On the morning of April 26, 2024, Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank, stock code: HDB) held the 2024 annual general meeting of shareholders virtually.

NEW VENUE AND VIRTUAL FORMAT AFFIRMHDBANK’S PIONEERING SPIRIT OFINNOVATION AND CREATIVITY

This year’s general meeting is quite special as the venue is a completely new location. Galaxy Innovation Hub, recently inaugurated and invested by HDBank, is located in Ho Chi Minh City High-Tech Park.

The new venue for the shareholder meeting is also an affirmation that HDBank has always been a pioneer in implementing ESG, innovation, and creativity, marking HDBank’s transformation in the era of Science, Technology, and Innovation, aiming for high growth for the 12th consecutive year.

HDBank shareholders checking in

At exactly 9:00 AM, HDBank’s general meeting commenced. According to the opening remarks by Mr. Le Thanh Trung, Deputy General Director of HDBank, the number of shareholders registered to attend the 2024 General Meeting of Shareholders was nearly 2,000, of which nearly 200 were institutional shareholders. HDBank organized the general meeting in a virtual format combined with an in-person meeting. As usual, this year’s HDBank general meeting was also attended by representatives of management agencies, major shareholders, and foreign strategic partners.

According to the report by Mr. Dao Duy Tuong, Chairman of the Supervisory Board and concurrently Chairman of the Shareholder Qualification Verification Committee, as of the shareholder registration closing date, HDBank had 18,427 shareholders, representing more than 2.89 billion voting shares, of which 246 were institutional shareholders (122 domestic shareholders and 124 foreign shareholders). The general meeting was attended by shareholders representing more than 2.477 billion shares, equivalent to 84.6% of the total voting shares. The general meeting had sufficient quorum to proceed.

Shareholders attending HDBank’s general meeting

HDBANK 2024: GREEN THINKING – SUSTAINABLE GROWTH

Before the opening, HDBank showed a short film to shareholders about the theme of this year’s general meeting, “Green Thinking – Sustainable Growth,” and the highlights of its operations in 2023, including:

1. In 2023, HDBank paid a 30% dividend, of which 10% was in cash, making it one of the few banks that have consistently maintained a high dividend payout ratio for many years.

2. Record profit, one of the few banks to achieve 11 consecutive years of growth and move towards the milestone of 12 years of sustainable growth.

3. Individual non-performing loan ratio of only 1.5%, which is low in the industry

4. Continued to be among the leaders in safety and efficiency indicators, especially CAR and ROE. These indicators are expected to continue to strengthen in 2024.

5, HDBank’s market capitalization growth rate was 46.4%, and its market price increased by 54.3% in 2023, making it one of the stocks most heavily bought by foreign investors. HDBank is the only bank selected for the Vn-Diamond Index.

6, Focus on ESG strategy, ready to quickly and deeply participate in the carbon credit market as soon as the legal framework is finalized. Accompany the Government in the commitment to NET ZERO CARBON.

7, Continue to expand the market in tier 2 cities and rural areas, promoting economic development strategies in localities. Currently, HDBank has expanded its network in all 63 provinces and cities nationwide, creating a basis for a strong increase in the customer base.

8, Investing in a securities company in 2023, HDBank expanded its operations in investment banking, thereby focusing on developing a number of services such as asset management, providing investment opportunities in good companies, and diversifying products and services to meet customer needs and market development trends.

9, The State Bank of Vietnam has assessed HDBank as one of 14 key banks. HDBank is ready to take on the task of participating in restructuring the industry.

10, Technology has been and is helping HDBank to significantly change the way it reaches customers, manages the bank safely, and especially supports a rapid reduction in CIR, helping the bank increase profits and have more room to reduce fees, supporting customers.

11, Completed the comprehensive implementation of Basel III

Growth target for 2024: Building on the foundation of a high-yield asset base, in line with the Sustainability trend, and meeting the urgent needs of the economy. The 2024 plan for high growth but safety is in line with the guidelines of the State Bank of Vietnam. HDBank is confident in a growth rate of 21.8%, with all growth indicators from 16%.

