VietinBank reports over VND 6.2 trillion in profit

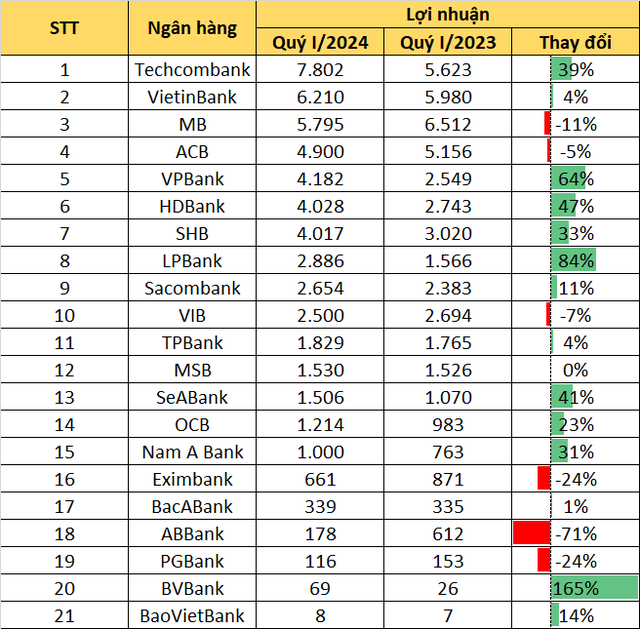

VietinBank has just announced its financial report for the first quarter, with consolidated pre-tax profit reaching VND 6,210 billion, up 3.8% year-on-year. The bank’s after-tax profit was VND 5,003 billion, an increase of 3.5%. With this result, VietinBank currently ranks second in the profit ranking, after Techcombank (VND 7,802 billion) and ahead of MB (VND 5,795 billion).

VietinBank’s profit growth momentum in the past quarter mainly came from an increase in net interest income and foreign exchange trading profit. Meanwhile, operating expenses and risk provision costs increased by 12% and 19.7% year-on-year, respectively, hindering the profit growth potential.

As of the end of the first quarter, VietinBank’s total assets increased by 2.2% compared to the beginning of the year, reaching VND 2.08 million billion. Of which, loans to customers increased by 2.8%, reaching an outstanding balance of VND 1.51 million billion. The bank also increased its loan loss provision to VND 30,775 billion, up 10.8%.

As of March 31, the bank’s non-performing loan ratio/total loan balance was 1.35%. The coverage ratio reached nearly 151%, a decrease of 16 percentage points but still among the leading banks in the industry.

Sacombank earns VND 2,654 billion

At the 2024 Annual General Meeting of Shareholders, Sacombank’s management board reported that, at the end of Q1/2024, the bank’s pre-tax profit reached VND 2,654 billion, total assets of over VND 693,500 billion, total mobilization of over VND 606,200 billion, total outstanding credit balance of over VND 500,400 billion, and a non-performing loan ratio of 2.1%.

Previously, the bank recorded a consolidated pre-tax profit of VND 2,383 billion in Q1/2023.

Nam A Bank achieves a profit of thousands of billion for the first time

Nam A Bank has just announced its financial report for the first quarter of 2024, with a pre-tax profit of nearly VND 1,000 billion, an increase of 30.98% compared to the same period in 2023, completing 25% of the 2024 plan. Business results improved thanks to increased interest income, and the bank reduced its provision for bad debts significantly due to the settlement of debts on VAMC.

Notably, this is the first time in Q1/2024 that Nam A Bank recorded a profit of nearly VND 1,000 billion. Of which, net interest income increased by VND 163 billion, equivalent to an increase of 10.48% compared to the same period in 2023. Income from service activities increased by VND 78.9 billion, up 60.83% year-on-year.

As of March 31, 2024, Nam A Bank’s total assets reached over VND 216 trillion, an increase of VND 6,275 billion compared to the beginning of the year, completing 93% of the year’s plan. Mobilization of capital reached VND 167.2 trillion, outstanding loans reached nearly VND 146.7 trillion, respectively increasing by 2.05% and 3.76% compared to the beginning of the year.

SHB achieves record profit in Q1/2024

Sharing at the 2024 Annual General Meeting of Shareholders, General Director Ngo Thu Ha announced that pre-tax profit for the first quarter of 2024 reached over VND 4,017 billion, fulfilling 35% of the annual plan. This is the highest Q1 profit in SHB’s operating history. Previously, the bank recorded a consolidated pre-tax profit of nearly VND 3,020 billion in Q1/2023.

HDBank earns over VND 1,340 billion per month

Sharing at the Annual General Meeting of Shareholders in 2024 held this morning, Mr. Pham Quoc Thanh, General Director of HDBank, said that in the first quarter of 2024, HDBank achieved a profit of over VND 4,000 billion, ensuring the set progress and creating trust for shareholders.

According to the financial statements recently announced by the bank, the exact profit was VND 4,028 billion, an increase of 47% compared to the same period in 2023 and . Thus, on average, HDBank earns a profit of over VND 1,340 billion per month.

Eximbank earns over VND 1,000 billion in the first 4 months of the year

At the 2024 Annual General Meeting of Shareholders held this morning, Eximbank’s Acting General Director Nguyen Hoang Hai said that in Q1/2024, the bank’s profit reached VND 661 billion, and as of April, it was VND 1,009 billion.

VPBank’s consolidated profit nearly VND 4,200 billion, up 64% compared to the same period in 2023

In the first quarter of 2024, VPBank recorded a consolidated pre-tax profit of nearly VND 4,200 billion, an increase of nearly 66% compared to the previous quarter and 64% compared to the same period. At the parent bank alone, Q1 pre-tax profit reached over VND 4,900 billion, nearly doubling compared to Q4/2023, with total operating income increasing by 15% and net interest income increasing by 25% year-on-year.

ACB earns VND 4,900 billion in Q1, slightly down compared to the same period in 2023

As of the end of March 2024, ACB’s consolidated pre-tax profit reached VND 4,900 billion, completing 22% of the annual plan. Quarterly profit decreased slightly compared to the same period due to the fact that in the same period in 2023 there was an unusual income and an increase in loan loss provision. ACB’s current non-performing loan ratio is 1.45%. Excluding the impact of the group of debts according to CIC, ACB’s NPL ratio is only 1.3%.

According to the report, ACB’s credit reached VND 506 trillion, while mobilization reached nearly VND 493 trillion. Compared to the beginning of the year, the growth rates of credit and mobilization were 3.8% and 2.1%, respectively, higher than the industry growth rate.

OCB’s pre-tax profit over VND 1,200 billion, up 23%

Totaling Q1/2024, OCB recorded a pre-tax profit of VND 1,214 billion, an increase of 23% compared to the same period.

Compared to the end of 2023, it reached VND 153,199 billion. Total assets remained stable, reaching nearly VND 237 trillion. Capital mobilization from market 1 reached over VND 163,400 billion.

Risk management related indicators such as capital adequacy ratio (CAR), short-term capital to medium- and long-term lending ratio, loan-to-deposit ratio (LDR), are ensured by OCB at a safe level. The NPL ratio is controlled below 3%, meeting all regulations of the SBV. Liquidity indicators are stable, with a sufficient liquidity buffer.

MSB: Pre-tax profit of VND 1,530 billion

MSB has just announced its business results for the first quarter with a pre-tax profit of VND 1,530 billion, a slight increase compared to the