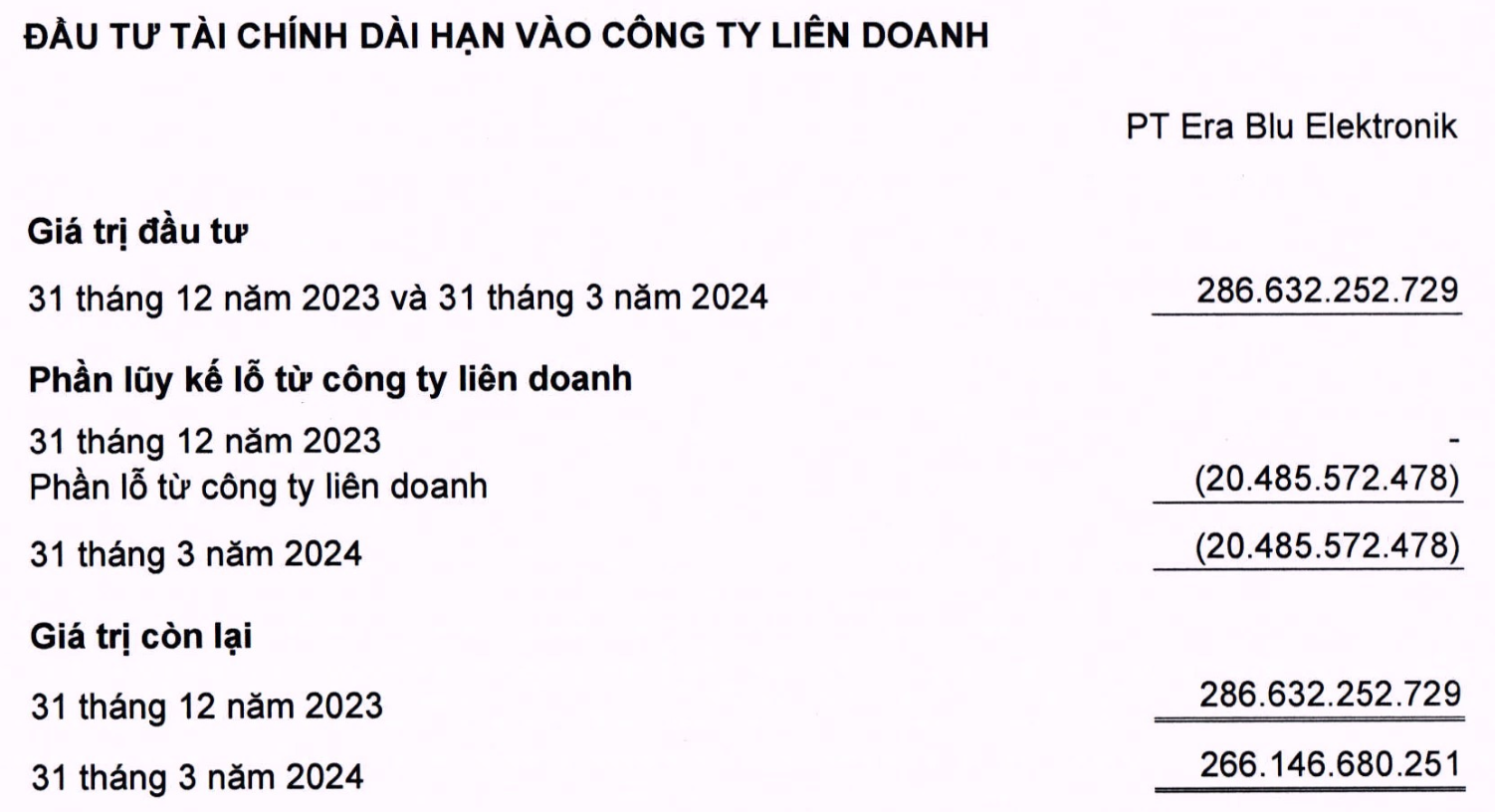

According to the consolidated financial report of the first quarter of 2024, Mobile World Investment Corporation (code MWG) recorded a loss of nearly 20.5 billion VND from the associate company PT Era Blu Elektronik (Era Blue) in the first quarter of the year. The fair value of this investment as of March 31, 2024 was approximately over 266 billion VND.

Source: MWG’s consolidated financial statements for the first quarter of 2024

Era Blue is a new experiment in the foreign market by MWG since 2022, mainly operating in the retail business of mobile devices, electrical appliances, household appliances, and other equipment and machinery in Indonesia. Era Blue is a joint venture established by a Vietnamese company and PT Erafone Artha Retailindo (Erafone), a subsidiary of the Erajaya Group.

