Revenue to Increase by 20%, Net Profit to Increase by 30%

The general meeting of shareholders approved a revenue plan of VND 2,400 billion, a 20% increase compared to 2023. Most of the revenue, valued at VND 2,274 billion (95% of the annual plan), will come from transportation and electrical construction projects. Key projects include Vung Ang – Bung Expressway, Nha Trang – Van Phong Expressway, and Hanoi’s Ring Road 4. Of these, the Nha Trang – Van Phong Expressway project is expected to generate the highest revenue of VND 850 billion.

In addition to construction, LCG is also developing real estate projects such as Hiep Thanh Residential Area and Nam Phuong City.

The planned net profit is VND 131 billion, an increase of 30%. LCG expects 2024 to be a breakthrough year for achieving the targets of the 2021-2025 plan, with a series of large-scale projects beginning construction. The three largest projects, the Vung Ang – Bung Expressway, the Nha Trang – Van Phong Expressway, and the Hanoi Ring Road 4, have already commenced construction.

Notably, as of April 13, the Nha Trang – Van Phong Expressway project is progressing 2% ahead of schedule and is expected to be completed six months early. This is package XL01 of the project, being executed by a consortium comprising Lizen Joint Stock Company (C4G), Phuong Thanh Investment and Construction Transport Joint Stock Company, VNCN E&C Investment Construction and Engineering Joint Stock Company, and Hai Dang Company, with a length of 52.25km.

In the real estate sector, LCG is also accelerating the development of real estate projects to ensure timely completion of plans. The Hiep Thanh Residential Area project (Ho Chi Minh City) has completed the issuance of land use right certificates to all customers. The Nam Phuong City project (Lam Dong) has completed the construction of a shell building for the 13.3ha area and compensation and site clearance for the 3.4ha area. Simultaneously, LCG is carrying out legal procedures for new projects in localities such as Ninh Thuan, Thanh Hoa, and Lam Dong to include in its business development plan for the period up to 2025.

Additionally, two wind power projects, Thang Hung and Dinh Lap, are still awaiting the announcement of electricity purchase and sale prices by EVN, while the bidding mechanism for selecting investors for electricity projects and the Electricity Law are being submitted to the National Assembly for approval by the Government.

Why Did Profit Decline While Revenue Doubled?

According to a report by Mr. Cao Ngoc Phuong, the company’s General Director, 2023 was a challenging year for the economy, with the momentum of public investment providing strong support for economic growth, job creation, and business opportunities in multiple industries and sectors. During the year, LCG focused primarily on public investment projects, de-emphasizing PPP-type projects, and consistently won bids or was nominated for various construction contracts, such as the Vung Ang – Bung Expressway, Van Phong – Nha Trang Expressway, Bien Hoa – Vung Tau Expressway Phase 1, and Hung Yen Province Cluster Project.

As a result, the company recorded a doubling of revenue to VND 2,007 billion, primarily from the construction segment with VND 1,785 billion from projects including National Highway 45 Nghi Son, Van Phong – Nha Trang, Vung Ang – Bung Expressway, and others. The real estate segment contributed VND 81 billion, while subsidiaries contributed VND 141 billion.

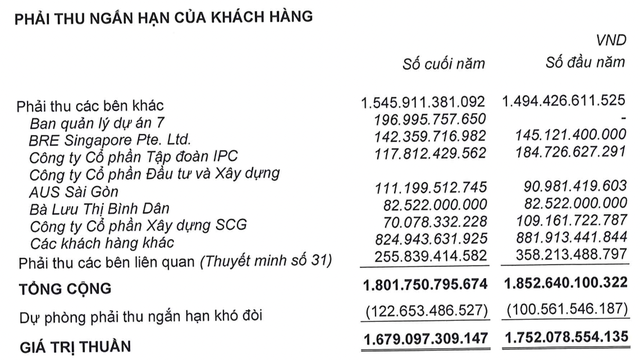

However, net profit halved to VND 103 billion. The General Director attributed this to the recognition of capital transfer activities at a subsidiary in 2022 and a reduction in 2023 profit due to provisions for doubtful debts.

”It’s the First Time I’ve Seen Praise for Spending More Money”

In the context of increased public investment, LCG’s Chairman stated, “For the first time in my life, I’ve seen praise for spending more money (i.e., LCG’s accelerated project progress).”

