Investors have just witnessed the biggest single-day drop in gold futures in over 3 years. On the first trading day of this week, the price of gold futures plunged by 65.6 USD, or 2.73%, marking the steepest one-day decline since February 2021.

The selloff was triggered by Israel’s measured response to the recent Iranian strike, which avoided an escalation of tensions in the Middle East. As a result, gold’s appeal as a safe haven lost some of its luster.

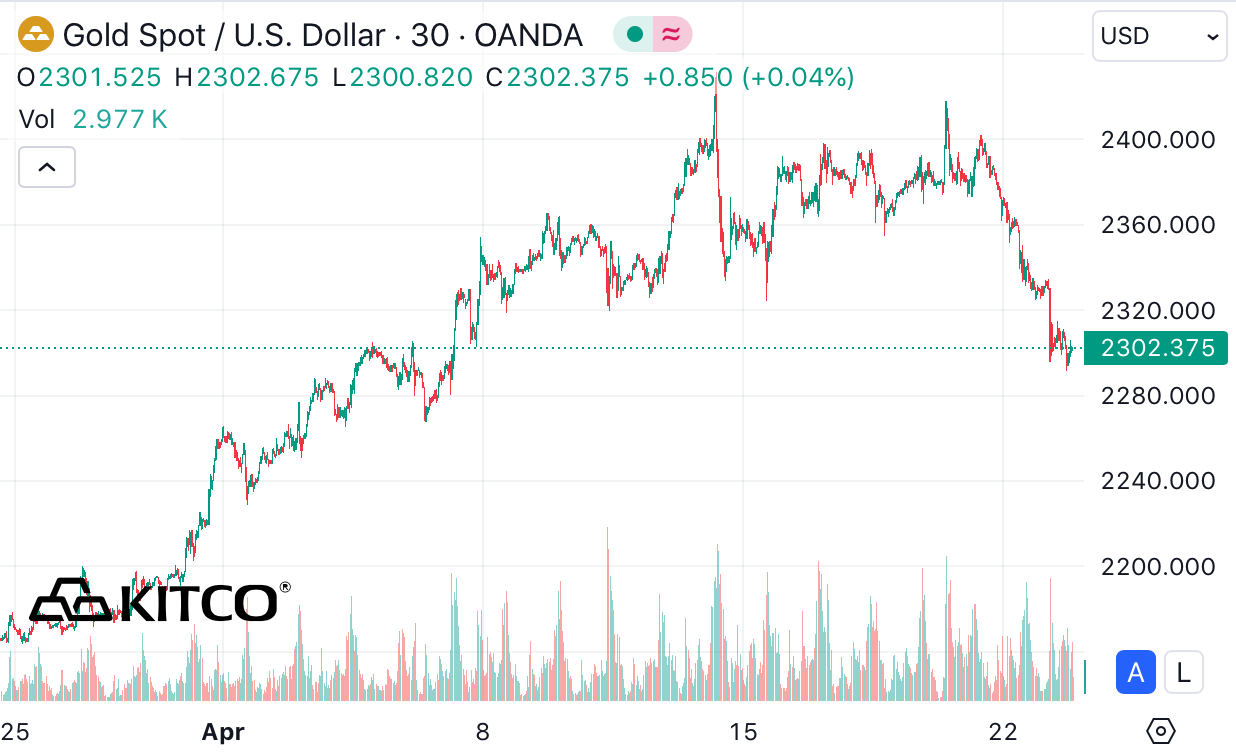

On April 23 (Vietnam time), the international gold price plummeted, briefly falling below the $2,300/ounce mark to $2,290/ounce. Compared to its peak two weeks ago, the international gold price has now decreased by $140/ounce.

After reaching a high of $2,432/ounce on April 12, the international gold price lost momentum as geopolitical tensions eased and expectations of higher interest rates for an extended period. The higher-than-expected US inflation data for March may force the US Federal Reserve (FED) to maintain interest rates for a longer duration. Previously, analysts and investors anticipated the FED to cut rates in June, but recent inflation developments suggest that the timing may not be right. This has also kept the US dollar elevated, which acts as a headwind for the precious metal. Currently, the DXY index, which measures the strength of the US dollar against major currencies, remains above 106 points.

Gold also faced selling pressure as retail investors locked in profits. Weak buying liquidity in the futures market further contributed to the price decline.