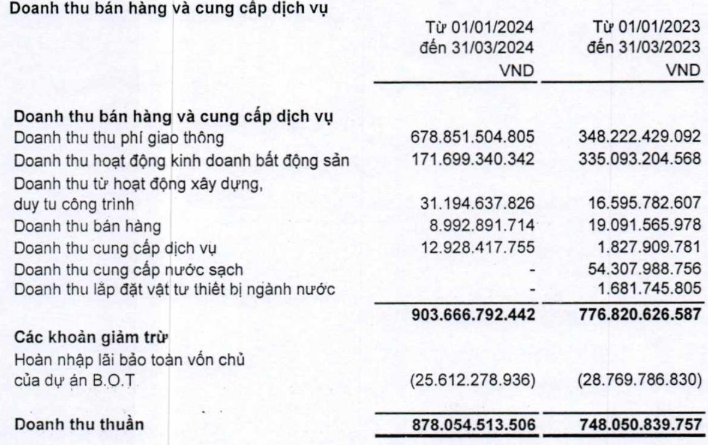

Specifically, CII’s net revenue in the first quarter was more than VND 878 billion, up 17% year-on-year. Although there is no revenue from the water sector, toll revenue nearly doubled to nearly VND 679 billion in the same period.

|

CII’s revenue structure in the first quarter of 2024

Source: CII

|

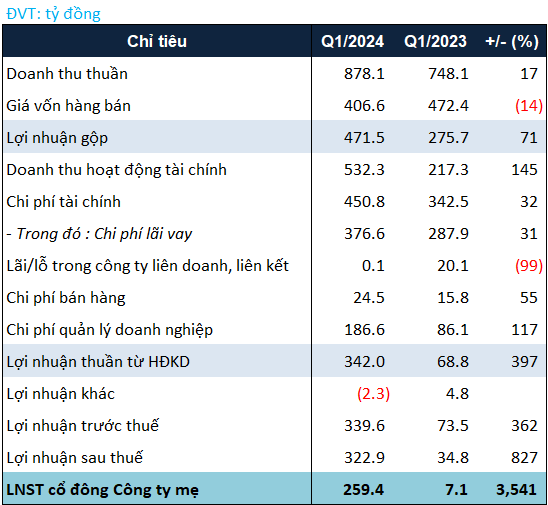

Not only that, financial revenue is also nearly 2.5 times higher than the first quarter of last year, with more than VND 532 billion, of which more than VND 430 billion is the profit from the revaluation of fair value of investments and associates when CII controls.

Besides revenue, CII’s expenses also increased significantly when financial expenses and management expenses increased by 32% and 2.2 times year-on-year, respectively, with nearly VND 451 billion and nearly VND 187 billion.

With the above volatility, CII’s net profit was more than VND 259 billion in the first quarter of 2024, while in the same period last year it was only VND 7 billion. Compared to the plan of VND 430 billion submitted by CII’s BOD to the annual General Meeting of Shareholders, the profit for the first quarter is equivalent to more than 60% of the implementation.

CII explained that the first-quarter result was achieved thanks to an increase in net profit from the BOT Trung Luong – My Thuan project (from Trung Luong – My Thuan BOT JSC – a subsidiary of CII from the fourth quarter of 2023) and from the consolidated profit from Nam Bay Bay Investment JSC (HOSE: NBB) after becoming a subsidiary of CII from the first quarter of 2024.

|

CII’s business results in the first quarter of 2024

Source: VietstockFinance

|

As of March 31, 2024, CII’s total assets were recorded at more than VND 36.2 trillion, an increase of 9% over the beginning of the year. Cash increased by 86%, to over VND 2.2 trillion. Due to the consolidation of financial statements with NBB, CII’s inventory value was nearly 2.7 times higher than at the end of the previous year, at over VND 2.1 trillion, thanks to the recognition of the value of unfinished real estate of the De Lagi project (over VND 929 billion) and Son Tinh residential area – Quang Ngai (nearly VND 603 billion).

On the other hand, liabilities increased by 8%, to nearly VND 26.7 trillion. In which, total borrowings increased by 7%, to over VND 20.1 trillion. The value of convertible bonds accounted for by CII in a separate item is over VND 2.8 trillion. Also, from the incorporation of NBB as a subsidiary, the value of CII’s other long-term payable item decreased by 98%, to only nearly VND 35 billion, as it no longer recognizes other payables of more than VND 2,061 billion from NBB.