According to a recent report by Agriseco Research, the VN-Index has significantly declined from its peak amidst the release of Q1 business results, leading to attractive valuation levels. Given the extremely low interest rates on deposits, with major banks offering annual deposit rates ranging from 4.3% to 4.9%, the optimal strategy is to acquire quality stocks at reasonable prices to benefit from cash dividends and potential future price appreciation.

Agriseco Research recommends selecting stocks with a history of high and consistent cash dividends, solid financial health, and operating in industries with low sensitivity to economic cycles.

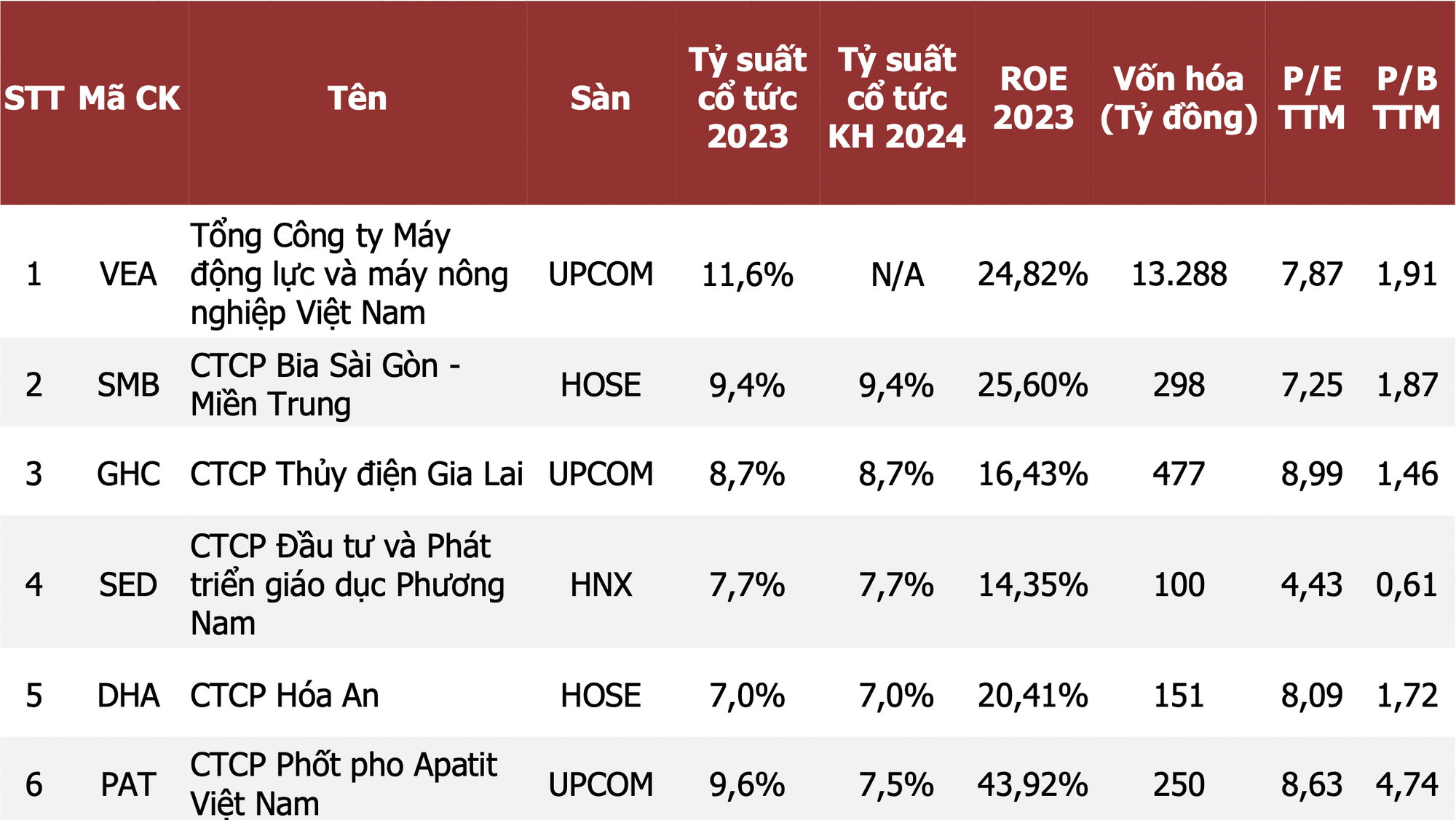

Agriseco Research suggests six potential stocks: VEA, SMB, GHC, SED, DHA, and PAT.

Vietnam Mechanical and Agricultural Machinery Corporation (VEA) specializes in manufacturing, assembling, and distributing automobiles and casting machinery parts. The company has abundant cash reserves, with deposits accounting for nearly 48% of total assets. With stable cash flow from its core business, VEA has paid attractive cash dividends ranging from 40-100% over the past three years.

Saigon – Central Beer Joint Stock Company (SMB) manufactures and distributes beer, liquor, and soft drinks. The company maintains a sound capital structure through low leverage levels. SMB plans to pay a cash dividend of 35% in 2024, corresponding to a dividend yield of 9.4% per annum. In the current low-interest-rate environment, where bank deposit rates range from only 4.3% to 4.9% per annum, SMB presents an attractive investment opportunity.

Gia Lai Hydropower Joint Stock Company (GHC) operates in the electricity generation sector, owning two hydropower plants and four solar power plants with total capacities of 28.2 MW and 56.1 MW, respectively. This is a resilient industry that has consistently experienced stable growth. In 2024, the company plans to pay a cash dividend of 25%, equivalent to a dividend yield of 8.7% per annum, nearly twice the current bank deposit rates.

Phuong Nam Education Investment and Development Joint Stock Company (SED) operates in the education sector and delivered stable business performance in 2023, with a 9% year-over-year increase in after-tax profit to over VND 41 billion. SED maintains a healthy financial position, with improved coverage of short-term debt obligations. Additionally, the company has consistently maintained a high cash dividend payout ratio, with a dividend yield of approximately 7.7% per annum, offering an attractive income-generating investment option.

Hoa An Joint Stock Company (DHA) was formerly known as Hoa An Stone Enterprise (1980) and operates in the mining and processing of construction materials. In 2023, net income grew by 83.4% year-over-year to VND 95.94 billion, driven by increased stone production for public investment projects, an improvement in gross profit margin from 27% to 30%, and financial provision reversal of VND 25.26 billion. With stable business operations and a solid financial structure, the company has consistently paid high cash dividends over the years.

Vietnam Apatite Phosphate Joint Stock Company (PAT) is a subsidiary of DGC and is primarily engaged in the production, processing, and distribution of yellow phosphorus. The company was listed on the stock exchange in 2022. Since its listing, PAT has maintained a high cash dividend payout ratio. In 2024, PAT plans to pay a cash dividend of 70%, corresponding to a dividend yield of 7.5% per annum, exceeding bank deposit rates. Investors may consider holding the company’s shares to benefit from dividends during this period.