Annual General Meeting of BMP 2024

On April 29, 2024, Binh Minh Plastics Joint Stock Company (stock code: BMP) successfully held its 2024 Annual General Meeting of Shareholders (AGM). Reporting to shareholders on the 2023 business performance and the 2024 operating plan, Mr. Chaowalit Treejak, member of the Board of Directors and General Director of BMP, presented the 2024 business plan with revenue of VND 5,540 billion, a 6.5% increase compared to 2023. Pre-tax profit is estimated at VND 1,290 billion and post-tax profit at VND 1,030 billion, a 1% decrease compared to the previous year. The investment plan is VND 141 billion.

Q1/2024 PROFIT DECREASED BY MORE THAN 30%

The board of directors stated that the orientation in 2024 is to continue leading the market share in the plastics industry, diversify products to expand the customer base, establish an ESG committee and a Risk Management committee, etc.

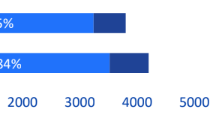

With the positive results, the board of directors plans to use 99% of the 2023 post-tax profit to pay cash dividends to shareholders (equivalent to VND 1,031 billion) and the remaining will be allocated to the bonus fund. The total dividend payout ratio is 126% (1 share receives VND 12,600).

Binh Minh Plastics has provisionally paid the first dividend installment of 65% at the end of 2023. Therefore, the company has one more dividend payment with a rate of 61%, equivalent to nearly VND 500 billion.

In 2024, Binh Minh Plastics plans to pay a minimum dividend rate of 50% on post-tax profit.

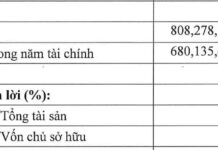

At the end of 2023, the company’s revenue decreased by 11% compared to 2022 to nearly VND 5,200 billion, achieving about 82% of the plan. Post-tax profit reached a record VND 1,041 billion, 1.5 times higher than in 2022 and far exceeding the plan.

In the discussion, answering a shareholder’s question about the market situation in 2024, Mr. Sakchai Patiparnpreechawud, Chairman of BMP’s Board of Directors, stated that last year the company faced many challenges including competition, geopolitical conflicts, and an unstable real estate market. In 2024, there will be a lot of work to do.

Over the past 05 years, BMP has achieved performance growth thanks to continuous investment and management in automation, and the use of robots has brought about great competitive advantages.

In addition, the company is the only one that provides products that do not contain heavy metals, ensuring health for consumers, and can be used for many years without leaking. BMP is continuing to research and develop to introduce new products to meet diverse needs.

The plastics industry is correlated with the real estate industry. This could also affect the company’s expectations. Currently, the real estate industry has not shown any significant signs of recovery, and demand is still low.

BMP’s business results in the first quarter of 2024 decreased by about 30% compared to the same period last year in terms of both revenue and net profit. Mr. Chaowalit Treejak, CEO of BMP, said that it was partly due to the long Tet holiday and stated that the upcoming period could be more positive as the real estate and construction markets improve.

However, this year’s growth will not be significant and depends on the government’s policies, such as the priority of investing heavily in infrastructure. Currently, although this has not really taken off in the first half of 2024, it is expected that the second half of the year will be better, when companies like BMP will benefit. In the second quarter of 2024, the company also has plans to compensate for this to achieve good results.

According to Mr. Chaowalit Treejak, BMP’s market share is decreasing in the first quarter of 2024 compared to some competitors because the companies identify different main segments. BMP is strong in the Southern region and identifies real estate as the main segment. There are companies that identify the main segment in construction projects and may not be affected by the demand.

Regarding the forecast of raw material prices in 2024, Mr. Sakchai Patiparnpreechawud, Chairman of BMP, predicted that the PVC plastics market in the second half of this year will likely continue as in the first quarter of 2024, prices may increase or decrease slightly but will be stable. Accordingly, the EBITDA margin (profit before tax, interest and depreciation) will be as it is now, and if the crude oil price increases suddenly, it will be a factor beyond control.

“Last year, this profit margin was quite good and it will be successful this year if it reaches that level. If the PVC price remains stable at this level, the whole chain will not be affected, if the input price increases, the output must be adjusted. The exchange rate will not be a significant concern,” said Mr. Sakchai Patiparnpreechawud.

Regarding whether BMP will conduct M&A in the near future, according to Mr. Sakchai Patiparnpreechawud, Chairman of BMP, the company currently has no decisions regarding plans to invest through mergers and acquisitions. The company believes that supplying products to the agricultural sector will have a lot of potential in the future.

Responding to the question about the recent high turnover of employees, which could lead to the disclosure of business secrets, Mr. Sakchai Patiparnpreechawud said that this is very normal and that the human resource policies in both the short term and long term are very good, and it is certainly not possible to guarantee that information cannot be disclosed, but currently BMP has very good information protection policies and believes that this is still guaranteed.

At the meeting, BMP approved the resignation of Mr. Poramate Larnroongroj as a member of the Board of Directors. At the same time, Mr. Krit Bunnag (born in 1975) was elected to be a member of the Board of Directors. Mr. Bunnag is the director of Nawaplastic Industries (NPI) Co., Ltd. (major shareholder, owning 54.99%).

_BMP’s 2024 Annual General Meeting of Shareholders ended with all submissions approved._

Nawaplastic Industries (Thailand) is currently the major shareholder of Binh Minh Plastics with a holding ratio of over 55%. Since 2018, Nawaplastic has made several purchases of BMP shares. To date, Nawaplastic owns about 45 million BMP shares, equivalent to a holding ratio of over 55% of Binh Minh Plastics’ charter capital. Overall, the total amount of money Nawaplastic has spent to acquire Binh Minh Plastics is about VND 2,800 billion.

Nawaplastic, is one of the direct beneficiaries when Binh Minh Plastics maintains a high dividend payment ratio, regularly, mainly in cash. In 2022, BMP’s cash dividend payout ratio reached 84%.