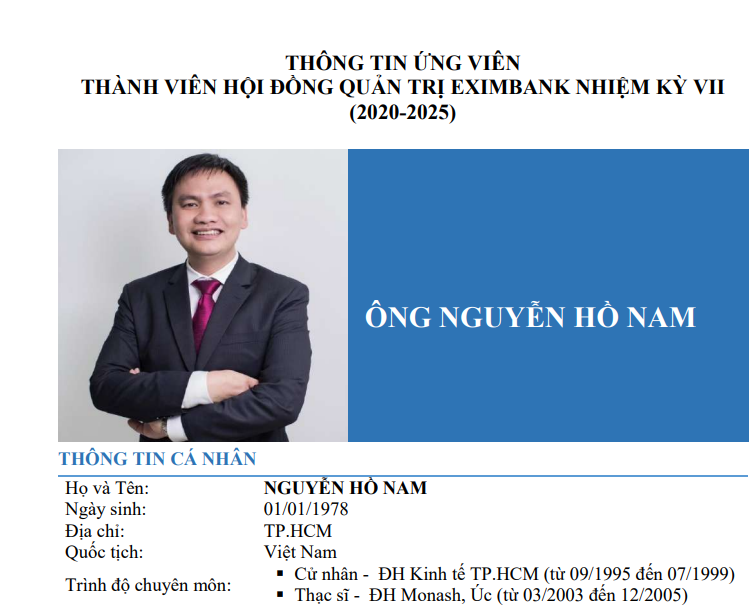

Eximbank has elected a new member to its Board of Directors for the 7th term (2020-2025) from a list of candidates approved by the State Bank of Vietnam. The elected candidate is Mr. **Nguyễn Hồ Nam** – Chairman of Bamboo Capital JSC. Mr. Nam also holds the position of Chairman at Bamboo Energy JSC and Member of the Board of Directors at Fides Vietnam Fund Management.

Mr. Nam was elected to the Board of Directors with a vote of 99.63% of the voting shares present at the meeting.

Mr. **Nguyễn Hồ Nam** (holding flowers) was elected to the Board of Directors of Eximbank

|

Dividend Distribution of 10% in Cash and Shares

In 2023, Eximbank had a post-tax profit of 2,146 billion VND. After deducting the necessary reserves, Eximbank had 1,949 billion VND of retained earnings up to 31/12/2023. After deducting the bonus and welfare funds, the bank had 1,740 billion VND left to distribute dividends to shareholders at a rate of 10%. Of this, 7% will be distributed in shares (1,219 billion VND) and 3% in cash (over 522 billion VND).

After the dividend distribution, the bank had approximately 59 billion VND of retained earnings.

Regarding the dividend distribution in shares, Eximbank plans to issue an additional 121.86 million shares at a ratio of 7% (shareholders owning 100 shares will receive up to 7 new shares).

The capital source for this issue will be the undistributed retained earnings up to 2023 after deducting the necessary reserves. If the issuance is successful, Eximbank’s charter capital will increase from 17,470 billion VND to a maximum of 18,688 billion VND.

The additional capital will be used by the bank for business operations, including investment in infrastructure, technology, construction of office buildings, expansion of the operating network, and investment in fixed assets. The implementation period is expected to be in 2024.

Previously, in 2023, Eximbank had paid dividends in shares twice at a ratio of 20% and 18%. The bank first distributed stock dividends in February 2023 from the retained earnings of 2017, 2018, 2019, 2020, and 2021.

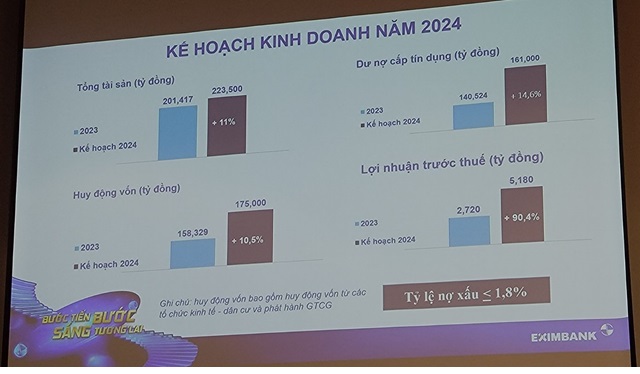

2024 Pre-Tax Profit Target of 5,180 Billion VND, an Increase of 90%

With the additional capital, Eximbank has set a pre-tax profit target of 5,180 billion VND for 2024, an increase of 90% compared to the 2023 results. By the end of 2024, the total assets are expected to reach 223,500 billion VND, an increase of 11% compared to the beginning of the year. Capital mobilization and outstanding loans are expected to reach 175,000 billion VND and 161,000 billion VND respectively, an increase of 10.5% and 14.6%. The non-performing loan ratio is controlled at 1.8%.

**EIB**’s 2024 Business Plan Presented to Shareholders’ Meeting

|

Relocation of Headquarters

Eximbank also sought shareholder approval for a change in its headquarters location. Eximbank stated that the current headquarters is located in the Vincom Center Building, 7 Le Thanh Ton, Ben Nghe Ward, District 1, Ho Chi Minh City, which has been