Update

Chairman Nguyen Ho Nam opened the conference. Screenshot

|

BCG is accelerating its ESG journey

Opening the conference, Chairman of the Board of Directors, Mr. Nguyen Ho Nam, shared that BCG is accelerating its ESG journey by applying leading-edge modern platforms to monitor, analyze, and evaluate carbon emission levels at its member companies. Sustainable development reports are given high priority and implemented with greater rigor and higher standards. This is a critical part of the sustainable development plan that BCG has outlined for itself and its member companies.

In 2024, the Vietnamese and global economies are expected to remain challenging; however, BCG will continue its efforts to enhance its ability to turn challenges into opportunities, thereby achieving its 2024 business targets.

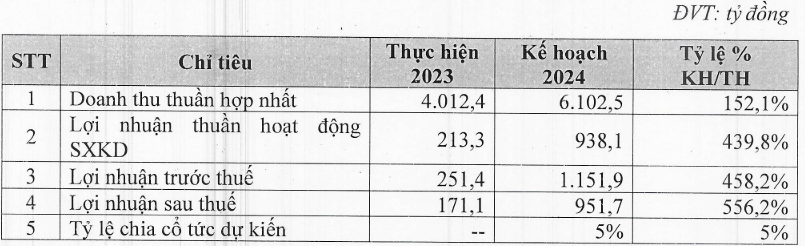

Profit target increased nearly sixfold, bringing AAA Insurance to UPCoM

In 2024, BCG sets a target of consolidated net revenue of approximately VND 6.103 billion and after-tax profit of nearly VND 952 billion, representing a 52% increase in revenue and a nearly 5.6-fold increase in profit. The company plans not to distribute dividends in 2023, while the dividend for 2024 is 5%.

|

BCG’s 2024 business plan

Source: BCG

|

In terms of plans for each sector, in the renewable energy sector, BCG plans to complete price negotiations for the Phu My and Krong Pa 2 solar power projects; continue to promote the completion of the 150MW rooftop solar power project; and develop 550 MW of onshore and offshore wind power (expected to begin commercial operation in 2025).

Specifically for the waste-to-energy sector, BCG Energy plans to develop the first waste-to-energy plant in Cu Chi district (with a total capacity of 200MW) in 2024, processing 2,000 tons of waste per day. Phase 1 is expected to be completed in 2025, and phase 2 is expected to be completed in 2026. Additionally, the company plans to build a plant in Long An with a capacity of 500 tons per day.

For real estate, BCG Land (UPCoM: BCR) will focus on completing the construction of ongoing projects, including Malibu Hoi An, Hoian d’Or, and King Crown Infinity; accelerating the process of legal completion of the project; and researching and developing industrial real estate products.

In the construction and infrastructure investment sector, Tradico plans to implement the construction of Contract Package No. 12 of the Chau Doc – Can Tho – Soc Trang Expressway project and the Duc Thinh residential area project (Bac Giang) in 2024.

Regarding the financial services sector (AAA Insurance), AAA aims for insurance premium revenue of at least VND 1,000 billion in 2024, with after-tax profit at least equal to 2023 but potentially reaching approximately VND 17 billion (an increase of 71%). Additionally, AAA will submit an application to register for trading securities on the UPCoM.

In the manufacturing and trading sector, Tipharco, a member of BCG, will focus on core products such as domestic and export furniture, modified starch, and cassava starch, with the aim of generating stable revenue and seeking partners to expand the market.

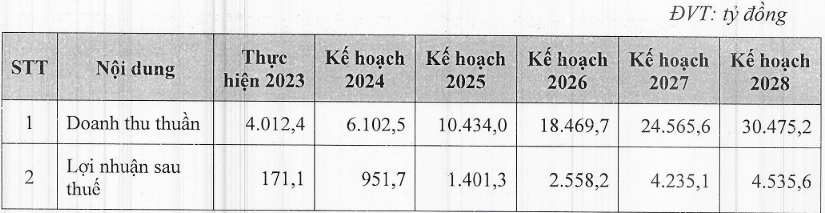

BCG plans to record approximately VND 30.5 trillion in revenue and over VND 4.5 trillion in after-tax profit by 2028.

|

BCG’s 2024-2028 business plan

Source: BCG

|

This year, BCG plans to increase its charter capital to over VND 8.8 trillion through an issuance of shares to existing shareholders (in a 2:1 ratio) and an issuance of shares to increase share capital from shareholders’ equity or issuance of bonus shares (in a 10% ratio).

Chairman Nguyen Ho Nam resigns from the Board of Directors

At this conference, BCG will approve the dismissal of two members of the Board of Directors for the 2020-2025 term: Mr. Nguyen The Tai and Mr. Pham Nguyen Thien Chuong. Notably, Chairman of the Board of Directors, Mr. Nguyen Ho Nam, submitted a resignation letter one day before the conference.

In his resignation letter, Mr. Nam stated that he is stepping down as Chairman to “focus on his role as Head of the Founding Council and Advisory Council in directing the strategic orientation of Bamboo Capital Group.”.

Additionally, the company will also approve the dismissal of the Supervisory Board for the 2020-2025 term, including Mr. Kou Kok Yiow.

After resigning from the Supervisory Board, Mr. Kou Kok Yiow appears on the list of candidates running for the BCG Board of Directors, along with Mr. Hoang Trung Thanh (Vice Chairman of the Board of Directors of BCG Energy). Meanwhile, the candidate running for the Supervisory Board is Mr. Leong Kwek Choon, who is currently a senior advisor at RE Subtainability International (Singapore).

Discussion

Why did Chairman Nguyen Ho Nam resign?

Chairman Nguyen Ho Nam: The Group has prepared for this restructuring in advance. BCG currently has 12 leaders ready to succeed the original 9 founders, and below these 12 leaders, there is a team of 42 core personnel ready to take the next step.

BCG is developing a group model that does not depend on any single member, so the founding members will gradually withdraw from the Board of Directors so that the next generation of personnel can develop with greater confidence. I am resigning not to leave but to transition to a new role as a strategic advisory board, where I will serve as Chairman. With this new perspective, the strategic advisory board will dedicate time to exploring new directions for the Group.

Feasibility of the 2024 business plan?

Vice Chairman of the Board of Directors and Deputy General Director Pham Minh Tuan: The Group invests in real estate and renewable energy, sectors that are dependent on the policy environment and legal progress. Specifically, the renewable energy sector is currently facing challenges in development due to slow policy and approval processes.

The 2024 business plan is based on the Group’s capabilities, not taking into account policy delays.

Compared to peers in the same industry, at the same time, while other businesses are reporting losses and many projects remain undeveloped, BCG has been able to record profits thanks to its strict monitoring process. Therefore, if profits are not achieved this year, efforts will be made in the following year.

Chairman Nguyen Ho Nam: BCG has a compensation and income mechanism that is at an average level compared to the industry. To attract a skilled workforce, the Group has consulted shareholders