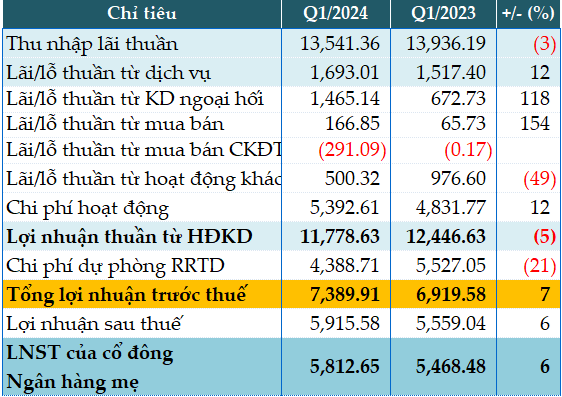

In the first quarter, BIDV‘s core business retreated by 3% year-over-year, raking in only VND13,541 billion (US$581.53 million) in net interest income.

Meanwhile, non-interest revenue witnessed a growth. Service fee income rose by 12%, reaching VND1,693 billion (US$73.06 million).

Notably, foreign exchange trading (up by 2.2 times) and trading of marketable securities (up by 2.5 times) grew exponentially, earning VND1,465 billion (US$63.18 million) and VND167 billion (US$7.21 million), respectively.

Operating expenses increased by 12%, recorded at VND5,393 billion (US$232.73 million). Additionally, the bank set aside only VND4,389 billion (US$189.72 million) for credit risk provisions, down by 21%. As a result, BIDV‘s pre-tax profit reached nearly VND7,390 billion (US$318.90 million), up by 7% year-on-year.

|

BID‘s operating results in Q1/2024. Unit: VND billion

Source: VietstockFinance

|

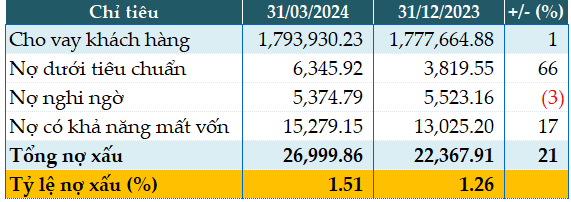

BIDV‘s total assets by the end of Q1 amounted to over VND2.3 million billion (US$99.17 billion), slightly up by 1% compared to the beginning of the year. Loans to customers and customer deposits increased by 1% and 2%, reaching over VND1.79 million billion (US$77.39 billion) and over VND1.73 million billion (US$74.79 billion), respectively.

As of March 31, 2024, BIDV‘s total bad debt reached VND27,000 billion (US$1.16 billion), up by 21% from the beginning of the year. The ratio of bad debt to outstanding loans increased from 1.26% to 1.51%.

|

BID‘s loan quality as of March 31, 2024. Unit: VND billion

Source: VietstockFinance

|