Chinese EV Maker Zhido Resurrected Amidst Market Glut, Government Support

Image Caption: Illustrative Photo

Introduction:

In 2019, Chinese electric vehicle (EV) manufacturer Zhido went bankrupt after Beijing cut subsidies for small EVs, causing sales to plummet. Recently, it has staged a surprise comeback, launching a mini EV called “Caihong” or “Rainbow” in Chinese, priced from around $4,400.

Government’s Massive Backing:

China is perpetually facing automotive overcapacity, with over 100 domestic brands producing more vehicles than consumers demand.

Despite this, the government continues to support companies like Zhido, encouraging loss-making automakers to keep producing to meet economic growth targets, save jobs, and bolster China’s role in the global EV sector.

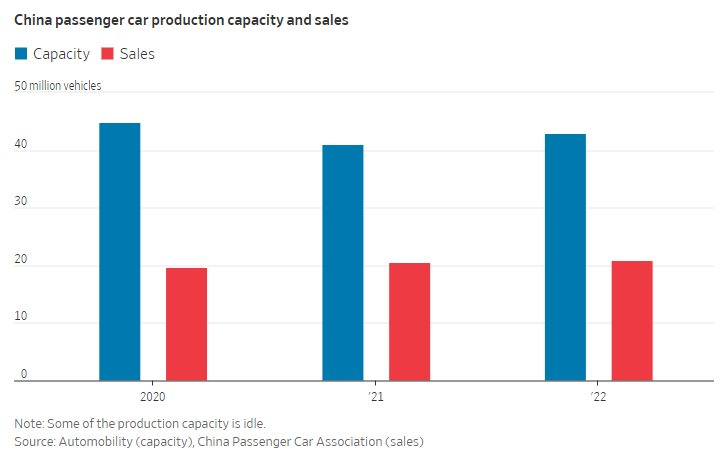

Such propping up of automakers has contributed to a global automotive glut. China now has the capacity to produce around 40 million vehicles annually, despite selling only about 22 million domestically.

Overcapacity:

This has sparked intense price competition, with Tesla and others slashing prices in China and raising concerns in the US and Europe about Chinese automakers flooding other markets.

Overcapacity is particularly acute for internal combustion engine (ICE) vehicles, which have fallen out of favor as Chinese consumers shift towards EVs.

However, overcapacity also exists in Chinese EVs, with too many companies vying for market share. Stephen Dyer, an automotive consultant with AlixPartners in Shanghai, says that 123 brands sold at least one EV model in China last year.

Supply-Demand Gap Widens:

China’s EV Supply-Demand Gap Widens

Global Concerns:

Washington fears Chinese companies will try to dump subsidized vehicles in the US, despite high American tariffs on auto imports from China. Europe last year opened an investigation into China’s EV subsidies, potentially leading to import duties in the coming months.

China’s auto exports have increased nearly five-fold in just three years, reaching around 5 million vehicles in 2023, contributing to US and European worries. Three-quarters of last year’s exports were ICE vehicles, many going to Russia, though EVs shipped overseas are also rising.

Local Government Support:

Beijing has long identified EVs as an industry it wants to dominate globally, and many local governments have competed to nurture new automakers to generate jobs.

According to a report in April by the Kiel Institute for the World Economy in Germany, government support for the sector includes below-market loans, discounted steel, and batteries for automakers.

BYD, China’s largest EV manufacturer, received around $3.5 billion in direct government subsidies from 2018 to 2022. Overall, China has spent about $173 billion subsidizing new energy vehicles (NEVs), which include EVs and hybrids, from 2009 to 2022.

Market Consolidation:

AlixPartners’ Dyer says that only four electric vehicle brands in China sell more than 400,000 vehicles annually – a volume considered the break-even point for EVs based on Tesla’s historical financial performance. The four are BYD, Tesla, Aion, and Wuling.

In March, Premier Li Qiang said in the government’s annual work report that China will consolidate and enhance its lead in industries including NEVs. Local governments have responded by propping up automakers in their regions.

In February, the central Chinese city of Zhengzhou vowed to promote industries in the “new manufacturing force” and become a new energy vehicle city with an annual capacity of 700,000 such autos.

Struggling Automakers Gain Lifeline:

Haima Auto sold fewer than 2,000 cars in the first quarter, and the struggling automaker has been given a lifeline. It was recently backed by a state-owned entity in Zhengzhou, taking temporary control of its assets, including a factory and nearly 3,000 employees. The five-year deal provided Haima with much-needed cash, equivalent to about $27.5 million. Haima says it will focus on increasing exports to markets such as Russia and Vietnam to drive growth.

References:

Financial Times, Wall Street Journal