Mr. Trinh Xuan Duong – Vice President of Vietnam Plywood Association (under the Vietnam Timber and Forest Products Association) said: South Korea has reopened its investigation into imposing anti-dumping duties on plywood – veneer products exported from Vietnam to the South Korean market during 2020 – 2023. The on-site inspection by Korean authorities at enterprises was concluded in November 2023.

Currently, the Korean authorities are about to issue final rulings on anti-dumping duty levels for investigated and non-investigated enterprises. During this period, the Vietnam Plywood Association continuously received information that there are huge differences in tax rates with fluctuations ranging from 4.2 – 13.04%.

SOUTH KOREA ACCOUNTS FOR 29% OF VIETNAM’S PLYWOOD EXPORTS

Plywood is considered the first type of industrial wood invented in the world and is still widely used in furniture production today. Plywood (including plywood, veneer, and plywood) is a material sheet made from many layers of natural wood peeled about 1 mm thin. These wood layers are arranged perpendicular to the grain direction of each layer and then pressed together under high temperature and pressure with the addition of adhesives.

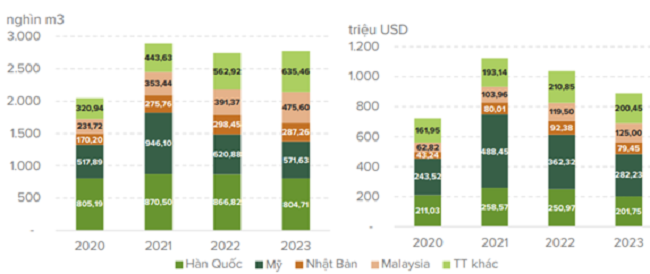

According to the Vietnam Timber and Forest Products Association, the export value of plywood in 2023 is 889 million USD, accounting for 6.7% of the total export turnover of Vietnam’s wood industry. Last year’s plywood exports increased by 1.2% in volume but decreased by 14.2% in value compared to 2022.

2020 – 2023. Source: Vietnam Timber and Forest Products Association.

Export market for plywood Vietnam’s plywood and joinery products are exported to 81 countries and territories worldwide in 2023. However, South Korea, Japan, the United States, and Malaysia are the four main export markets for Vietnamese plywood in 2023, accounting for 77.1% in volume and 77.4% in value.

Among these, South Korea is the largest market, accounting for 29% in volume and 22.7% in value of Vietnam’s total plywood exports. Plywood accounts for 25.3% of Vietnam’s total wood and wood products exports to South Korea. This item ranks second in export value in the group of wood and wood products of Vietnam to the Korean market.

“In 2023, Vietnam exported 804,71 thousand m3 of plywood to the South Korean market, bringing in 201.75 million USD, down 7.2% in volume and 19.6% in value compared to 2022”.

According to the data of Vietnam Timber and Forest Products Association.

In the US market, Vietnam exported 571,63 thousand m3 of plywood, reaching 282.23 million USD, down 7.9% in volume and 22.1% in value compared to 2022, accounting for 20.6% in volume and 31.8% in value.

In the Malaysian market, plywood exports reached 475.6 thousand m3, with a value of 125 million USD, up 21.5% in volume and 4.6% in value, accounting for 17.1% in volume and 14.1% in value. This is the only export market for plywood to increase.

Plywood export volume to Japan reached 287.26 thousand m3, reaching 79.45 million USD, down 3.8% in volume and 14% in value, accounting for 10.4% in volume and 8.9% in value.

KOREA’S INVESTIGATION IS NOT OBJECTIVE

South Korea is the largest market for Vietnamese plywood exports. Therefore, the investigation conducted by Korean authorities and the upcoming anti-dumping duty rulings on this product will significantly impact the wood industry enterprises.

Mr. Trinh Xuan Duong believes that the investigation and imposition of tariffs by South Korea are not objective. In Vietnam, there are about 152 enterprises exporting plywood and plywood products to South Korea. However, the Korean authorities only investigated 6 companies in Vietnam, including a company that had ceased operations.

“Investigating only 6 businesses, but if Korea announces and imposes anti-dumping duties on all 152 Vietnamese plywood exporting companies, with tax rates from 4.2 to 13.04%, it would be highly unreasonable”.

Mr. Trinh Xuan Duong – Vice President of Vietnam Plywood Association.

“The number of enterprises that are (or are) investigated accounts for only a tiny proportion of the total number of Vietnamese enterprises exporting this product to the South Korean market. The export turnover of these companies to the Korean market in recent years also accounts for no more than 20% of the total export turnover of this product to the Korean market,” Mr. Duong emphasized.

According to the Vietnam Plywood Association, South Korea is a market with significant potential for plywood products. Currently, there are enterprises with little or no export output to the Korean market, even having never exported to South Korea. These enterprises are, of course, not subject to the investigation. However, in the future, when they want to export to this market and are subject to general tariffs, it will be a long-term disadvantage and unfairness to those enterprises.

When South Korea applies anti-dumping duties, many plywood and veneer enterprises will not be able to compete and will have to suspend their operations, leading to job losses for workers. The entire supply chain of forest planting and forest product processing will be disrupted, and raw material suppliers will also have to stop operating. Thereby, the price of planted forest wood will decrease, and people will not want to plant new forests.

Therefore, it will directly affect the State’s objectives in the coming period, relating to green certification and environmental pollution reduction. Besides, Korean enterprises importing plywood from Vietnam and the entire system that goes with their business will also face significant challenges.

Accompanying enterprises in exporting Vietnamese plywood, the Vietnam Plywood Association proposes that the Vietnam Timber and Forest Products Association and the Trade Defense Department (Ministry of Industry and Trade) make recommendations to the Korean Government’s management agency to create favorable conditions for plywood products – Vietnamese plywood is exported to this market in the best way.

In addition, it recommends that the Trade Defense Department discuss, find solutions, and propose them to the Korean authorities to keep the anti-dumping duty rate the same as the previous investigation (10.54%). This will create conditions for Vietnamese enterprises to maintain their market and stabilize production in the context of the current global economic downturn.