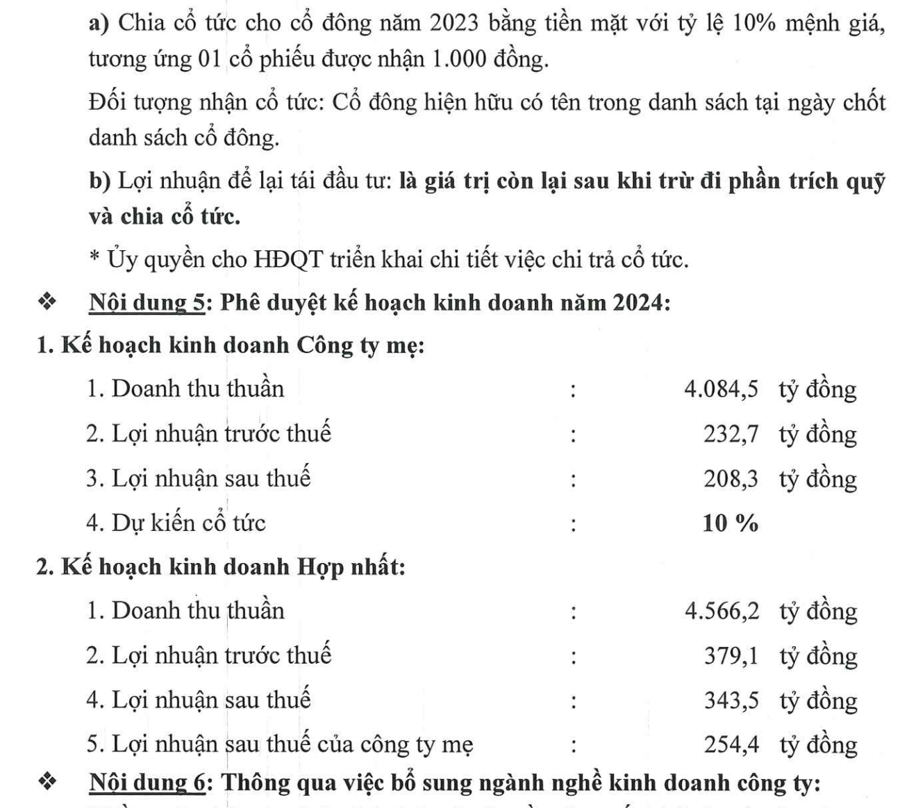

In this regard, the parent company assumes the role of devising strategies and planning resources, aiming for a net revenue of VND 4,084.5 billion, representing a 38.8% growth compared to the year 2023. The subsidiaries execute the strategies and proactively seek growth in line with their strengths.

Since transitioning to a diversified and concentrated conglomerate model, Dat Phuong has maintained its three core pillars of construction, energy, and real estate, while adding the sectors of hospitality services and glass manufacturing. This model has proven effective, integrating the resources of the entire corporation.

Determining that construction will continue as the primary focus, with a net revenue target of VND 3,827.2 billion, Dat Phuong adheres to the principle of ensuring business efficiency and financial safety. The company actively seeks and participates in bidding for projects prioritized by the Government for capital allocation, securing successful execution of the proposed plan.

In the energy sector, despite the complex weather and hydrological conditions and the increasingly unpredictable climate change, all of Dat Phuong’s plants will enhance management efforts and ensure stable operations, aiming for a net revenue of VND 499.69 billion.

In real estate, Dat Phuong targets a net revenue of VND 239.3 billion. This year, the company will prioritize the implementation of tasks at the Con Tien Urban Area project, continuing its collaboration with the international hotel group Hilton to accelerate the investment and construction of the 5-star Casamia Hoi An hotel, scheduled for operation in 2026. In addition, Dat Phuong will continue to research and explore investment opportunities in industrial real estate projects.

Regarding the ultra-clear glass manufacturing plant project in Thua Thien Hue, the corporation has completed the legal procedures for establishing the enterprise and will expedite investment formalities to meet the commencement schedule in the first quarter of 2025.

DPG’s management stated that to successfully execute the tasks of the new phase, Dat Phuong will accelerate digital transformation in its management and operations, aiming for an optimized governance system that reduces business management costs.

During the discussion at the Shareholders Meeting, in response to shareholders’ inquiries about the company’s financial capacity, Mr. Luong Minh Tuan, Chairman of Dat Phuong’s Board of Directors, stated that the company does not face any financial difficulties or pressures. Currently, the Con Tien Urban Area project (spanning 31.1 hectares in Hoi An) has largely completed its infrastructure and is merely awaiting payment for land use rights, but the funds have essentially been arranged. It is anticipated that this project will finalize all procedures and be ready for sales by the third quarter of 2024.

“The real estate market is showing signs of warming, beginning in Hanoi and Ho Chi Minh City and spreading to other localities. In Da Nang and Hoi An, positive signs are also emerging. Nevertheless, the company must carefully consider and determine the most opportune time to launch sales. Additionally, Dat Phuong has fully contributed capital to the glass factory project. Our research indicates that the clear glass segment holds significant potential, and the factory’s proximity to an abundant source of raw materials makes it a new area of focus for the corporation in the near future,” Mr. Tuan explained.

According to Dat Phuong’s management, if executed effectively, real estate remains an industry with high profitability. The corporation has been exploring numerous investment opportunities, and when appropriate, will increase its land bank. It anticipates successfully bidding on several projects in 2024. However, real estate projects cannot be implemented and completed in a short period of time, often requiring five to seven years to yield results.

With new laws即将生效, the market will become more transparent, but land clearance for projects is also expected to become more challenging. Therefore, the company identifies the services sector (hotels) as well as the energy industry as areas that will provide long-term stability for the business. Glass manufacturing will serve as a core industry, contributing to the corporation’s primary revenue.