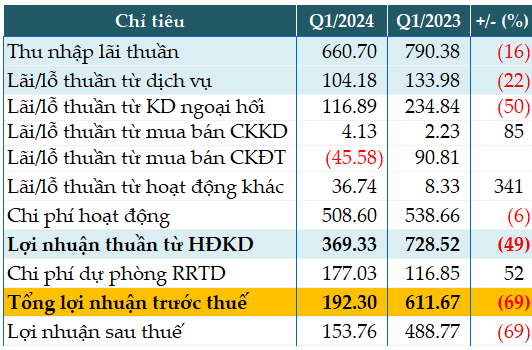

In the first quarter, most of ABBank’s business activities declined year-over-year. Net interest income fell by 16%, to nearly VND661 billion.

Other sources of income also decreased, such as service revenue (-22%) and foreign exchange trading revenue (-50%).

On the contrary, income from trading of financial instruments (+85%) and other operating income increased sharply (4.4 times).

The bank also cut operating expenses by 6%, to VND509 billion. In addition, the bank increased its risk provision expenses by more than 52% year-over-year, setting aside VND177 billion. As a result, ABBank’s pre-tax profit was over VND192 billion, down 69%.

Compared to the VND1,000 billion pre-tax profit target set for the whole year, ABBank has only achieved 19% after the first quarter.

|

Q1/2024 business results of ABB. Unit: Billion VND

Source: VietstockFinance

|

Total assets as of the end of the first quarter also narrowed by 11% compared to the beginning of the year, to VND144,777 billion. Both customer loans (-19%) and customer deposits (-17%) saw negative growth, to VND79,132 billion and VND83,524 billion, respectively.

As of March 31, 2024, the bank’s total bad debt was VND3,102 billion, up 9% year-over-year. The ratio of bad debt to outstanding loans increased from 2.91% at the beginning of the year to 3.92%. The bad debt ratio according to Circular 11/2021/TT-NHNN was 2.63%.

|

ABB’s loan quality as of March 31, 2024. Unit: Billion VND

Source: VietstockFinance

|