International balance of payments transactions include: (1) current account: including all transactions in goods, services, labor income, investment income, and current transfers; (2) capital account: including all transactions in capital transfers and purchases and sales of non-financial, non-produced assets by the government and private sectors; (3) financial account encompassing all transactions in direct investment, indirect investment, financial derivative transactions, foreign borrowing and repayment, trade credit, money, and deposits.

(4) Errors and omissions are the difference between the sum of the current account, capital account, and financial account and the overall balance of payments; (5) the overall balance (E) is determined by the change in the overall balance, resulting in a change in official foreign exchange reserves generated by specific transactions during the period (E=-F); (6) reserves and related items (F) are determined by the change in official foreign exchange reserves generated by transactions during the period.

The balance of international payments plays a multifaceted role.

First, it helps balance specific transactions between Vietnamese residents and non-residents in Vietnam regarding specific items with surpluses or deficits; as a result, there are solutions for managing and operating these specific transactional relationships.

Second, based on the aggregation of these relationships, Vietnam’s international balance of payments is determined to have a surplus or deficit. If the international balance of payments has a surplus, foreign exchange reserves will increase. If the international balance of payments has a deficit, foreign exchange reserves will decrease.

Third, if foreign exchange reserves reach a scale exceeding three months of imports according to international practice and exceed short-term external debt, the country’s financial security will be guaranteed. If a country’s foreign exchange reserves fall below the above level, its financial security is not guaranteed.

Fourth, if the country’s financial security is ensured, the State can confidently intervene to stabilize the foreign exchange market (exchange rates) or introduce support/stimulus packages when there are adverse impacts.

CURRENT ACCOUNT

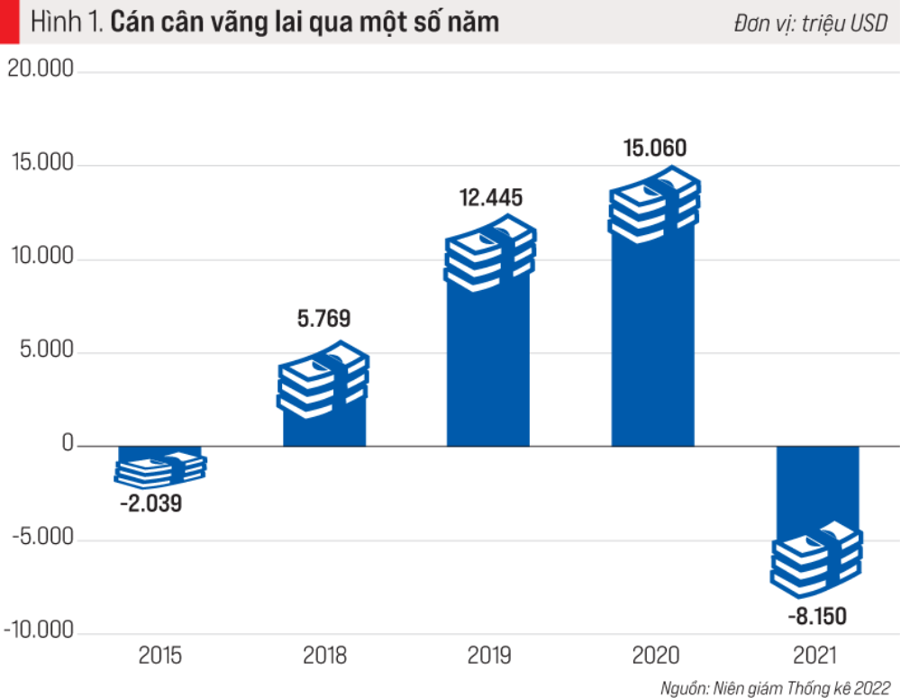

Vietnam’s current account balance over several years is shown in Figure 1. Accordingly, the current account has improved positively and has not suffered a deficit like in previous years; from 2015 to 2021, it only suffered a deficit in a few years and has had a continuous surplus in the last three years; the expectation is that it will have a large surplus in 2024 due to a large trade surplus.

The current account consists of four components: the goods account; the services account; the income account; and current transfers.

The goods account has consistently had the highest value of the four components over the past several years. This is consistent with an economy in transition, with a high proportion of real economy in GDP, a large labor force with low labor costs, and membership in the World Trade Organization (WTO) since 2007; to date, it has signed 16 free trade agreements (FTAs) with approximately 60 markets… In addition, the goods account has consistently had a surplus for many years (in 2015, it was 7,375 million USD; in 2018, it was 16,540 million USD; in 2020, it was 30,708 million USD; preliminary figure for 2021: 15,672 million USD).

The services account has consistently had a deficit, sometimes very large (in 2021, it was 15,395 million USD, almost equal to the 15,672 million USD surplus in the goods account). The deficit is due to imports consistently being greater than exports (in 2015, it was 4,765 million USD; in 2019, it was 945 million USD; in 2020, it was 10,287 million USD; in 2021, it was 15,395 million USD). The main reason for this is the services for the import and export of services, especially transportation services, because Vietnam’s deep-sea shipping is still weak; several other services, including financial services, are mostly heavily dependent on imports; even tourism services have shifted to a net import basis during the Covid-19 pandemic years and have only returned to a net export basis since 2023. Therefore, the issue at hand is the urgent need to develop an ocean-going fleet and increase railway capacity, especially intermodal railways.

The income account has also consistently had a large deficit (in 2015, it was 12,150 million USD; in 2018, it was 15,818 million USD; in 2019, it was 16,795 million USD; in 2021, it was 18,749 million USD), which is higher than the deficit in the export and import of services and contributes significantly to the current account deficit or significantly reduces the current account surplus. The large deficit in the income account also contributes to the fact that gross national income (GNI) is only around 94% of GDP. The large deficit in the income account is because expenses are many times greater than income, mainly due to income from investment abroad less income from investment in Vietnam.

The current transfers account has consistently had a surplus (in 2015, it was 7,501 million USD; in 2018, it was 8,857 million USD; in 2020, it was 9,456 million USD; in 2021, it was 10,322 million USD), which contributes to reducing the current account deficit. The surplus has increased over the years, mainly because revenue is greater than expenditure, especially revenue from remittances (including remittances from workers working abroad under long-term contracts with foreign countries).

CAPITAL ACCOUNT AND FINANCIAL ACCOUNT

The capital account and financial account comprise three major components: the direct investment account, the indirect investment account, and the other investment account.

The direct investment account over the past few years (Figure 2) shows that, although Vietnam is a developing country, several of its companies have expanded abroad with significant capital investment; investments have been made in approximately 40 countries and territories, including eight with investments exceeding 1 billion USD; these include not only developing countries but also developed countries…

This article is published in the special edition Economy 2023-2024: Vietnam & The World, released on March 6, 2024. We invite you to read it at: here:

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam