On the international market, the USD-Index fell by a marginal 0.03 points from the previous week, standing at 106.09 points.

The US Department of Commerce reported on April 25th that in the first quarter of 2024, the country’s economy saw its slowest growth in nearly two years, as elevated imports catering to strong consumer spending widened the trade deficit.

Specifically, the US gross domestic product (GDP) expanded by only 1.6% in the first quarter of 2024, significantly lower than the median forecast of 2.4% projected by economists.

Inflation is also picking up, with the Personal Consumption Expenditures (PCE) price index, excluding the volatile food and energy components, rising by 3.7% in the first quarter of 2024, after increasing by 2.0% in the fourth quarter of 2023.

The cooling economic growth further reinforces the likelihood that the Fed will have to cut interest rates to stimulate the economy, pulling the USD price slightly lower.

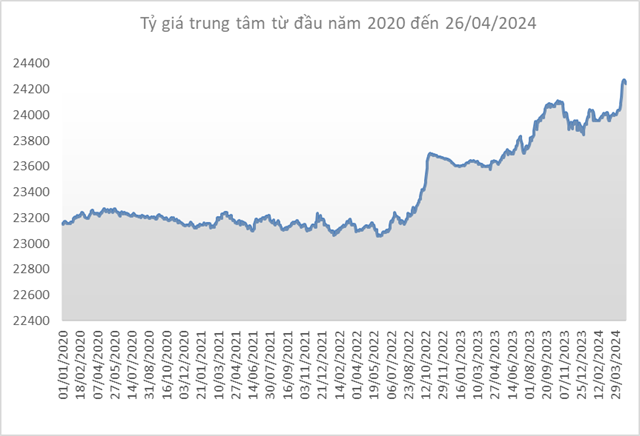

Source: SBV

|

Domestically, the central parity rate between the Vietnamese dong and the USD also decreased by 14 dong per USD compared to the previous week (April 19th’s session), to 24,246 dong/USD in the session of April 26th.

The State Bank of Vietnam (SBV) kept the immediate purchase price unchanged at 23,400 dong/USD. The central bank also maintained the immediate selling price at 25,450 dong/USD since April 19th. This is the intervention selling rate at which the SBV announces the sale of USD to banks with negative foreign exchange status to adjust their foreign exchange status to zero.

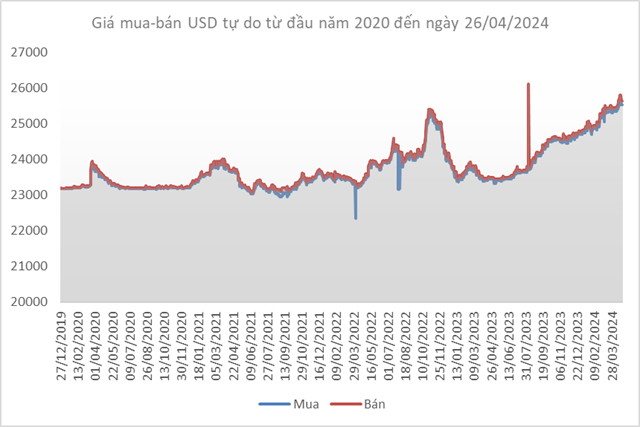

Source: VCB

|

The exchange rate listed at Vietcombank decreased by 45 dong/USD for buying and 15 dong/USD for selling after one week, down to 25,088 dong/USD (buying) and 25,458 dong/USD (selling).

Source: VietstockFinance

|