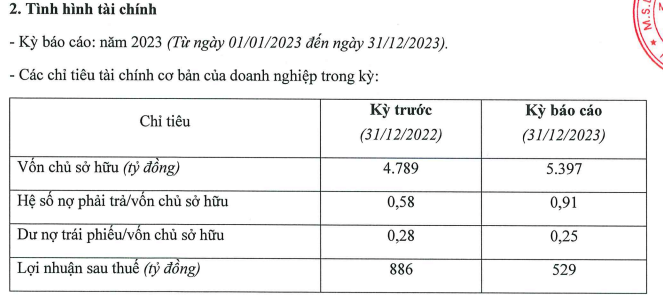

Recently, DB Investment and Development Limited Liability Company has announced its periodic information on the financial situation in 2023, according to which the company recorded after-tax profit of 526 billion VND, down nearly 40% compared to the same period. The after-tax profit margin on equity is 9.8% while the same period is 18.5%.

As of December 31, 2023, equity increased by more than 600 billion VND to 5,397 billion VND compared to the figure of 4,789 billion VND at the end of 2022. In addition, DB’s debt ratio recorded at the end of 2023 is 0.91 times, equivalent to VND 4,911 billion, while the same period the debt is VND 2,778 billion. Of which, the outstanding bond on equity at the end of 2023 is 0.25 times, equivalent to the bond debt of 1,360 billion VND, a slight decrease compared to the end of 2022. Thus, at the end of last year, this enterprise has total assets of more than 10,200 billion VND.

Regarding the bond issue, according to data from HNX, this enterprise has only one bond lot DBICB2124001 issued on October 26, 2021 with a term of 3 years and the volume of bonds in circulation is 1,360 billion VND.

Regarding the bond issue, according to data from HNX, this enterprise has only one bond lot DBICB2124001 issued on October 26, 2021 with a term of 3 years and the volume of bonds in circulation is 1,360 billion VND.

In the past year, this company has paid bond interest to bondholders twice on January 18 and April 24, 2023.

According to VnDirect, DB Investment and Development Limited Liability Company was established in 2016 with a charter capital of 250 billion VND, operating mainly in the real estate business.

In 2020, the equity recorded in the consolidated financial statements of the company has exceeded 1,500 billion VND. The company also showed very good growth from its business activities when, in just 3 years from 2018 to 2020, the company’s after-tax profit increased by 9 times, from 63 billion VND to 570 billion VND. This period also recorded DB’s total assets increasing by 1.7 times, reaching 3,500 billion VND.

Currently, this enterprise is participating in the project of expanding the urban area in Hung Hoa commune, Vinh city, and the urban area along the Vinh river in Vinh Tan ward, Vinh city. Not only that, in the middle of last year, DB and Ecopark Group Joint Stock Company were approved by the Department of Planning and Investment of Long An province to be investors of Thanh Phu Urban Project. The project is expected to have a population of over 37,000 people with a total area of 220 ha, in which the residential land area accounts for 54.22% of the project area, including 111.4 ha of new low-rise residential land (4,951 lots); 5.84 ha of mixed-use high-rise land (4,300 apartments, maximum of 45 floors), 2.07 ha of resettlement land (180 lots, maximum construction height of 5 floors).

In terms of progress, the project will be implemented within 6 years from the date of investment approval and is divided into 2 phases.

Specifically, Phase 1 (2023 – 2025) will carry out compensation and site clearance for the entire project. To invest in the construction of works and components of project components No. 1, No. 2, No. 3, No. 4 and No. 7.

Phase 2 (2025 – 2028) to invest in the construction of works and components of project components No. 5, No. 6, No. 8 and No. 9.