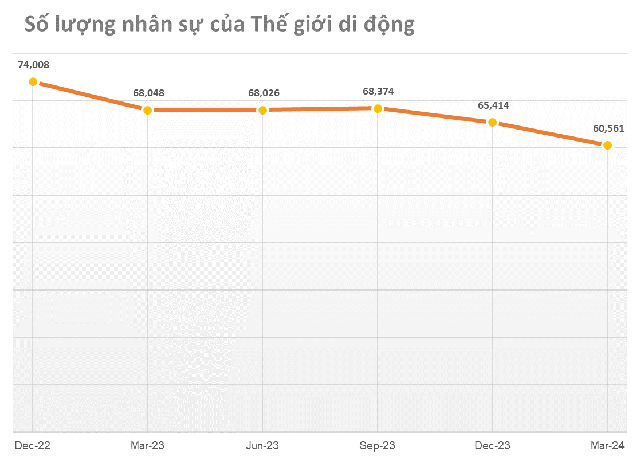

Mobile World Investment Corporation (Code MWG) has just announced its consolidated financial report for the first quarter of 2024. Accordingly, the company’s number of employees as of March 31, 2024 was 60,561, a decrease of 4,853 compared to 65,414 on December 31, 2023.

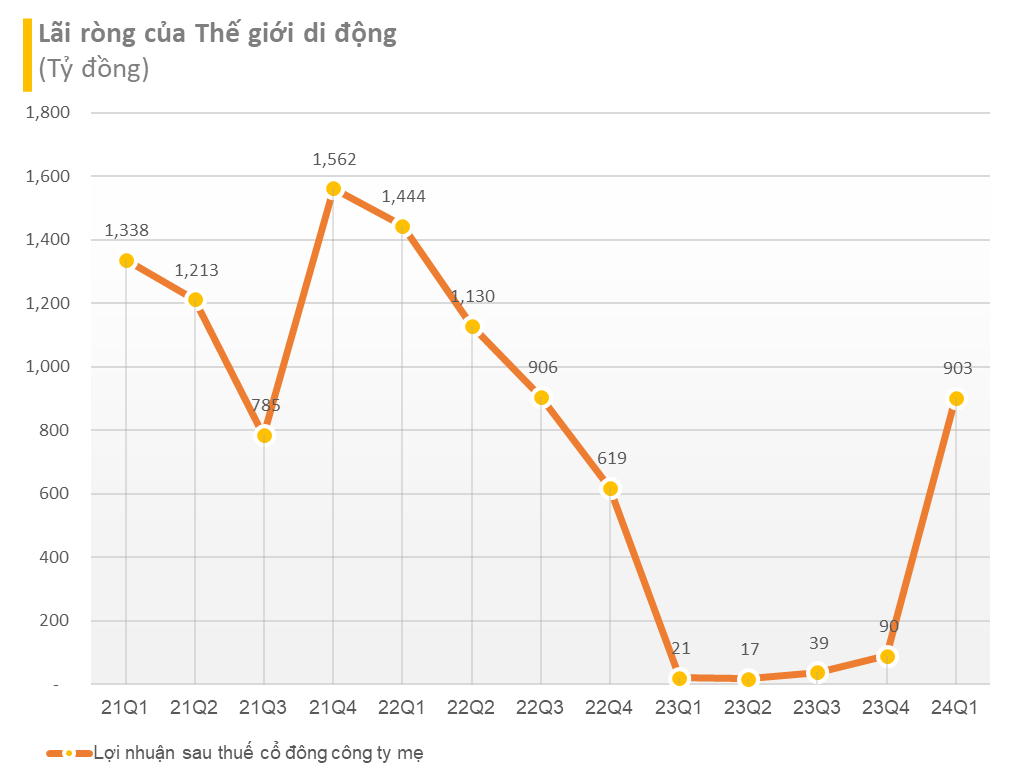

Thus, MWG continues to reduce its workforce by nearly 5,000 employees, despite the recovery in its business results. In the first quarter, MWG recorded net revenue of VND 31,486 billion, up more than 16% over the same period last year, completing 25% of its full-year revenue plan. Net profit increased 43 times over the same period in 2023 to VND 902 billion, the highest in 6 quarters since the third quarter of 2022, and completed 38% of the target set for the year.

The main growth driver for MWG in the first quarter came from the consumer electronics segment with a double-digit increase in revenue, with air conditioners being the standout product with a 50% increase over the same period last year.

According to MWG, the gross profit margin of both TGDĐ and ĐMX chains recorded a significant improvement in the first quarter of 2024 due to the consumer electronics segment’s increasing contribution to total revenue, while this is a product group with a stable profit margin. In addition, the advantage of a full product portfolio, diverse shopping options with attractive promotions, and financial support solutions was achieved through efforts to strengthen and expand market share in 2023.

The previous year, 2023, was assessed by MWG’s leadership as the most challenging in history. This retail company recorded an 11% decrease in net revenue compared to 2022, and after-tax profit decreased by 96% over the same period. Also in 2023, MWG reduced its workforce by nearly 8,600 employees compared to the end of 2022, marking the first time in 10 years that MWG has cut its workforce. Compared to the beginning of 2022, MWG’s number of employees has now decreased by more than 13,400.

At the 2024 Annual General Meeting of Shareholders, Chairman Nguyen Duc Tai expressed his gratitude and apologized to shareholders for an ineffective year of investment in MWG. “MWG shares did not bring efficiency to investors in 2023, but many investors still hold shares and believe in the future. This is valuable to the Group. We will strive to improve business efficiency in 2024 and expect this efficiency to be reflected in the enterprise value and investment performance of shareholders,” said MWG’s Chairman.

In 2024, MWG’s management assessed that consumer demand will generally remain flat or even decline compared to 2023 for some non-essential items. However, with a healthy financial foundation and a leaner “body” after restructuring, MWG’s Chairman said that the company is ready to cope with market fluctuations and has the resources and determination to realize the revenue target of VND 125,000 billion and after-tax profit of VND 2,400 billion in 2024. After the first quarter of the year, MWG has achieved more than 25% of its revenue plan and nearly 38% of its profit target for the year.