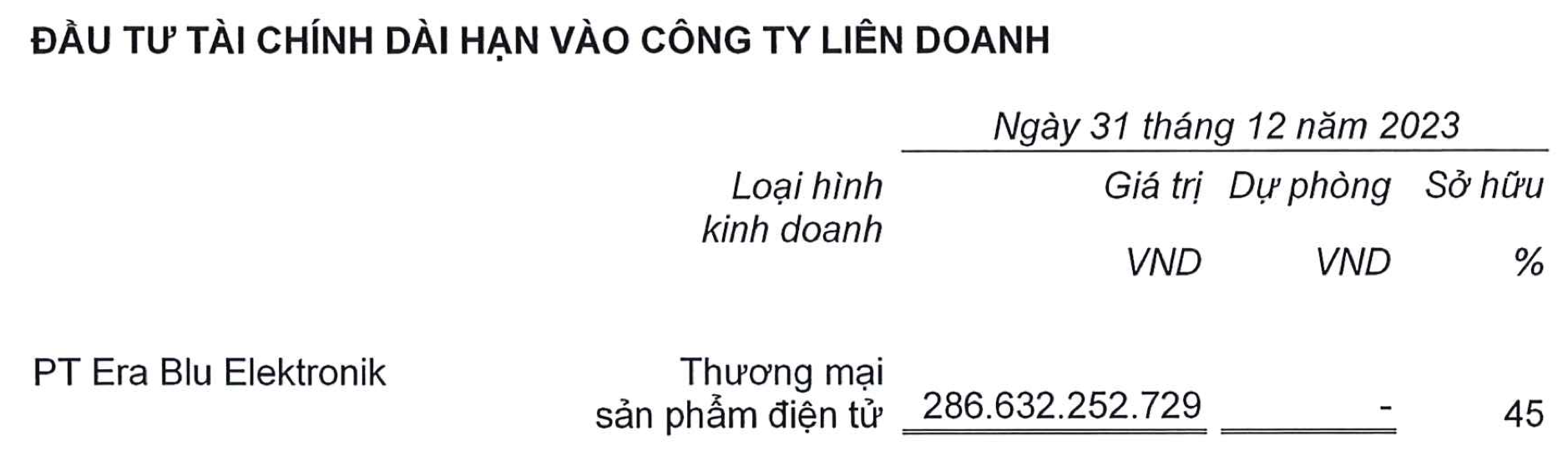

MWG contributed capital to Era Blue on April 22, 2022 according to the resolution of the Board of Directors on December 28, 2021 with an initial capital of 181 billion VND to hold 45% of the shares in this joint venture. By the end of 2023, MWG had increased the value of its investment in Era Blue to 286.6 billion VND, but the ownership ratio remained at 45%.

In case MWG’s ownership ratio does not change from the beginning of the year to the present, Era Blue is estimated to lose about 45.5 billion VND in the first quarter of 2024.

Source: MWG’s audited consolidated financial statements for 2023

With a similar model to Dien May Xanh in Vietnam, Era Blue is expected to become a leading electronics retailer in Indonesia, contributing to the long-term growth of MWG in the future. In 2023, the Era Blue chain successfully built a business model that was well-received by consumers with more than 38 points of sale in Indonesia.

In a share last August, MWG’s leadership said that the prospect of Era Blue is very large, 2-3 times that of Vietnam, and at the same time the consumer electronics retail market in Indonesia is still in its early stages. The retail sector is largely dominated by traditional small and medium-sized stores, with the two largest chains accounting for less than 200 stores.

According to MWG’s leadership, Era Blue offers competitive prices and differentiated services such as customers will receive a full package of services, from choosing goods in a rich display space, dedicated consulting staff, to delivery, installation in the day, fast warranty service and a 30-day return policy… These are the points that make MWG confident in its ability to win in Indonesia through Era Blue.

Era Blue is currently piloting the supermini business model with an area of 180-200 m2 along with the original standard store models with an area of 250-300 m2. As of the end of the first quarter of 2024, the Era Blue chain had 55 stores. The mini model currently has a revenue of 4.5 billion VND/store, while the supermini has a revenue of 2.5 billion VND/store.

Mr. Hieu Em also said that this year Era Blue still has a plan to expand, but not more than 100 stores. Next year, the chain will start to accelerate its expansion, aiming to have 500 stores by 2027 and is still on track.