Mr. Kim Byoungho, Chairman of HDBank

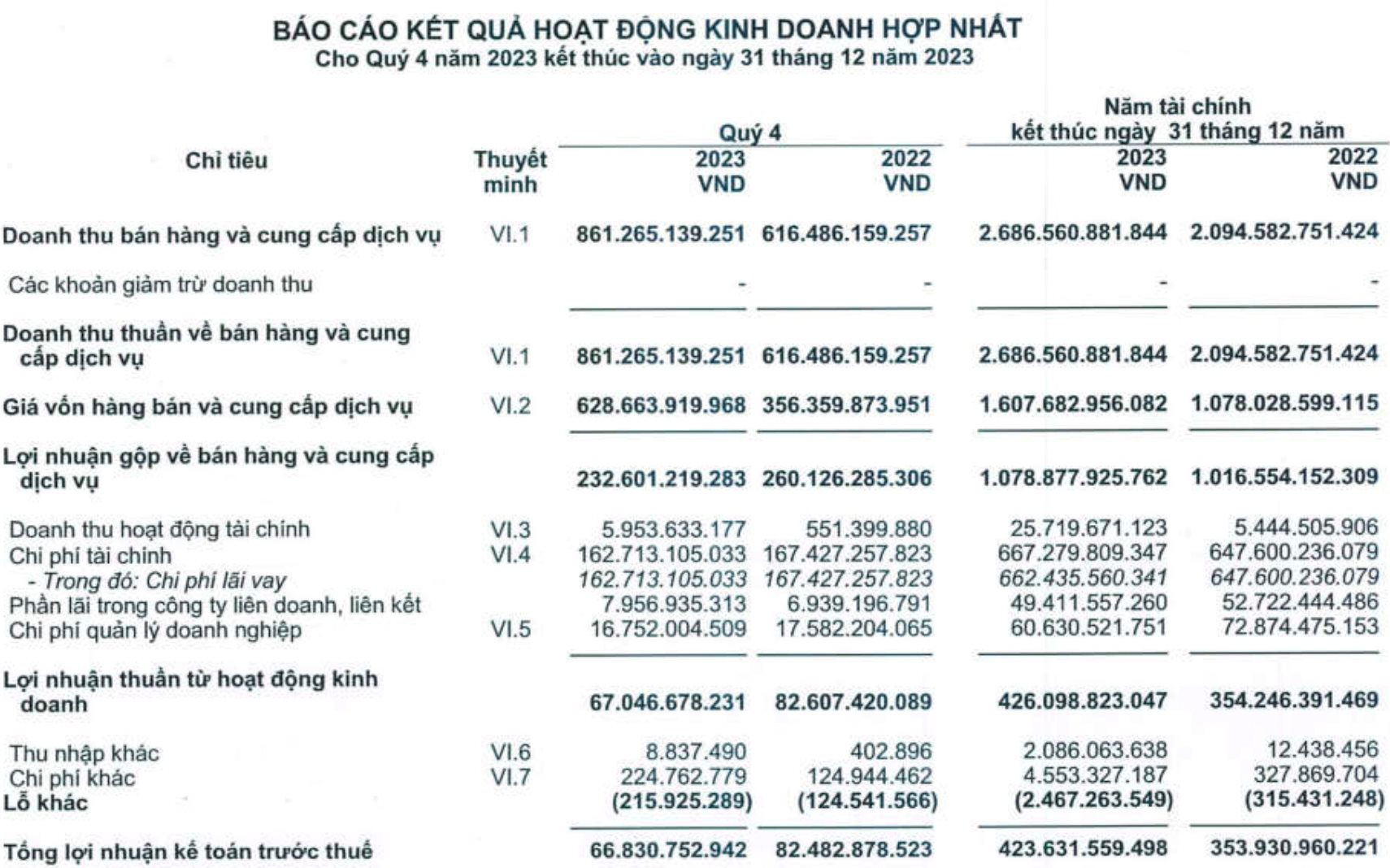

Mr. Kim Byoungho, Chairman of HDBank, gave the opening remarks at the general meeting. He said that 2023 was a year in which the domestic and international economies faced many difficulties and challenges. Overcoming these challenges, HDBank has completed and exceeded most of the targets set by its shareholders. Pre-tax profit reached VND 13,017 billion, the highest ever, up 26.8% year-on-year. Total assets exceeded VND 602 trillion, up 44.7% year-on-year. Total outstanding loans are expected to exceed VND 438 trillion, up about 24% compared to 2023 and in line with the credit growth target assigned by the State Bank of Vietnam. HDBank’s market capitalization increased sharply by 46.4% year-on-year to VND 58.7 trillion. The return on equity (ROE) was high at 24.2%.

This positive business result is a testament to HDBank’s proactive, flexible response, and ability to seize opportunities in challenges. The bank’s operational safety ratios have always been maintained at a high level, with the capital safety ratio being among the highest in the industry and the non-performing loan (NPL) ratio being low. At the same time, HDBank has continuously improved its risk management and corporate governance by implementing the Basel III international standard and ESG initiatives, ensuring full compliance with regulations and aiming to apply international best practices as well as commitment to shareholders.

Mrs. Nguyen Thi Phuong Thao, Permanent Deputy Chairwoman of the Board of Directors of HDBank, added that this is the second year that Mr. Kim Byoungho has presided over the general meeting. Mr. Kim Byoungho is both the Chairman of HDBank and the Chairman of the ESG Committee of the bank. 2023 was also the year when HDBank achieved its highest results ever, and it was also a new development stage as approved by the General Meeting of Shareholders.