The first quarter of 2024 was rather unfavorable for the “elder brother” of the banking sector as all sources of revenue fell compared to the same period last year.

Major revenue fell by 1%, to only VND14,078 billion in pure interest income.

Non-credit revenue streams all declined, such as service interest (-1%), foreign exchange trading interest (-30%), trading securities interest (-24%), and other activities interest (-53%).

The bank also cut operating expenses by 4%, to only VND5,054 billion. In parallel, Vietcombank also reduced credit risk provision expenses, to only VND1,508 billion. However, the bank also reduced pre-tax profit by 4%, to only VND10,718 billion.

|

Business results of Q1/2014 of VCB. Unit: Billion VND

Source: VietstockFinance

|

Vietcombank’s total assets by the end of the first quarter also narrowed by 4% compared to the beginning of the year, to just over VND1.77 million billion. Loans to customers decreased by 3%, to nearly VND1.23 million billion; customer deposits also decreased by 3% to nearly VND1.35 million billion.

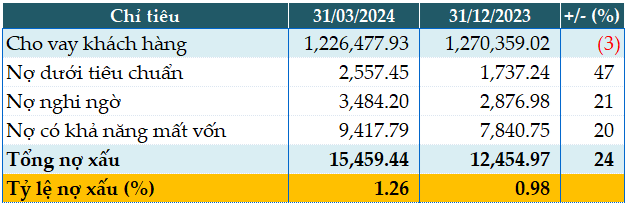

Loan quality deteriorated as total bad debts as of March 31, 2024 stood at VND15,459 billion, up 24% compared to the beginning of the year. All bad debt groups increased, resulting in the ratio of bad debt to outstanding debt increasing from 0.98% at the beginning of the year to 1.26%.

|

Loan quality of VCB as of March 31, 2024. Unit: Billion VND

Source: VietstockFinance

|