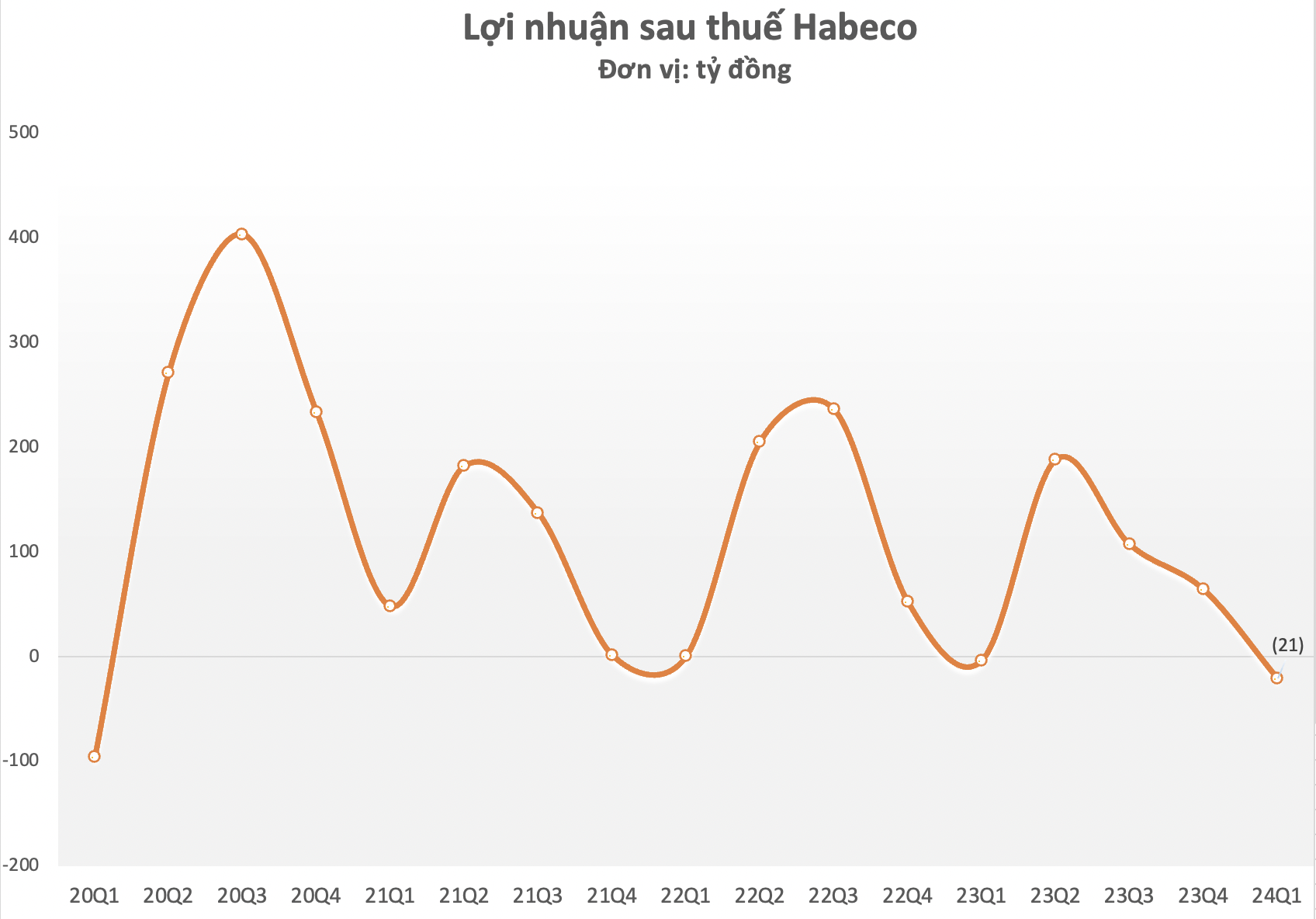

According to the financial report of the first quarter of 2024, Hanoi Beer-Alcohol-Beverage Joint Stock Corporation (Habeco, code BHN) recorded net revenue of VND 1,308 billion, up 12% year-on-year. After deducting the cost of goods sold, gross profit increased by nearly 9% to VND 267 billion.

However, after deducting expenses and taxes, Habeco made a net loss of nearly VND 21 billion, while in the same period the loss was VND 3.7 billion. Thus, after three business quarters, the company owning the Hanoi Beer brand recorded the largest quarterly loss in 4 years, since the first quarter of 2020.

Explaining the reasons behind the negative profit, Habeco’s leaders said that the reduction in interest rates has caused the company’s revenue from financial operations to decrease by 16% to nearly VND 38 billion. In addition, increasing investment in marketing activities also had a significant impact on costs.

Habeco’s financial report shows that in the recent period, sales expenses increased by 13% to over VND 230 billion, of which the largest expenses were advertising, promotion, and support, up to 42% to VND 105 billion. In fact, in the context of increasingly strict regulations on alcohol content, most beer companies are spending heavily on advertising to increase brand awareness and market share.

At the end of March, the total consolidated assets of this “big player” in the northern beer industry decreased by nearly VND 600 billion to nearly VND 6,552 billion. Notably, the amount of cash and cash equivalents dropped by nearly 54% to VND 540 billion, while the company’s inventory decreased by 10% to VND 646 billion. Accounts payable also decreased by VND 575 billion compared to the beginning of the year, to VND 1,267 billion.

Habeco, the predecessor of the Hommel Brewery, was built by the French in 1890. Having recovered from a small French brewery that was destroyed after the war, Habeco has become a “giant” leading the beer consumption market share in the North with legendary brands such as Hanoi Beer, Hanoi Draft Beer, and Truc Bach Beer.

Once the most popular domestic company in the North, in recent years Habeco has continuously faced fierce competition from strong rivals such as Heineken, Carlsberg, and others. The market share of the “symbol of the Northern beer industry” has gradually been overshadowed, even in its home market, and its business results have also declined in recent years.

After a difficult period during Covid, Habeco’s revenue recovered from 2022 but has not yet returned to pre-pandemic levels. The move to tighten up penalties for alcohol-related traffic violations has had a clear impact on the culture of drinking beer and alcohol, and this has directly affected the business of beer companies.

In 2023, the company recorded a 7% decrease in revenue compared to the previous year, down to VND 7,900 billion. Net profit reached VND 355 billion, down nearly 30% compared to 2022, and is the lowest level since its stock market listing, only higher than the figure in 2021.

Recognizing the challenging business environment with slow recovery of consumer purchasing power, strict control of alcohol content, and continued fierce competition as demand has been affected by the psychology of foreign consumption, Habeco has set a revenue target for this year of about VND 6,543 billion and a profit after tax of VND 202 billion, both lower than the achievement in 2023. With the results of the first quarter, the company is still far from the above profit targets.

In the market, BHN shares are also falling to historic lows, with a market capitalization of only VND 8,800 billion, close to the lowest level ever.