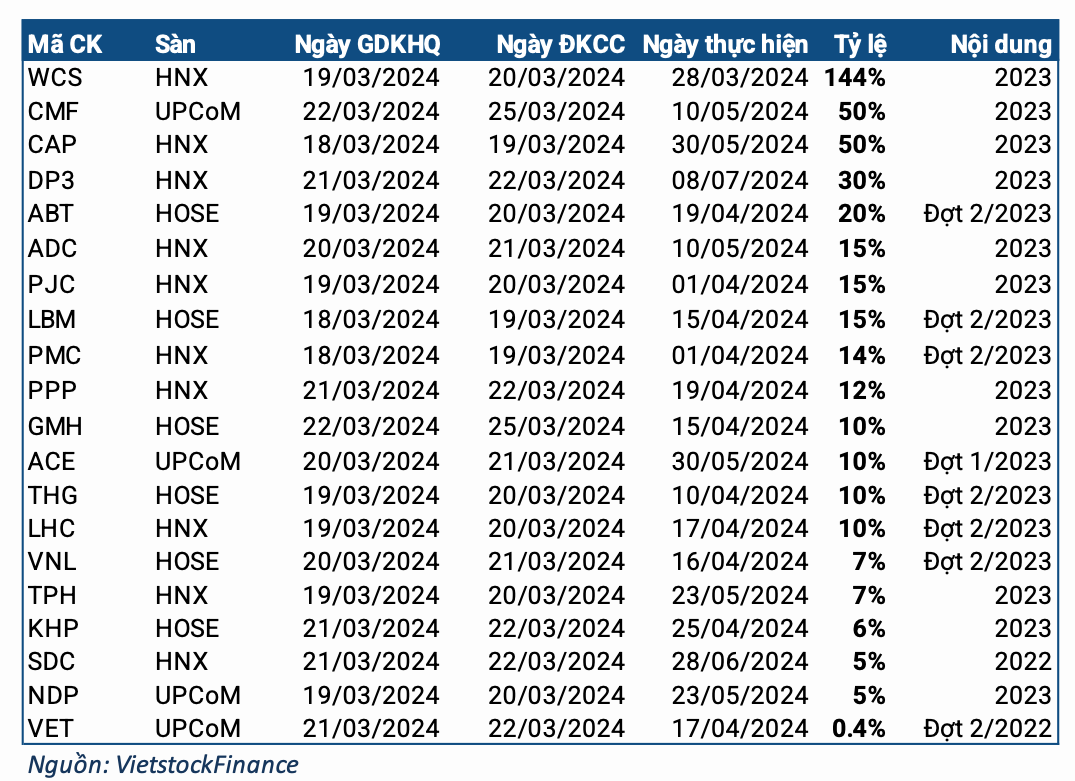

Shareholders also raised a point of interest and asked questions on the sidelines of the General Meeting regarding current short-term receivables of nearly VND 2,540 billion. LCG has established a provision of over VND 152 billion (according to the 2023 audited financial statements). Mr. Hung informed that the company has been and continues to make efforts to collect debts. Positive indications include the possibility of some parties settling debts with real estate. Last year, LCG received a project in Quy Nhon as debt repayment. “We only accept projects that are reasonably priced. For example, one party requested to repay with a real estate project but valued it at twice the reasonable price, which LCG declined,” he added.

1. Why Did 2023 Revenue Fall Short of the Plan?

Mr. Cao Ngoc Phuong – CEO: 2023 revenue fell short of the plan due to the substantial contribution of expressway construction revenue. The handover of construction sites by the project owner is a significant issue for all public investment projects; for LIZEN, the Bien Hoa – Vung Tau project, in particular, has been very slow. Additionally, the project owner’s bidding procedures have dragged on, resulting in the company’s revenue recognition schedule not aligning with progress.

2. Can Management Share Insights on Infrastructure Development Plans?

Mr. Bui Duong Hung – Chairman of the Board: Lizen has been involved in transportation infrastructure for exactly 10 years, with its first project being the expansion of National Highway 1A, which had an investment of only VND 135 billion. Currently, Lizen is working on projects with a total investment of VND 7,000 billion, making it a major player in the industry, with 5 of its 6 projects being national key projects and 1 being a provincial key project.

During its involvement in transportation infrastructure, the Board of Directors realized that this is an irreversible trend in a developing country. The management team has determined that engaging in transportation infrastructure is challenging, but the products created must be top-notch. Therefore, LIZEN invested in state-of-the-art production lines from 2015 to 2016 (primarily from Germany and Japan), which have now depreciated by 60% but still have a market value of 80%. The company has also invested in human resources, upgrading the capabilities of its workforce.

In my career in transportation infrastructure, I have never seen a time when spending more money has been more highly praised than it is now. Furthermore, the leadership of the Ministry of Transport has stated that this is a historic time for the transportation sector, where contractors compete during bidding but collaborate to overcome challenges.

3. Why Did 2023 Revenue Increase by 100% But Net Profit Margin Was Only 5%?

Mr. Cao Ngoc Phuong – CEO: The economy declined last year, making it difficult for the real estate and renewable energy sectors, resulting in LIZEN’s revenue coming solely from the construction of infrastructure projects. This segment has a low-profit margin